- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurial Marketing

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategic Financial Analysis

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Effectively Pitch a Business Idea

- 27 Aug 2020

You’ve identified an underserved need and validated your startup idea . Now it’s time to talk about your business to potential investors. Yet, how do you effectively communicate your idea’s promise and possible impact on the market?

Pitching a business idea is one of the most nerve-wracking parts of any entrepreneur’s journey. It’s what stands in the way between your vision and the financing needed to turn it into a reality. Although daunting, there are steps you can take to ensure a greater chance of success.

Access your free e-book today.

What Makes a Great Pitch?

To make a successful pitch, entrepreneurs must exhibit several characteristics to convince investors to fund their innovative ideas .

Every entrepreneur needs an intricate understanding of their idea, target market, growth strategy, product-market fit , and overall business model . This differentiates your business concept and solidifies the steps needed to make it a reality. The perfect pitch shows investors your proof of concept and instills confidence that they can expect a return on investment .

Check out our video on pitching below, and subscribe to our YouTube channel for more explainer content!

Another crucial component of a successful pitch is understanding the venture capital (VC) ecosystem.

“It’s critical for entrepreneurs to understand the background and motivations of venture capitalists so when entrepreneurs seek them out to help fund their venture, they know what to prioritize in a firm and how to build a strong, trusting relationship,” says Harvard Business School Senior Lecturer Jeffrey Bussgang in the online course Launching Tech Ventures .

To secure funding and support, here are essential steps to ensure your pitch is effective.

How to Pitch a Business Idea

1. know who you’re pitching.

Some entrepreneurs try to get in front of every investor, despite their industry expertise or firm’s investment stage. Consider that, when you accept an investment, it’s about more than money; you enter a partnership. You must perform your due diligence and research potential investors before making your pitch.

When researching, ask yourself:

What industries do they invest in?

A VC firm’s industry focus depends on what the partners’ niche is and where their passions lie. Some firms specialize in a particular sector, such as financial technology (fintech) or education technology (edtech).

For example, Rethink Education is a venture capital fund that invests in early- and growth-stage edtech startups, while Blockchain Capital is dedicated to financing companies innovating in the crypto market. Others are generalists and span several industries.

Knowing the types of companies the firm invests in can help you tailor your pitch and zero in on their presumed priorities.

What stage do they invest in?

If you’re in the earliest stages of business development, you won’t receive growth equity, which is reserved for mature companies that need capital to expand operations, enter a new market, or acquire another business. Before making your pitch, have a rough estimate of the money and resources you need to launch, and then align yourself with investors who can help at that particular stage.

What’s the investor’s track record?

Dig deeper into the investor’s experience and investment history to determine the types of companies they typically finance, the background knowledge they might already have, and whether your personalities will mesh. This information will enable you to modify your pitch and determine if this is the right person or fund to partner with.

“The best venture capitalists become trusted partners and advisors to the founders and team,” says HBS Professor William Sahlman in the online course Entrepreneurship Essentials . “They help recruit key employees. They introduce the company to potential customers. They help raise subsequent rounds of capital. In some cases, they signal that the firm they've backed is a winner, which helps make that assertion true.”

Given the benefits and high stakes, the more you know going into a pitch, the better.

2. Consider How You Present Yourself, Not Simply Your Idea

Although your ideas and skills matter , your personality is equally as important. According to research published in the Harvard Business Review , venture capitalists’ interest in a startup “was driven less by judgments that the founder was competent than by perceptions about character and trustworthiness.”

Investors also want to know they’re entering a partnership with the right people. Jennifer Fonstad, co-founder of Aspect Ventures , acknowledges in Entrepreneurship Essentials that her investment firm “thinks about team and team dynamics as being very critical.”

Investors want to know whether the founders have worked together before, if your startup’s early hires have complementary skill sets, and whether you’ll be flexible, open-minded, and willing to embrace different perspectives.

Think about this as you prepare your pitch. If investors poke holes in your idea, will you get defensive? When they ask for financial projections, will you exaggerate the numbers? Hopefully, your answers are “no”—firms want to partner with founders they can trust who are open to guidance and mentorship—but if you’re second-guessing your reactions, consider what you might be asked and practice your responses.

As Sahlman reinforces in Entrepreneurship Essentials : “Most experienced investors look at the people first and the opportunity second. Even when a team is young and inexperienced, an investor depends on them to make the right decisions.”

3. Tell a Story

When describing your business idea, zero in on the problem you address for your target audience and how you solve it better than the competition. You could do this by presenting a real-life scenario in which you describe the pain point a current or prospective customer faced and how your product or service fixed the issue. This can help engage investors on a personal level and inspire them to see your idea’s potential.

By complementing your spreadsheets and charts with a compelling story, you can paint a fuller picture of your startup’s future and more effectively highlight its business opportunity.

4. Cover the Details

While it’s important to set the stage, you also need to cover the specifics. In your pitch deck, concisely define your value proposition and share a memorable tagline for investors to leave the meeting with.

According to Bussgang in Launching Tech Ventures , every pitch to an investor should contain the following:

- Intro: Focus on answering important questions like who you are, why you’re asking for funding, and what your founder-market fit is.

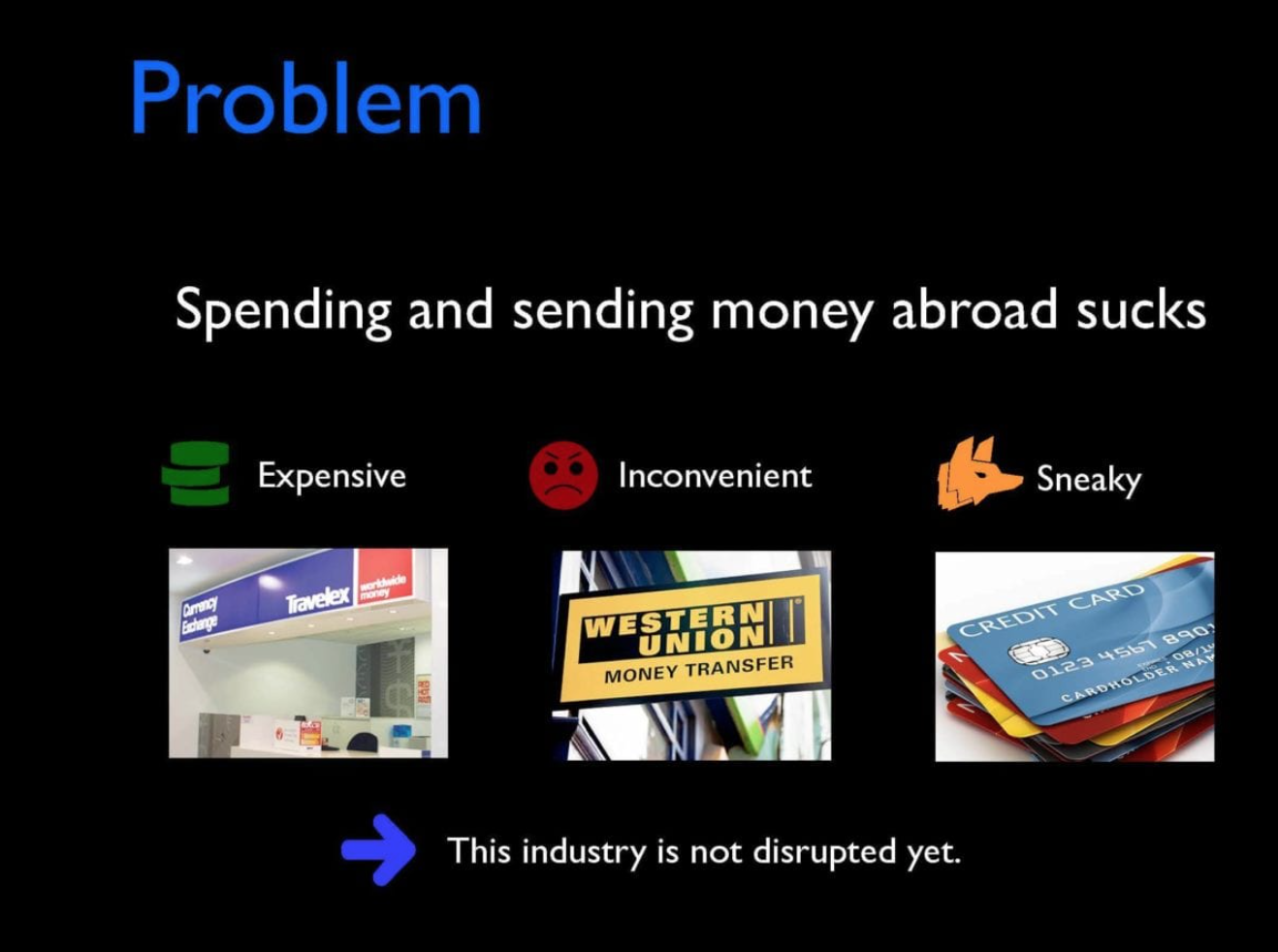

- Problem: Talk about your ideal customer’s pain point and how you plan to solve it.

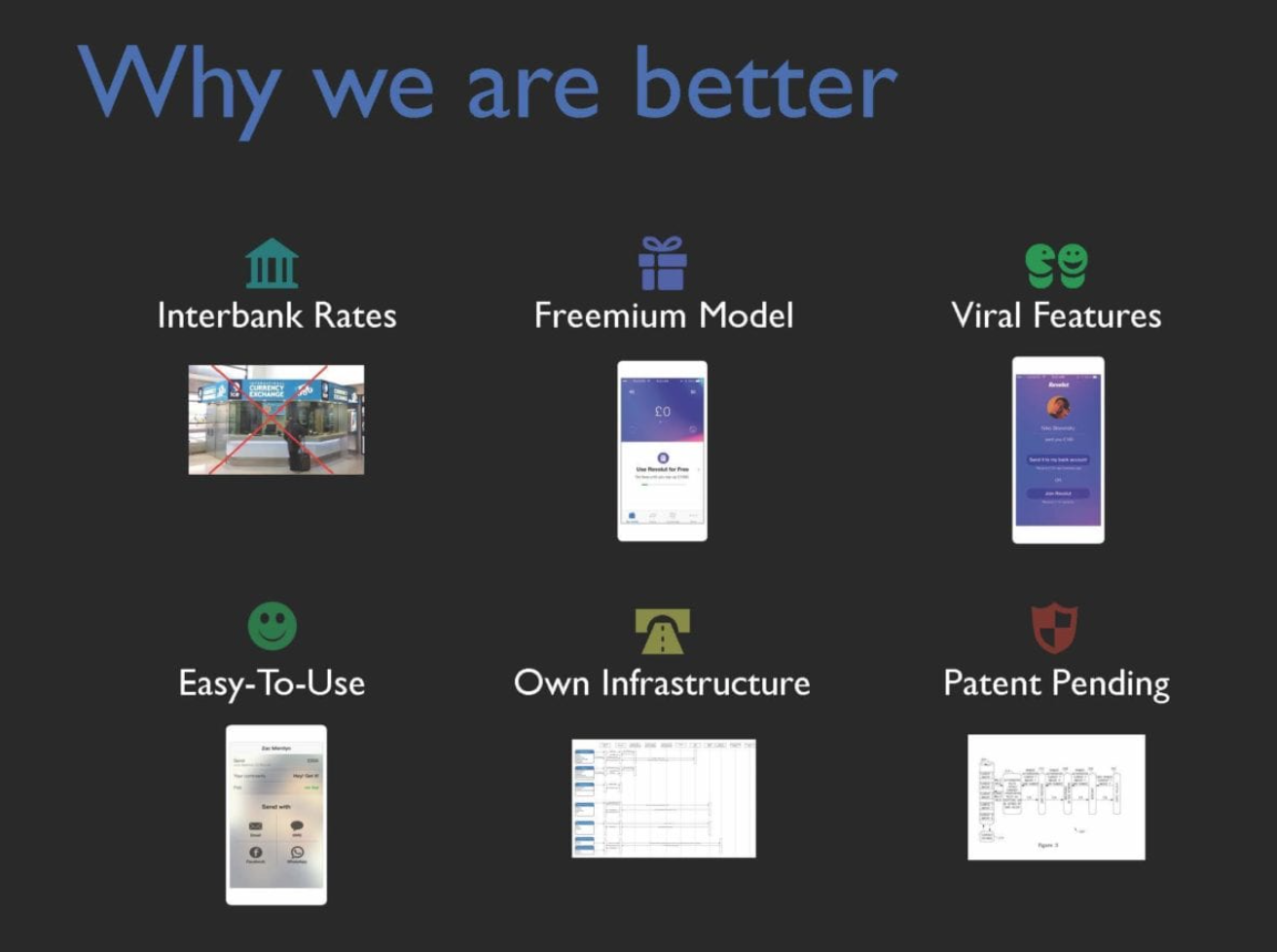

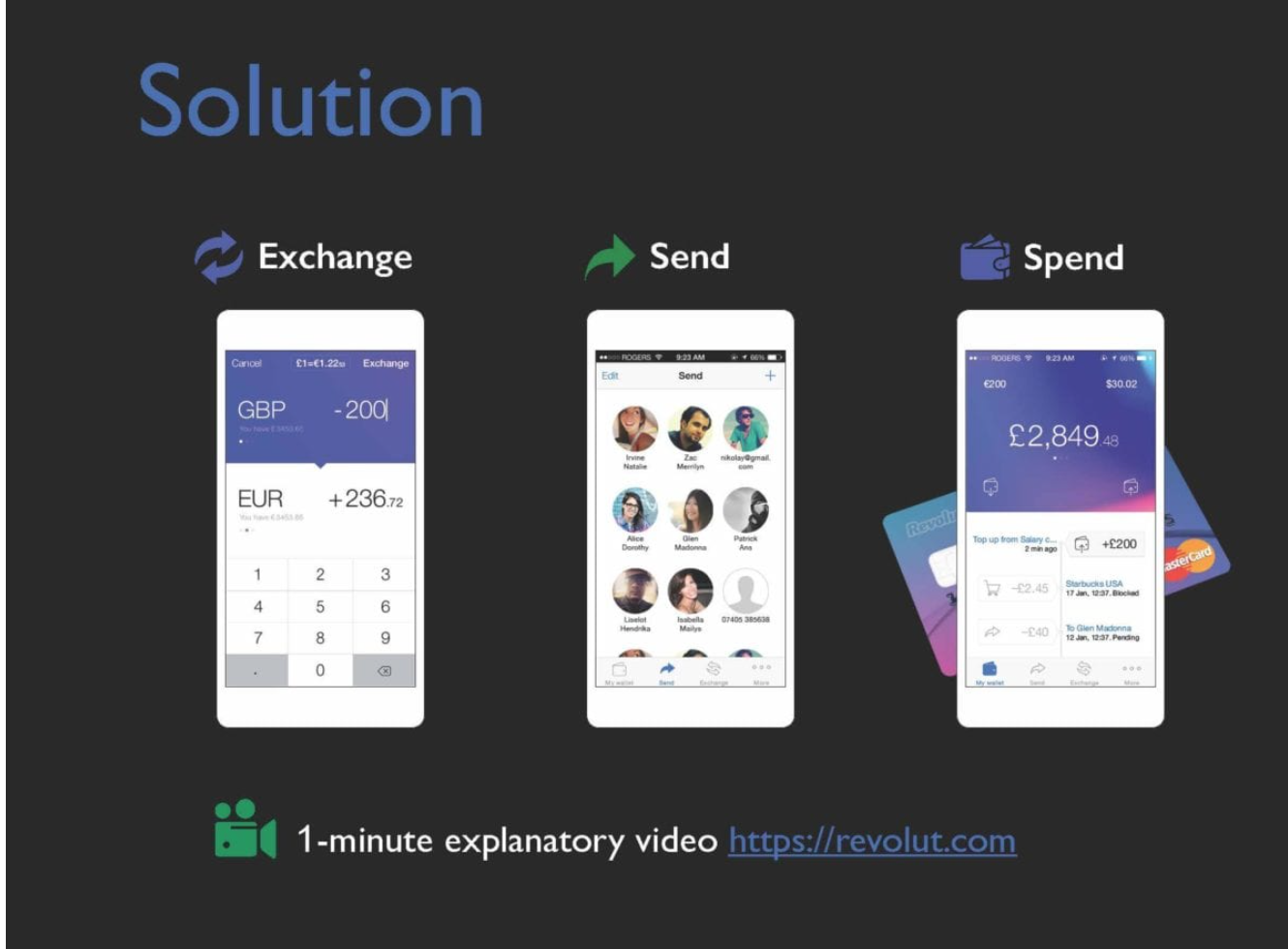

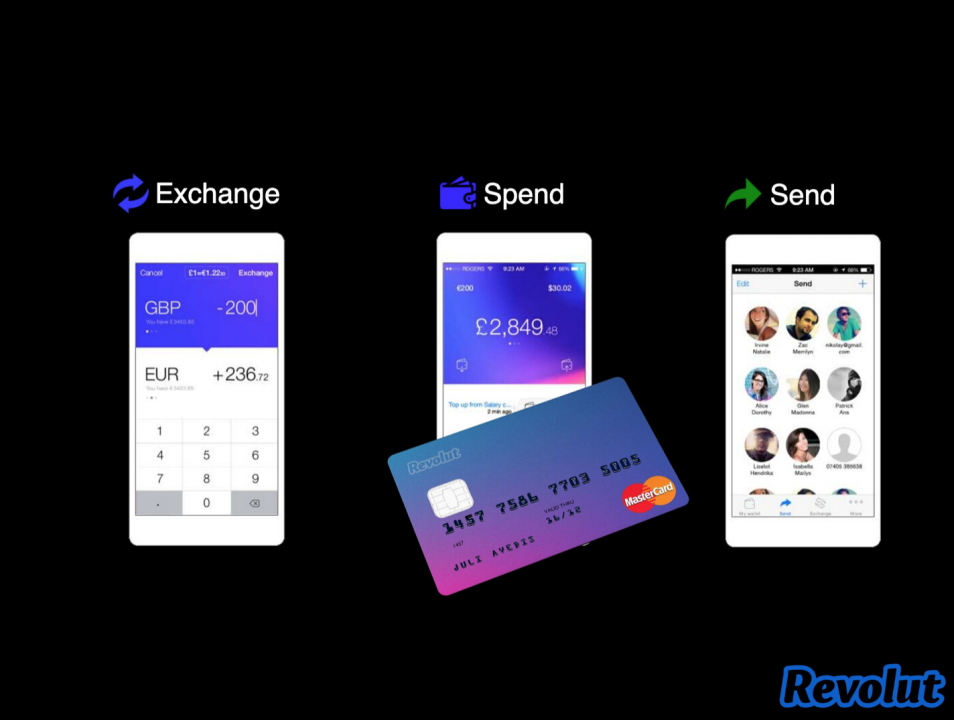

- Solution: Explain how your idea is a compelling solution and why it’s better than existing solutions.

- Opportunity and Market Size: Provide your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) through research.

- Competitive Analysis: Understand your unique differences in the market that can help you sustain a competitive advantage.

- Go-to-Market Plan: Clarify how you’re going to reach your customers.

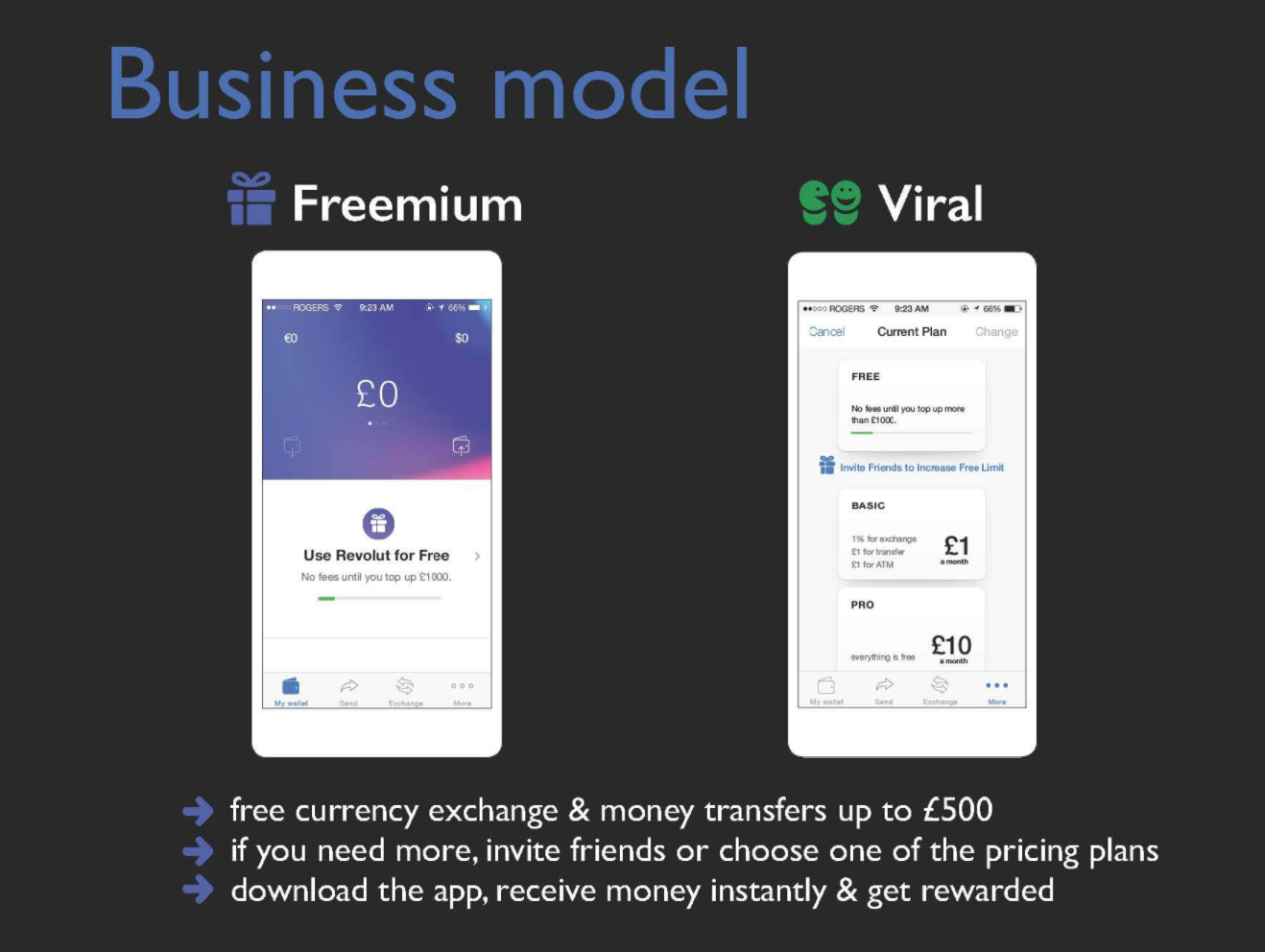

- Business Model: Describe how you’re going to make money.

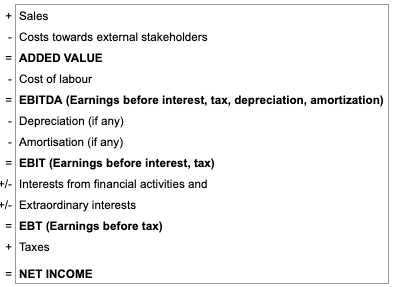

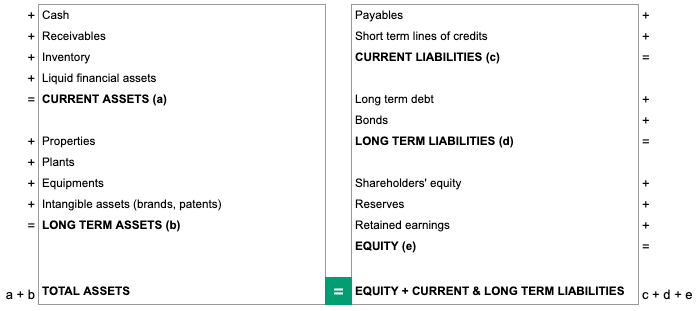

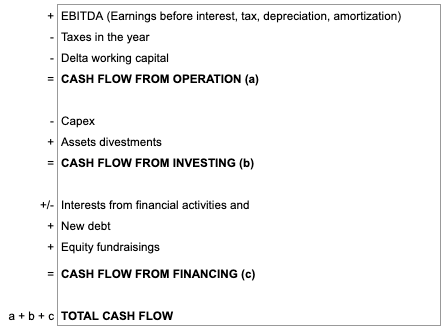

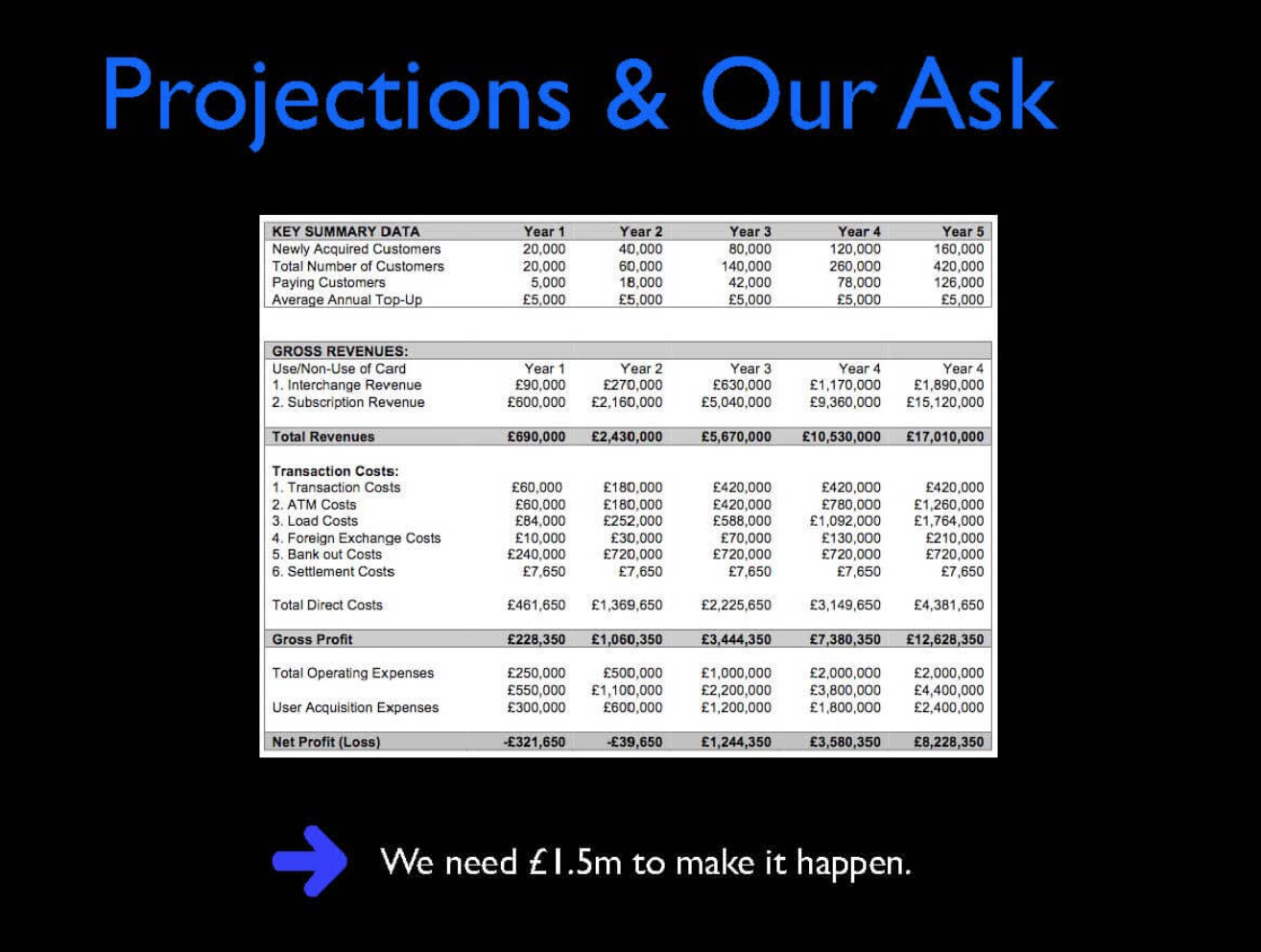

- Financials: Define what your financial projections are and how you’re going to provide returns for investors.

- The Ask: Detail how much funding you need, how long it will last, and what milestones you hope to achieve.

“VCs will expect entrepreneurs to clearly define the milestones they need to achieve with each round of funding,” Bussgang continues. “Entrepreneurs should know what experiments they will run to reach these milestones and what they expect the results will be.”

5. Show the Roadmap

Although you’re in your business’s early stages, investors want to know how they’ll cash out in the end.

“To truly understand the motivations behind VC firms, remember that they are professional investors,” Bussgang explains in Launching Tech Ventures . “Their objective is to generate the maximum return for their limited partners with a dual fiduciary duty to their investors and the company.”

To clinch your pitch, highlight your exit strategy and the options available.

The most common exit strategies include:

- Acquisition: When one company buys most or all of another company’s shares to gain control of it

- Merger: When two existing companies unite into one new company

- Initial Public Offering (IPO): When a private company issues its first sale of stocks to the public and can start raising capital from public investors

Related: What Are Mergers & Acquisitions? 4 Key Risks

3 Kinds of Pitches for Entrepreneurs

While all effective pitches share foundational elements, you should use different types depending on the scenario. To increase your chances of success, tailor your pitch to your audience and the available time frame.

1. The Elevator Pitch

This is one of the most popular pitches. Use this when you need to communicate their startup’s value in 60 seconds or less.

An effective elevator pitch should be concise, convincing, and convey your startup’s value proposition and differentiators. For tech business ideas, mention the innovative technology that sets your concept apart. At the end, include a call to action, such as the amount of capital required to launch.

2. The Short-Form Pitch

You should portray your business idea’s value to prospective clients and investors as efficiently as possible. This means summarizing the most important elements of your idea in a way that makes them want to hear more. Highlight the market size, how you’ll create barriers for competition, your plan to monetize the business, and how much financing you need.

Short-form pitches can run from three to 10 minutes; if you’re pitching in a competitive setting, note any length requirements. These shorter pitches can pique investors’ interest and earn you the chance to present a long-form pitch.

3. The Long-Form Pitch

Sometimes, you’re fortunate enough to have more than a few minutes to pitch your idea. If this opportunity presents itself, it’s crucial to make the most of your time and address every aspect of your business plan.

“You’re not just trying to start any business,” Bussgang says in Launching Tech Ventures . “You’re trying to create a business that’s profitable, sustainable, and valuable.

Zero in on your story and share a real-life scenario. Detail the market size to illustrate demand and clear examples of how you’ll attract and retain customers, particularly in light of competitors. This will show you’re planning for—and ahead of—future challenges.

You should also have a blueprint for testing product-market fit and early results, along with a detailed monetization plan. Lastly, share your exit strategy and the amount of capital needed to, one day, achieve it. Your long-form pitch should communicate your business concept clearly and concisely, open the possibility for follow-up questions, and capture the investors’ interest.

Consider preparing all three pitch lengths to be ready for any opportunity. It’s important to stay agile so you can modify your pitch to fit specific length requirements.

Landing the Pitch

Every investor prioritizes different data and information. Yet, if you start by choosing the right investor and then align their needs with your proposed market opportunity, value proposition, and exit strategy, you have a chance at landing the pitch.

“In some ways, startup success depends just as much on whether your hypothesis about the future is right, as it does on whether your idea is a good one,” Bussgang explains in Launching Tech Ventures .

As a result, it’s important for you to do your due diligence before pitching your business idea to investors.

If you’re interested in learning more about what investors look for and how you can create value, explore Entrepreneurship Essentials and Launching Tech Ventures , two of our entrepreneurship and innovation courses . Not sure which is the right fit? Download our free course flowchart to determine which best aligns with your goals.

This post was updated on July 28, 2023. It was originally published on August 27, 2020.

About the Author

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Successfully Pitch Your Business Idea to Investors

Caroline Cummings

8 min. read

Updated December 3, 2024

If you’re an entrepreneur, you need to know how to pitch your business. Even if you’re not planning to pursue funding, having a solid elevator pitch ensures that you know your business inside and out. Which comes in handy if or when you eventually decide to seek out investment.

- How to make a pitch for investors

Creating a successful pitch starts with a thorough business plan. From there it’s up to you to identify what makes your business valuable and worth investing in. You may have 5-pages of proven financial history and a deep analysis of how you stack up against the competition across multiple industries, but you simply can’t cover it all.

Because, when your pitching to angel investors and venture capitalists for the first time, you’ll often only have around 10-minutes to make your case. Here’s how to make that quick pitch successful.

1. Create a presentation

First, take the time to put together your pitch deck . The goal is to create a deck that is easy for you to work off of and gets investors excited about your business.

Keeping that in mind, you should have a short version that you can speak to within 10-minutes as well as an extended version that includes everything you’d like to give potential investors access to.

You can use our free pitch deck template for Powerpoint to get started. If you need help putting your pitch together, check out this list of tools that can help you put together a professional-looking presentation.

2. Practice your pitch

You need to practice your pitch. Not being able to quickly speak to each element of your business makes every other tip on this list virtually useless.

Too many entrepreneurs think that just by knowing their business they can quickly and succinctly explain its’ value. And having a killer pitch deck with eye-popping visuals will be enough to fall back on. So they go into pitch meetings unprepared.

Instead of being able to say, “I only need 10 minutes of your time,” and actually only taking 10 minutes, you’ll soon find yourself rambling 20 minutes in having only made it through slide 5. Take the time to practice, simplify your messaging, and only keep elements that build up your business. Leave everything else on the cutting room floor.

3. Outline the problem with a story

Begin your pitch with a compelling story. It should address the problem you’re solving in the marketplace. This will engage your audience right out of the gate. And if you’ve done any testing try to include actual data here.

If you can relate your story to your audience, in this case, the investor, even better. What industries have they invested in previously? What pain points do their previous entrepreneurial endeavors have? Do some research about the investor, so you have a good sense of what they care about and can tailor your story to them.

4. Your solution

Share what’s unique about your product and how it will solve the issue you shared in the previous slide.

Keep it short, concise, and easy for the investor to explain to others. Avoid using buzzwords unless your investors are very familiar with your industry. Again, if you’ve done any testing beforehand, plugin results here to give your solution more credibility.

5. Your target market

Don’t say that everyone in the world is potentially your target market , even if it could be true one day.

Be realistic about who you’re building your product for and break out your market into TAM, SAM, and SOM . This will not only impress your audience, but it will help you think more strategically about your roll-out plan.

If you can, try and develop a user persona or your ideal customer when speaking about your target market. This can help investors visualize the potential customer base and displays that you’ve thought intently about who your business will serve. It’s also much easier to speak to a named individual in a quick pitch, rather than a broad demographic.

6. Your revenue or business model

Investors tend to care about this slide the most. How will you make money ? Be very specific about your products and pricing and emphasize again how your market is anxiously awaiting your arrival.

7. Your successes: Early traction and milestones

Early in the presentation, you want to build some credibility. Take some time to share the relevant traction you’ve made.

This is your opportunity to blow your own horn. Impress the investors with what you and your team have accomplished to date (sales, contracts, key hires, product launches, and so on). You’ve likely mentioned bits and pieces of this early on, but this is the point where you create a full snapshot of your business.

But don’t just leave it at what you’ve done, be sure to speak to where you’re going. Show them a roadmap of next steps, additional milestones and even mention how funding will help achieve them.

8. Customer acquisition: Marketing and sales strategy

This is usually one of the most skipped sections of an investor pitch and a full business plan. How will you reach your customers? How much will it cost? How will you measure success?

Your financials should easily allow you to calculate your customer acquisition costs. But you should also mention how you intend to reach customers, which channels you’ll be advertising on, and even present an example of messaging. You’ve done your research, you know your customer, why not show investors what that will look like in action.

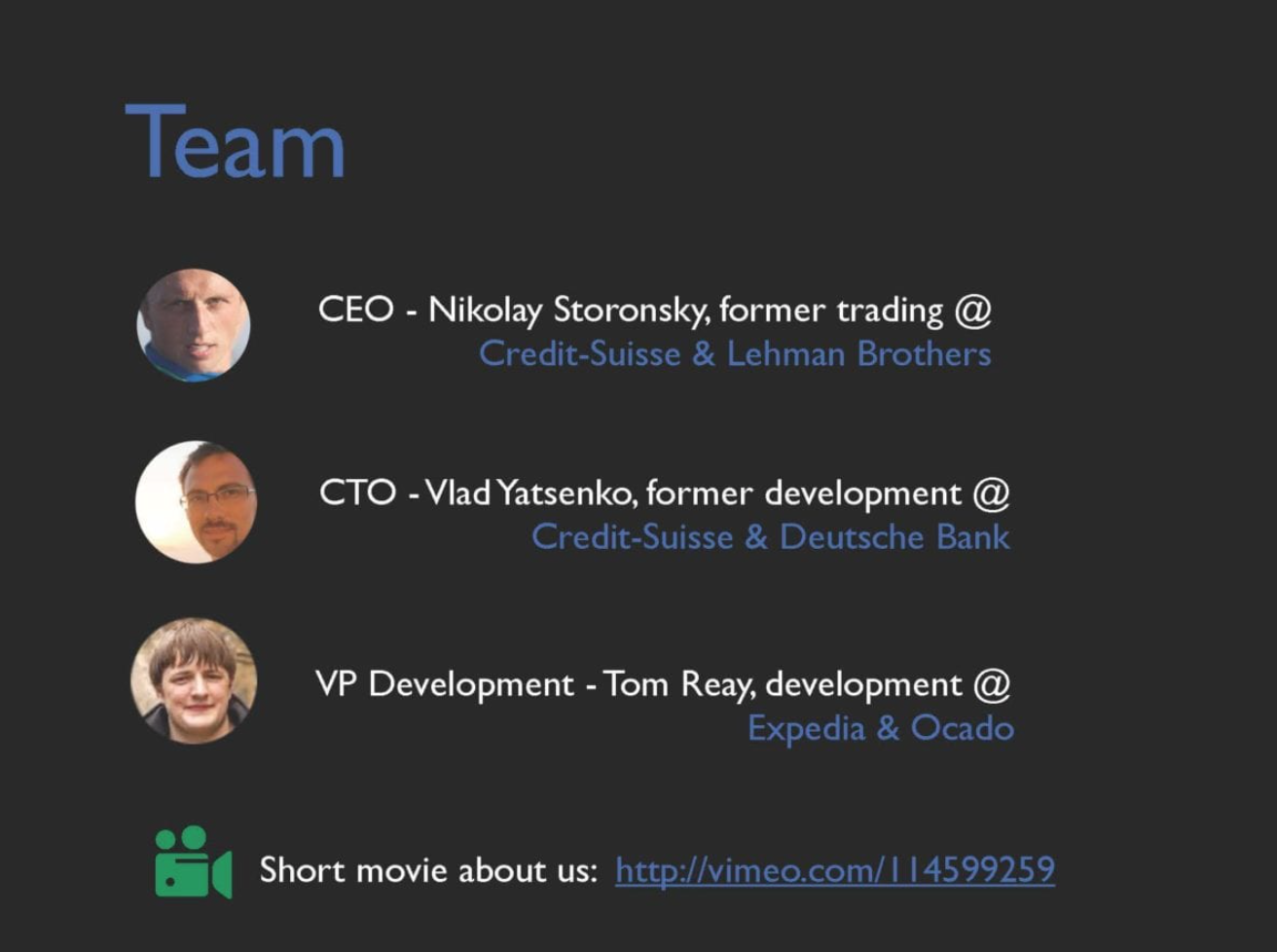

9. Your team

Investors invest in people first and ideas second, so be sure to share details about your rock star team and why they are the right people to lead this company.

Also, be sure to share what skill-sets you may be missing on your team. Most startup teams are missing some key talent—be it marketing, management expertise, programmers, sales, operations, financial management, and so on. Let them know that you know that you don’t know everything.

10. Your financial projections

Show what you’re projecting in revenue (per product) over the next three to five years. You must back up your numbers by sharing your assumptions. You’ll see investors taking out their smartphone calculators to make sure your numbers make sense, so give them the information they need to see that your calculations are accurate.

If your financial chart shows “hockey-stick growth,” be sure to explain what happens to cause those inflection points. Now it can be incredibly easy to spend a ton of your time explaining financials but keep in mind that you need to speak to them quickly. If investors want to hear or know more, add your full financials to the extended pitch deck or offer to answer questions after you’ve finished presenting.

11. Your competition

Again, this is a very important part of your pitch, and many people omit this section or don’t provide enough detail about why they’re so different from their competitors.

The best way to communicate your value proposition over your competitors’ is to show this slide in a competitive matrix format —where you list your competitors down the left side of the page, you have your features/benefits across the top, and place checkmarks in the boxes for which company offers that service. Ideally, you have checkmarks across the top for every category, and your competitors lack in key areas to show your competitive advantage.

12. Your funding needs

Clearly spell out how much money has already been invested in your company, by whom, ownership percentages, and how much more you need to go to the next level (and be clear about what level that is). Will you need to raise multiple rounds of financing? Is the investment you’re seeking a convertible note, an equity round, or something else?

Remind the audience why your management team is capable of managing their investment for growth. Tell investors how much you need, why you need the money, what it will be used for, and the intended outcome.

13. Your exit strategy

If you’re seeking large sums of investment capital (over $1M), most investors will want to know what your exit strategy is . Are you planning on getting acquired, going public (very few companies actually do), or something else? Show you’ve done some due diligence on this exit strategy, including the companies you’re targeting, and why it would make sense three, five, or ten years down the road.

14. Follow-up

Investors will want you to be able to back up your claims. Have a well-thought-out business plan on-hand to share, so investors can read more if they’d like to. The intention, after all, is that you deliver a powerful pitch, and by the end, their hands are out asking for either your executive summary or your complete business plan.

15. Take feedback and refine your pitch

No matter the outcome of your pitch, whether you receive funding, another meeting, or rejection, look for areas to improve. Don’t be afraid to ask for feedback and take that into account for the next time you pitch. Now if the investor isn’t willing to provide any, don’t push the issue. It is their time you’ve just spent and are asking more of, so it’s a fine balance to achieve.

If you can, have another team member there to take notes and review with them after the fact. Look for weak-points, areas you stumbled over, and slides that led to negative reactions from the investor. Keep refining, practicing, and executing even if you think you’ve found the perfect pitch.

You’ll really never know how good your pitch is until you actually do it. Don’t stress yourself out, and treat every investor pitch as a learning experience for you and your business. You’ll only continue to get better and better and can apply those learnings to every area of your business.

An entrepreneur. A disruptor. An advocate. Caroline has been the CEO and co-founder of two tech startups—one failed and one she sold. She is passionate about helping other entrepreneurs realize their full potential and learn how to step outside of their comfort zones to catalyze their growth. Caroline is currently executive director of Oregon RAIN . She provides strategic leadership for the organization’s personnel, development, stakeholder relations, and community partnerships. In her dual role as the venture catalyst manager, Cummings oversees the execution of RAIN’s Rural Venture Catalyst programs. She provides outreach and support to small and rural communities; she coaches and mentors regional entrepreneurs, builds strategic local partnerships, and leads educational workshops.

Table of Contents

Related Articles

6 Min. Read

What to Say in Your 1, 5, 10, or 20-Minute Elevator Pitch

9 Min. Read

Is Bad Body Language Ruining Your Pitch? Here’s How to Fix It

4 Min. Read

Harness the Power of Pixar Storytelling to Perfect Your Pitch

5 Min. Read

Pitching Investors Over Zoom: 9 Practical Tips for Startup Founders

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

8 Expert Tips for Pitching to Investors

Updated: July 06, 2021

Published: June 30, 2021

So you have a million-dollar idea. Naturally, you're thrilled and ready to make your bold, big-time vision a reality — that much you're clear on. What's less clear is how, exactly, you're going to get the funding you need to set your plans in motion.

New businesses generally can't kickstart and sustain the momentum they need to thrive solely through elbow grease and power of will — they usually need some serious cash to get things going. So when you're looking to push a bold new idea, business plan, or strategy that needs capital to move forward, you need to have some idea of how to secure it.

That's why any aspiring entrepreneur has to understand how to pitch to investors. Here, we’ll go over some tips, tricks, and tactics that will help you pitch your ideas and business plans confidently and effectively. Let’s take a look!

How to Pitch an Idea to Investors

When you have that light bulb moment, it can be tempting to reach out with a couple of halfway fleshed-out ideas and a dream, but investors are too savvy and practical to bite on that.

They need to know they’ll receive a promising return on their investment — and ideas and dreams aren’t all that compelling when it comes to demonstrating that potential.

That’s why you need to consider these steps before you start pitching.

1. Tailor an Elevator Pitch

Seasoned comedians generally have something known as a “tight 10” rehearsed and ready — it’s a solid, reliable, short set of jokes they can count on to make people laugh. And while there might not be a ton of overlap between business and comedy, new business owners can still take a cue from that strategy.

New and aspiring entrepreneurs should have an intriguing, informative elevator pitch on hand — a 30-or-so second description of the nature of your business, offering, and value proposition, designed to help you earn a second conversation with a potential investor or network connection.

2. Narrow Down Your Target Audience

Preparation is half the battle when it comes to pitching — your efforts can only do so much for you if they’re not tailored to suit the investors on the other end of the table. That's why you need to thoroughly research who you’re going to be talking to.

Take a close look at the other types of businesses they invest in and the degree to which they tend to be involved in those companies' operations. Get a feel for how new they are to investing. And see if you can learn more about their individual personalities.

This step will be much easier with some firms than others. Many investors will have a lot of public information available, but several tend to keep their efforts and preferences closer to the chest. Still, you can’t skimp here — do everything you can to approach your meeting as well-prepared and thoughtfully as possible.

3. Market Research

One of the best ways to prepare an effective pitch is to have your market research done and organized. Being able to demonstrate an ability to compile, analyze, and draw meaningful conclusions from market data shows investors that you’re dedicated, incisive, and trustworthy.

It can make your idea seem sounder. If you can show that market trends are conducive to your offering’s success, you’ll make your pitch significantly more interesting than it would be if it was based on conjecture.

4. Create a Business Plan and Model

If you want investors to take you seriously, you can’t just walk in with an idea and nothing else. Even the most exciting concept means nothing without concrete plans behind it.

At the end of the day, investors are investing to make money — you need to demonstrate that you have the framework and courses of action in place to deliver on that.

You also need to give them an outline of the return they can expect to see on their investments. A sound business plan isn’t impressive if you can’t show accurate, attainable, intriguing results that will stem from it.

5. Prepare a Demo

Whether you’re looking to fund a physical product or digital services, prepare a demo and be sure to work out all the technical issues before appearing in front of investors.

Make sure the product model works as intended and any electronics or batteries are operating and fully charged. For digital products or services, make sure everything is in working order even minutes up to the pitch.

How to Pitch a Business Plan to Investors

Pitching an idea to investors goes hand-in-hand with pitching a business plan to investors, so always come prepared with a business plan when you want to pitch your idea.

1. Make it thorough and thoughtful.

The business plan will include the nuts and bolts of the business — that means providing a picture of what you are selling, the need your offering will fulfill, your target audience, plans for marketing and operations, budget, expected revenue, and any other market research data you collect. You want to be detailed and transparent when presenting your business plan, so investors know you have done the research and are trustworthy.

2. Show the data.

Explain current data and how it applies to your business plan, and be as open as possible. Share how many customers you currently have and how many new ones are coming to you each month or quarter. Discuss exactly how the business plan will generate revenue and how much revenue you expect to see, going forward.

3. Put a pitch deck together.

Once you’ve collected the data, it’s time to organize it in a clear, easy-to-follow pitch deck. Learning how to write a pitch deck is simpler than you might think. After compiling all the data for your business plan, break it down into different segments of the pitch deck, which can be presented easily in a slideshow.

You’ll start by explaining who you are, introducing any team members, and explaining the problem you want to solve with your business. Like an elevator pitch, you’ll share why your business is different from your competitors.

Explain the product or service, and include a pause to implement your product or service demo. Share your target audience, expected revenue model, and your budget. Conclude the pitch deck with contact information, so investors can reconnect later if they are interested.

Prepare to Get Funded

Having a brilliant idea is just the start of making your dream business a reality. Even before your company starts, you have to conduct research and make comprehensive plans if you want to attract investors.

The more research you prepare, the more confident and transparent you can be in your pitch — showing investors you are dedicated to knowing your business inside and out and helping them boost their ROI.

Don't forget to share this post!

Related articles.

9 Sales Pitch Examples (Plus Tips on How to Write Your Own)

Unique Selling Proposition: What It Is & How to Develop a Great One

5 Tips for a Great Sales Hook, According to Sales Reps

![business plan pitch to investors How to Win a Deal on Shark Tank: The Anatomy of a Perfect Business Pitch [Infographic]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/________SHARK%20%281%29.jpg)

How to Win a Deal on Shark Tank: The Anatomy of a Perfect Business Pitch [Infographic]

5 Steps to Telling a Better Story in Your Next Sales Presentation

![business plan pitch to investors 6 Essential Elements of a Successful Sales Pitch or Presentation [Infographic]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/sales-pitch.jpg)

6 Essential Elements of a Successful Sales Pitch or Presentation [Infographic]

6 Types of Sales Pitches Every Salesperson Should Know

The Best Sales Pitch Isn’t a Pitch at All

60 Sensory Words and Phrases to Spice Up Your Sales Pitch in 2020

Don’t Know the Answer? Try These 10 Tips for Thinking on Your Feet

E-pitch templates to better sell your product, fund your business, or network.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Pitch to Investors

Free The Art of Perfect Pitch E-book

- February 24, 2024

- 12 Min Read

After validating your business idea and refining it through a business plan, it is now time to pitch your business potential to the investors.

Now, pitching is a nerve-wracking job. Even the most promising business ideas will fail to secure funding if they aren’t pitched properly.

According to Forbes , less than 1% of businesses are successful in acquiring funds through their pitch. This puts you in an intensely competitive market space where you cannot afford to mess up.

Well, don’t sweat. If you too, like most startup entrepreneurs are struggling with how to pitch to investors , this article is for you.

It covers everything that you need to know about making a successful pitch and if you follow it thoroughly, you are most likely to increase your chances of getting funded.

Ready to get started? Let’s dive right in.

What do investors look for in a pitch?

Everyone says a captivating pitch deck sets you on the right path in capturing the interest of potential investors. But what is it that actually makes a pitch interesting?

Well, here are 4 distinct key elements that an investor looks for in a pitch deck.

Business Idea

Investors want to get a clear overview of your business idea and evaluate it based on its viability, growth predictions, market demand, and target market .

- Problem and the solution

A clear understanding of the problem you are solving and the solution you have to offer. A pitch deck must reflect your unique position in the market.

Financial projections

Investors want to know that the financials of the business are as good as the business idea. They want to see financial projections for the next 3-5 years, the business’s profitability, ROI, and its exit strategy down the lane.

Business plan

Pitch decks are concise. However, investors would generally prefer they get a detailed business plan after the presentation to understand minor nuances of your business in detail.

And most importantly, an investor is looking for a simple, easy-to-grasp pitch that serves all the essential information with no fluff.

How to make a business pitch for investors

Now that you understand what an investor looks for in a pitch deck, let’s create a solid pitch for your business.

1. Create a stellar pitch deck

First things first, you need a stellar pitch deck to get the investors excited about your business idea.

A pitch deck primarily explains your business concept, captures the investor’s attention, and propels them to offer funding for your business.

However, creating a compelling deck from scratch is a bit taxing. In fact, most startup entrepreneurs have no understanding of how to create a successful pitch deck . In such cases, a poorly made deck will be the reason you lose potential investment from the investors.

To avoid getting into such situations, build a fool-proof presentation using an AI pitch deck generator. This tool offers AI assistance, a pitch deck template, and step-by-step guidance that will enable you to prepare a stunning business plan presentation from scratch in less than an hour.

Ditch your old-school pitch deck creation methods

Make compelling pitch decks in minutes with AI

2. Know who you’re pitching

Before you approach any investors, take a step back and evaluate if that particular investor or VC firm is even suited for your business.

You see when you accept the investment, you are entering into a partnership with someone. This partnership will go in vain if your interests, fundamentals, and values don’t align with them.

So, here are a few things you need to analyze about an investor before approaching them:

Industry of operation

Certain investors and VCs usually limit their investments to specific industries and business sectors. It is better to research and evaluate beforehand, whether the investors of your liking are open to investment in your segment or not.

Stage of Investment

Investors usually have a pattern of investing in a specific business stage. While some invest in growth stages, many investors only invest in startups and incubators. Know the investment stage for your business and then find investors that align with your needs.

Investors’ track record

Your chances to secure funding increase substantially when you pitch the right investors. Before pitching someone, gather certain details like the type of companies they invest in, their usual investment amount, core philosophies, etc.

It’s better to get as many details as possible on a specific investor before you approach them with a pitch request. Such research will help you customize your deck and thereby increase your chances of getting funded.

3. Deliver your elevator pitch

An elevator pitch is a crisp snapshot of the entire pitch summarized in less than 60 seconds. Consider it as a pitch that will probe the investors to know more about the business idea.

Now, an elevator pitch must include details about your business, its product, and the business owner. It should sell your USP and highlight your value proposition to pique the potential investors’ attention.

Lastly, it’s mandatory to add a clear CTA emphasizing the amount you seek for a steady launch.

4. Explain the problem with a story

Adopt the art of storytelling if you want to be heard, resonated with, and valued at your presentations. However, don’t beat around the bush and get straight to the problems.

While telling your story, talk about your inspiration to launch a particular product or service. Highlight the pain point of your market and bring interesting data points to make your story relatable and relevant.

5. Present your market research

A thorough market research solidifies the foundation of your business idea making it more of a concrete plan. It instills the faith of angel investors in your business idea and its potential scope of growth.

Now, whenever you include market research always back that data with relevant sources to prove that the research is relevant and fruitful.

For instance, when you include details regarding your market size , show a clear demarcation of your TAM (Total Addressable Market), SAM(Serviceable Addressable Market), and SOM(Serviceable Obtainable Market) through numbers.

Further, offer a brief understanding of who will be your ideal customer, their potential income, hobbies, interests, and pain points. The investor should be able to visualize your target market and its potential size to contribute to your growth.

Also include any industry-specific trends, risks, challenges, and how you plan to overcome those strategically.

6. Introduce your product/service as the solution

Introduce your product or service and show how it manages to solve the problems mentioned earlier.

In this section of your presentation, you can offer a practical demo of your services or a beta version of your product. If it’s a certain type of app, ensure that its core functions are perfectly adept to be presented during the presentation.

If you don’t have a product or service for demonstration, at least embed a video of how it works or plugin the testing results to gain some credibility for your solution.

Again weave a compelling story and present your solution in a distinguishing light.

7. Explain your revenue and business model

This is the most important section of interest when you pitch investors with funding requests. Explain your business revenue model answering how will you make money.

In this section, lay out a clear pricing plan for products and services. If you are planning a subscription model, show the prices for different subscription plans and their monthly and annual fees.

With data points and figures, show how the prices are perfectly in line with your sales and revenue goals.

8. Your customer acquisition strategy

Earlier in your market research you proved that there is a sizable target market for your solution. It is now time to explain your strategies to capture that target market.

Begin by explaining your acquisition plan highlighting your overall process of sales from lead to conversion. Elaborate on this section by defining your sales channel and marketing strategies.

For instance, cold calling, email outreach, paid advertisements, social media marketing, etc.

Now professional investors are interested in figures that demonstrate your cost of acquisition, conversion rate, retention, and related financials to measure the success of your overall business. So be prepared with these growth metrics and prove your point statistically during the presentation.

9. Early traction and milestones achieved

Win your potential investor by sharing your early business achievements in terms of sales, growth, revenue, contracts, product launches, and much more. This will help you build credibility amongst the investors.

However, don’t stop just yet. Go on and talk about the milestones you plan to achieve with the investment capital. Show them the roadmap to the future and present granular details of different milestones.

10. Introduce your team

When you pitch your business idea to investors, they would like to know that their money is in the right hands. Moreover, they want an assurance that you have the right people with the right skill sets to turn your business idea into reality.

Romanticize your team and talk about the interesting skill sets and achievements they bring to the table. At the same time, also talks about the shortcomings be it in terms of limited teams or lack of expertise in certain areas.

Bear in mind that you want to show a realistic picture and not something that just sounds ideal.

11. Present financial projections

A successful pitch is incomplete without thorough financials offering an overview of your revenue projections over the next 3-5 years. So while you do that, make sure that you back those financial numbers by sharing your realistic assumptions.

Investors may have a couple of complicated questions at this stage to get a clear understanding of your financial position. To not fumble then, ensure that you have a thorough understanding of what these numbers interpret.

Now, don’t complicate this deck by adding way too many numbers. Attach your key reports and detailed financials to your extended pitch and refer to that when the investor asks you to dive deep.

12. Discuss competition

The competitive analysis section of your business plan presentation will help the investors understand the competitive landscape of your market.

An effective way to present this section is by evaluating your key competitors based on their strengths, offerings, target customers, pricing, expertise, and revenue. Ideally, the slide should subtly indicate the areas where your competitors lack and you excel.

That being said, discuss your competitive advantage over other players by highlighting your USPs, strengths, and opportunities.

13. Funding requirements

It’s now time to get to the point. Clearly state how much funding you will require to achieve your business goals. Justify your funding needs and convince investors by presenting your key metrics.

Talk about the funds you have already invested and where they come from. Explain the current equity distribution and the investors’ stake if they agree to invest in your business. Also, clarify if this would be one-time financing or if you plan to raise money through multiple rounds of financing.

Overall, the investor must know where the money will be used, the company’s position after receiving the finance, and whether they will be investing in the early stage or growth stage of a company.

14. Explain your exit strategy

The investors would be interested to learn about your exit strategy , especially if you are seeking large funding. Down the lane after 10 years, do you plan to get acquired or go public? Do you have any other exit plans?

Well, whatever it is that you plan, explain why it is in favor of an investor to venture down your path. All in all, they are interested to know if they will get their money back before the exit.

And that’s pretty much all the information pitch decks must include. However, let’s now talk about the mistakes you should avoid during the presentation.

What are some common mistakes made when pitching to investors?

Let’s have a look at a few common mistakes you should avoid to enhance the efficiency of your overall pitch:

1. Not practicing the presentation

If you don’t practice your pitch, you will take an unnecessarily long time and lose the attention of your target audience. So, always practice your pitch and time your presentation to make it short, crisp, and informative.

2. Not backing up the data

Always back the data with reliable high-end sources. This is essential to prove that your business and growth strategy are built on relevant research and analysis.

3. Not pitching to the right investor

Take your time identifying the right investor and venture capital for your business idea. Pitching alone is not sufficient. You have to pitch the right investors to ensure maximum funding approvals for your business.

4. Poorly designed presentation

While pitching, if your presentation is crammed with long slides with no visual aesthetic, you are likely to lose your investor. Follow Guy Kawasaki’s 10/20/30 rule while designing your presentation, where 10 is the maximum number of slides, 20 is the maximum time of presentation and 30 is the minimum font point.

5. Not leaving time for questions

Ideally, your pitch should be concise and brief touching on all the essential informative topics. However, always leave room for Q&A towards the end where the investors can probe further into topics they want additional information about.

How can Upmetrics help?

By now, you must have a rough understanding of how to pitch your potential investors. However, unless you go out and make your first pitch, all this information will just remain a theory.

So, let’s take the first step and create your pitch deck with the Upmetrics AI pitch deck generator . With features like AI assistance, a customizable pitch deck template, and a step-by-step guide, you can create your entire presentation in less than an hour.

Sign up now and unlock the features that will help you strengthen your overall business planning.

Frequently Asked Questions

How long should my pitch be.

In terms of slides, a startup pitch deck should have no more than 10-15 slides. Remember that the number of slides has nothing to do with the efficiency of your pitch deck.

If you can convey the crux of your business idea and offer all that an investor needs within 7-8 minutes, nothing like it. However, even if we consider an extended pitch, the presentation should not be longer than 20 minutes.

What should be included in my pitch deck?

A pitch deck should offer a thorough insight into your business idea and its key financials to enable the investors to make the decision. However, here are a few things that a pitch deck must absolutely contain:

- Business Overview

- Mission objectives

- Market Opportunities

- Competition

- Revenue Model

- Early Traction and Milestones

- Key financials and projections

- Funding request

What are the must-have slides in an investor pitch deck?

An investor pitch deck is a stepping stone that will help you acquire the funding for your business. Considering the essentials, an investor pitch deck must include details about the business, the problem and the solution, business and growth strategies, tractions and milestones, market research and competition, and funding requests.

What is the ideal length for a startup pitch to investors?

The ideal length for a startup pitch varies considerably. Now, if we talk about elevator pitch, it should be made within 60 seconds or 4 minutes at max. However, if we talk about short-form pitch and long-form pitch, you get about 3-12 minutes for your presentation in general.

How do I prepare for potential questions from investors?

Here are a few ways that will prepare you for the potential questions from investors:

- Explain why you need a particular amount and how it will be used.

- Prove the product’s efficiency with MVP and beta testing.

- Offer a clear picture of your revenue model, growth projections, equity stake, and other key financials.

- Show your competitive advantage in the market.

- Define the TAM, SAM, and SOM for your business.

- Talk about your shortcomings and show how you plan to succeed despite that hurdle.

How do I start my investor pitch to make a strong first impression?

Always begin an investor pitch with a compelling story narrating your aspirations and ideas behind the startup. Once you have successfully managed to evoke the emotion in investors, remove all the fluffs and get straight to the point. Offer everything that an investor looks for in a pitch and make it crisp, on-point, and interesting.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here .

How to Pitch Your Business Idea to Potential Investors

These four simple tips can help you find funding for your new business or product.

Table of Contents

After you’ve drawn up your business idea and crafted your business plan, you need funding to turn your entrepreneurial dream into a reality. When your ability to secure funds comes down to a 10- to 20-minute pitch to potential investors, it’s easy to feel nervous. It’s a pressure-packed moment, and you need to be at your best.

So how can you erase your anxiety and impress potential investors? Business News Daily spoke with a handful of experts, including a former participant on ABC’s Shark Tank , about how to nail a pitch to potential investors.

How to present a business idea to investors

1. tell a story..

A common topic among experts was the need to be personable and create a narrative. While facts and figures go a long way, it’s important to use those numbers to tell a meaningful story. Framing your business idea as a story also helps you explain your passion for your business.

Erin Beck, the CEO of Komae, a cooperative childcare app, believes storytelling sets her presentations apart from those of her peers. She creates an emotional appeal with an engaging pitch. “Make the story more important than what you’re selling because once the market numbers speak for themselves, they don’t connect with you for what you’re doing, but why you’re doing it,” said Beck.

2. Define the problem.

You might be head over heels about your business concept. Your prototypes for the product are all stellar, and you’re thrilled about your business plan. Unfortunately, if your product doesn’t solve a problem or fill a need for customers, investors aren’t going to share your excitement.

“Start off with the problem,” said Donna Griffit, a corporate storyteller for startups. “Do you understand the need that’s in the market today? Do you have the facts to back that up?”

It is critical that you can answer these questions when heading into a meeting with investors. Thorough market research , along with customer surveys and interviews, can show if your product is needed. If you lack the data to prove that your idea addresses a problem, it’s difficult to engage the audience and even more difficult to get funding from investors.

“I’ve seen startups try to take shortcuts on this and end up with glazed-over eyes in their audience,” Griffit said.

3. Practice as much as you can.

The weeks and days leading up to your pitch to potential investors is no time to be shy. Give your pitch to friends, family, neighbors or anyone else willing to listen. Not only does practicing help take the nerves off, but it also allows you to learn where you can improve your presentation.

“You’ve likely told your origin story dozens of times and have it down,” said David Ciccarelli, the founder and CEO of Voices.com. “Now, get ready to tell it possibly hundreds more. During our capital raise, I told our founding story 200 times. While it’s old news to you, it’s new for the investor, so keep it upbeat and tell it with enthusiasm.”

Don’t hesitate to pitch to multiple potential investors. Ciccarelli went with his team to cities across the country and met with a few investors in each city. This gave his group practice and put his business idea in front of more eyes.

Once you’ve gotten comfortable with your pitch, start focusing on the little details.

“Use the privacy of your home or office to talk through your pitch and work on making it flow well,” Ciccarelli said. “Don’t be afraid to record your pitch, both audio and video, and review it with a critical eye to make sure you nail every sentence.”

Demonstrating proper body language and tightening up speaking mistakes can be the difference between successful and unsuccessful pitches. When you go over the minor details, Ciccarelli recommends planning your pauses. By doing this, you can make a perfectly rehearsed speech sound spontaneous.

“To make your pitch sound more natural, plan your dramatic pauses out,” he said. “The pause gives the impression that you’re coming up with the material on the fly. Plus, you’ll have a moment to collect your thoughts for what you’re going to say next.”

4. Be realistic.

While practicing the pitch is a must, very rarely will your pitch go exactly as planned. Having realistic expectations will help when you’re preparing. It’s important to practice for a realistic presentation experience, which may include interruptions by investors asking questions.

In addition to expecting disruptions, it’s important to view the presentation from the audience’s perspective. Brian Lim, an entrepreneur who owns three e-commerce businesses (EmazingLights, iHeartRaves and INTO THE AM) that collectively earn more than $20 million annually, pitched one of his businesses on Shark Tank in 2015. He received offers from all five judges on the show and made a deal with Mark Cuban and Daymond John. Lim credits his success to proof of concept: He entered the show with $13 million in sales to date, and his ability to view his business from a different vantage point set him apart.

“I had to imagine myself as an investor and check off boxes that I would want to see if I were going to invest money into a company,” Lim said.

Presentation mistakes to avoid

There are also some important things not to do when making a pitch:

- Be late for the meeting.

- Dress inappropriately. What’s appropriate will depend on your audience and your company/product brand.

- Fail to convey clear benefits for your intended target market .

- Use terminology, lingo or acronyms your audience may not recognize.

- Talk over or interrupt those in your audience.

- Be self-congratulatory; e.g., “This is a great idea/product!”

- Argue with your potential investors.

- Bring up deal details, like pricing, too early.

Move forward with confidence

It takes time and tenacity to make and close a business deal. Following the ideas above about what to do and what not to do can help you ensure that you’re prepared to make the pitch.

While immigrants and women entrepreneurs can face additional challenges , these stories of successful young entrepreneurs can provide inspiration to push onward.

Maintaining your confidence and conveying your belief in your business or product idea, without being arrogant, is key to making a positive impact and getting the funding you want.

Additional reporting by Linda Pophal.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Pitching to Investors: What to Cover and How to Succeed

Turning to investors to raise capital is one way to obtain money to get a startup off the ground or take it to the next level. And as it goes with any presentation, you must be persuasive and engaging enough to catch the audience's attention. But how do you make the presentation memorable and leave a good first impression? What should you do to convince the investors that you're worth it? After all, you might not get a second chance.

On this page, we go over how to pitch to investors and succeed. We share the best practices that founders should make a note of if they want to stand out, succeed with their fundraising initiative, and get money.

How to Approach Investors

First things first, it's vital to determine the investor type that you'd like to pursue (individual investors, angel investors, venture capital firms, and so on). After that, decide on how much funding you need and precisely what your business needs it for.

You can then leverage your professional network and search the web while seeking investors who are currently open to new opportunities. Other paths include attending specialized events or conferences where you can meet investors in person or join startup communities where investors hang out.

When you've shortlisted a few of them, you have to break the ice, get to first base, and introduce yourself. But how exactly do you do that if you plan on pitching investors?

Your aim is to get noticed and book a meeting during which you'll come forward with your presentation for investors. It all starts with the first contact . During the meeting, make sure to take detailed meeting notes to capture key points and investor feedback. And there are a few best practices regarding how to approach investors for funding the right way.

Emails, cold calls, messages on LinkedIn, filling out forms on investor websites, and connecting online are options for reaching out. But, in this case, you have to be prepared that you might be ignored because investors receive hundreds of inquiries. If a mutual contact or another founder who's acquainted with your potential investor can put in a word for you, such a warm introduction raises credibility and can cushion the situation.

Either way, during your initial approach , you have to:

- personalize your message (use information you've researched about the investor as leverage);

- be polite and clear when introducing yourself (after all, you're not only doing this for the money, you're going to build a relationship too);

- make it evident that there's a whole team behind the product;

- confirm that it's a functioning product that already has traction to make the business opportunity more obvious and to sound convincing;

- do your best not to come off as desperate;

- keep your message short, cut out excessive details, stick to the point;

- request a meeting;

- attach an executive summary or overview of what you'll be proposing, possibly along with the pitch deck ;

- add a hook that'll urge the investors to reply, get the conversation going, and lead to a scheduled meeting.

How to Prepare for Pitching to Investors

Think of your pitch to investors as a first date. You'd want to look good and make a great impression, so you should spend some time on preparation. Let's first go over the things you must take care of before "showtime". Here's what you should do during startup pitching to help your audience remember you and appreciate the solution's value.

Craft a Flawless Pitch Deck and Presentation Script

Let's start with the pitch deck. It'll serve you multiple times, i.e., you'll use it during the presentations and send the slides to the investors as a follow-up afterward. Therefore, the content of the deck has to be polished either way.

Supporting materials are always an integral part of any presentation. And if you plan to pitch investors, ensure you've given your slides much thought beforehand. The same applies to planning what you're going to say.

According to recent statistics , venture capital investors (short for VCs) tend to spend much less time looking through pitch decks than previously. On average, they spend 2 minutes and 42 seconds reviewing pitch decks, which is down by almost a quarter in just a year. It's no surprise, really, as investors receive thousands of applications with pitches. And this means that you're fighting against the clock to stand out and convince them.

So, one of the main tips on how to pitch an idea to investors effectively is to take the time to put together a deck that'll cover all the main points and make it simpler to follow what you're presenting. Include the vitals in a concise and easy-to-understand way. Make sure to add key information:

- an introduction to the problem;

- the offered solution;

- a product preview, demo, or short overview;

- your financials;

- startup equity distribution;

- the business plan;

- market research and well-researched facts;

- competitor analysis;

- gained traction;

- core startup analytics and metrics.

What do investors want? Mind that they care about their return on investment, so your pitch has to be solid regarding your business plan and revenue streams. Not to mention that the pitch deck must make sense on its own without your comments.

There are many more tips and tricks on how to make a good pitch presentation and craft a standout deck (like using PowerPoint slides , pitch deck templates, AI presentation makers , and so on). But here are several fundamentals:

- Follow a logical structure, have a clean layout with readable text and elements.

- Think through your strategy presentation , but keep it short (say, 10 to 12 slides that are not crowded with text or packed with complicated visuals, as this is not the right place for fluff, period).

- Consider using AI to make the slides maker or apply pitch deck slide templates to keep the design concise.

Modify Your Pitch for Every Audience

It's very likely that you'll present your pitch to investors more than once. And the worst thing you can do is not have an individual approach to various investors . For example, are you turning to angel investors or VCs? Which ones in particular?

These aren't just startup terms , and you have to keep in mind that investors often have their own thesis. That is, they might be interested in funding products that fit particular niches. For instance, if they solely care about the healthcare sector, then most of the presented SaaS ideas from other categories won't make the cut. And in this case, it doesn't really matter how great or revolutionary the solution is.

Pitches more likely to secure funding are the ones that manage to hit the bull's eye and show that "we're a great match". What's this investor's appeal ? Bottom line: by researching what the VCs are interested in , their priorities, portfolios, and areas of expertise, you can save yourself and the investors time. Try to find answers to these questions to understand what they're searching for:

- What do they prefer?

- Who did they already fund?

- Are they more inclined toward AI based startup ideas ?

- Who are these people as individuals?

Mind that you will likely be restricted to a specific time limit (usually under 30 minutes in total, including the question-answer part). Therefore, not adjusting your pitch presentation and refining the slides based on the audience is among the common startup mistakes not to repeat during pitches.

Practice Your Pitch

Have you ever seen poorly rehearsed shows or plays? Make certain that your investor pitch is nothing like that.

A well-honed program is much easier to perceive than if the presenter forgets his lines, stumbles, goes back and forth from one idea to another, and presents some improvised mess. However, there is a balance to strive for, as a perfectly memorized speech may sound fake and emotionless, which isn't good.

Take the time to practice your speech and presentation out loud while clicking through the slides of your pitch deck for a more consistent performance and to get the feeling that you really own it.

Try Testing the Pitch on a Demo Audience

Holding several test pitch presentation rounds to non-investors can also be good practice. You'll polish up your speech, gain confidence, get feedback, allocate areas for improvement, and get a better understanding of how to do a pitch presentation.

Did you notice that people get distracted by a slide with a complicated graph? Did they stop listening to you because they were trying to figure out the slide content? Were some parts of your story too confusing? Use this information and your observations to improve the presentation, eliminating any weak points for when you actually pitch investors.

Think Through the Q&A Part

Which questions can come up during your pitch for investment? Most likely, you'll be asked about the potential risks and how you'll approach them. Or what your go-to-market strategy includes (for instance, whether you plan to spread the word about the product by going through a Product Hunt launch ). If you're at the later stages of startup development , then you might be asked about your exit strategy plans.

Try to anticipate what people might be thinking and give answers before they even ask. Plus, brush up the answers and prepare them in advance to raise the odds of obtaining sought-after funds. Some startups even ask a Chief Technology Officer to tag along to answer tech questions, but if you don't have your own CTO yet, you can turn to an outsourced CTO for such assistance.

Also, bear in mind that it's not a one-way street. There are plenty of questions to ask investors in first meeting scenarios, such as:

- how involved the investors generally are (e.g., frequency of meetups);

- what is worth knowing about their network and partners;

- their funding range or check size;

- how long their typical timeline is for reaching investment decisions;

- their investment process and how long it takes;

- whether they have concerns about your business or see risks in the proposal;

- whether they have specific expectations (e.g., seats on the board);

- details on specific companies added to their portfolio;

- other questions that truly matter for your business.

What to Include in Your Investor Pitch

Properly approaching VCs or investors to get funding is a delicate matter, as the majority of applicants get turned down. Do we have to remind you that lacking the required funds is among the fundamental causes affecting the startup failure rate ?

And regardless of whether it's an on-stage investor deck presentation on demo day, a one-on-one meeting, or a video call, your presentation must be clear, meaningful, and concise. Here are the "musts" to include and the "dont's" to avoid. Let's learn how to pitch an app idea to investors using a quality deck.

Start the Pitch Explicitly

Your aim is to hook the audience early on as you pitch investors. So, make the statement with the purpose of your product brief . Preferably, limit it to a solid tagline or just one short sentence so it's clear who you are and what you're doing in one glance. This is a proven best practice on how to start a pitch presentation off the right foot.

This half-minute speech should reflect the essence of your product. It's often referred to as the "elevator pitch" (an elevator pitch to investors is what you'd say if you bumped into one in the elevator or in the hall).

Nailing the startup or MVP pitch isn't an easy task. But the tagline should be memorable, straightforward, and catchy, defining your vision and product core. Avoid terms that are too complicated and keep the message short.

Use Storytelling

To make an impression that lasts, the story you pitch to investors has to be memorable. Ideally, your narrative should sound like an engaging story with real and relatable examples and facts that can prove that what you're saying is true.

- Share your journey, how you came up with the tech startup idea , and the reasons why you're devoting so much time and effort to creating this product and launching a startup .

- Describe who the target audience is, which problem it's facing, and why your solution is necessary.

- Briefly explain what you're doing, how your product brings value, how it will make a difference, why the time is now, as well as what it may turn out to be in the long run.

- Bring up examples that people can picture and nod along to.

- Introduce the committed team behind the product and your background.

Being declarative with a story is an approach that can help you stand out and not sound robotic or monotonous. Storytelling could be a helping hand and a trick to how to pitch a business idea to investors. Be careful with jokes, though, as sometimes they end up being inappropriate and lead to the reverse effect.

Indicate Your Competitors

Claiming that your product has no competition during a fundraising pitch will cause suspicion. Thus, make sure you've done your homework and have thoroughly studied which competing solutions are already present on the market .

Mark how your offering is different and how its competitive advantage will lead to startup growth . In the context of financial technology, leveraging AI for capital markets can significantly enhance predictive analytics, risk management, and investment strategies, giving your startup a competitive edge. Explain what makes it better at solving the problem than any of the closest competitors based on your in-depth analysis of the main players and the industry.

Emphasize and Explain the Figures

While who you are, what, and why you're building really matters, the specific numbers behind it matter more during an investor pitch. Whether you're just getting traction or aiming at startup scaling , your chances of getting rejected can snowball faster than you think if you don't have:

- realistic projections and forecasts;

- grounded estimates;

- a doable financial plan;

- meaningful user, competitor, and market research ;

- figures on market potential;

- facts to verify you're the real deal.

What are the impactful statistics and findings that matter? What's the market size and bottom-up total addressable market (TAM)? Which of your metrics and numbers can demonstrate the solution's potential? Transparency and truthfulness are essential in this respect, and precise numbers and tangible data are what makes a good pitch.