- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Enterprise Risk Management

Business and leadership (bus102), mississippi gulf coast community college, recommended for you, students also viewed.

- Research Methods

- Business Plan on Risk Management

- Financial Accounting Report

- Innovation and Entrepreneurship

- Entrepreneurial Self Efficacy

- Marketing Analysis-Zappos Vs. Competitors

Related documents

- Disney Organizational Structure

- Credit Management Theory and Practice

- Moral Ethics in Accounting

- Globalization Analysis

- Global Communication Analysis

- Economic and Political Arguments on the Budget Deficit

Preview text

Business Notes – An Assignment on

Subject (Business)

These notes provide a concise summary of enterprise risk, management. firms are assets prone to damage if not well, secured. in these notes, you get to learn a firm-wide strategy, on how to highlight and thoroughly prepare for any hazard that, may affect the company’s operations and finances., these notes will benefit students greatly by enlightening them, on how to analyse risks. they will learn to make better risk, mitigation decisions and know to review both internal and, external risks to determine control and tolerance..

Enterprise Risk Management Introduction Nintendo Company Limited It is an entertainment and toy company and operates globally and is prominent for its video games. The company started its operations in the 1980s as an amusement arcade in the United States and Japan. Its major product in the United States is the Nintendo Entertainment System, while in Japan, it is the Family Computer. Both products are popular in both countries, but Nintendo loses market share in the 1990s with the rise of other platforms. However, at the same time, Nintendo fights back with Nintendo 64 to keep it afloat, and the plan works as the company becomes more competitive in the market. Pokémon game sets the company for more success at the same time as the company strives to take a share of the fifteen billion industry net worth.

Nintendo was initially founded by Fusajiro Yamauchi as Marufuku Company in 1889, Kyoto, Japan. Marufuku was a playing card company and the first products sold to soldiers and prisoners in the Russo Japanese War and World War 1. Exports of the playing cards start in 1925 to countries like Australia and Korea. Marufuku, during this time, intensifies their marketing, and they begin selling their products at strategic points like in shops that sell tobacco. The marketing strategy makes the company famous as it improves its business model to fit the modernization of the world economic practices. The company changes its name to Nintendo in 1951 to set it as a more suitable brand name in the entertainment industry. With innovation, the company diversifies to the creation of board games and later to video games, and at this point, Nintendo becomes more popular than ever before. Literature review Enterprise Risk Management It is the method of isolating the aspects that endanger the opportunities and advantages of a company to remain competitive in the market. It is an essential tool to create strategies, and an organization should adopt it to maintain their business. The main elements of enterprise risk management are identifying risks and setting up the response plan. A suitable response plan can include the creation of prevention strategies, internal mitigation strategies, collaboration, use of insurance, transferring risk, avoiding risk, and accepting risk (Berry- Stölzle & Xu, 2016). The response plan is meant to protect shareholders and stakeholders and to attract investors to the organization. Enterprise risk management is useful in any industry like finance, entertainment, and public health. Organizations normally mitigate risk by using property insurance, as it protects their assets from disasters, thefts, and fires. They also use malpractice and liability insurance to manage claims against the company for injury or damage. Enterprise risk management is a

Integrated Framework and Assessment Techniques Integrated framework and assessment techniques include quantitative risk assessment, event tree analysis, risk matrix approach, and indicator-based approach. Quantitative risk assessment gives information on risk and makes it easier to create mitigation measures and to create a cost-benefit analysis. The event-tree analysis is important as it provides a representation of the order of events, but it lacks enough data as it only covers the domino effects (Sekerci & Pagach, 2019). The risk matrix approach organizes risks into classes and does not utilize values, making it easy to create risk avoidance strategies. The indicator-based approach provides a complete assessment of the environmental, economic, and social factors.

Quantitative risk assessment

Quantitative risk assessment is useful to establish the relationship between the risk scenario and the factors that bring rise to the risk. In this method, the degree of each risk is presented in a graphical information system. The extent of each risk is useful to create a vulnerability curve to provide vulnerability values (Brustbauer, 2016). Quantitative risk assessment is important to give the risks to company reputation, the environment around it, and on the employees. The objectives of quantitative risk assessment are as follows. It gives the dangers that the company facilities face. It provides a representation of potential hazards, their consequences, and frequency of occurrence. It shows whether the company has the right systems to deal with risks. It provides values of the risks that the company facilities face.

Event tree analysis

Event tree analysis represents the triggers to risk, and they can be either positive or negative aspects. It starts by representing the trigger event at the top, then the resulting events towards the bottom. It is an essential technique for any risk analysis but mainly useful for

modelling physical accidents and compares them against possible prevention measures. It gives a clear pathway of the consequences of the risk factors making it simple to mitigate. The process of creating an event tree analysis is the following. The first step is to analyse the system of the organization and show all the factors or assets that face risk. Next is to create possible scenarios of accidents in each one of them. It is possible by following the design of the system. After creating scenarios, next is to show and analyse the trigger events. After analysing the trigger events, identifying their countermeasures is the next process. Next is to create an event tree representation and identify the probabilities of failure for every event. If not present, the event tree diagram is useful for calculation. Next is to identify the risk of every outcome and show their paths to show the specific risk (Brustbauer, 2016). After the identification of risk, it is important to analyse the risks on every path and whether they are acceptable. Next is to provide recommendations on the countermeasures and different paths of risk triggers and outcomes. Finally, document the event tree analysis and update where possible.

Risk matrix approach

The risk matrix approach works by providing the severity of risk against its probability. It represents risks visually and is useful for making decisions and mitigating risks. It is essential to cushion the effects of the risks on an organization. The risk matrix allows representation of risk events on one axis and the outcomes on the next axis. It is flexible and allows the addition of opinions from experts and is important in analysing the risk of natural disasters (Brustbauer, 2016). It makes it simple to observe the outcomes of risk factors and the effects that it has on an organization. However, its effectiveness is highly dependent on the expertise of individuals creating the matrix.

Business Strategy Nintendo Switch is Nintendo’s newest hybrid gaming console. It was previously Nintendo NX, and it is proving doubters wrong with its exceptional features and performance. It is a hybrid and represents a portable console and a traditional one. For the first time, many third-party games run on the Nintendo Switch, and it debuts many new features. Nintendo focuses on innovation originating from the DS and 3DS, 8-bit and 16-bit, and the Marufuku playing cards. Nintendo is conservative, and it maintains huge cash reserves. The company has about four billion dollars in cash reserves, according to its latest financial report. It is a decrease from about ten billion dollars, largely due to their recent investments in the Nintendo Switch. It enables the company to withstand financial difficulties from product failures like the Wii U and GameCube. It enables the company to reinvest, strategize, and come up with new and more competitive products. Nintendo utilizes simplicity to the core, providing stiff competition to the gaming giants in Sony and Microsoft (Callahan & Soileau, 2017). The company targets both hardcore gamers and mid-range gamers and all age groups. They represent this strategy in their products and their advertising by using a family theme. It is successful because, during the debut of the strategy, it was the best-selling gaming console, and it grew in the market value in Japan and the United States. The strategy attracts new consumers to the gaming industry as they do not have to play hardcore games as there are more family-based games (Oliva, 2016). Gaming console companies like Sony and Microsoft always strive to come up with new specs in their latest releases. It is crucial to attracting hardcore gamers as they are all about the performance of the consoles more than anything else. Nintendo uses the opposite of that strategy. The company strives to produce the best content to fit all types of gamers, and

their concerns are more on teraflops rather than specs. Their latest product, the Nintendo Switch, features additional specs, but there is a huge improvement in content and multi-player features. Nintendo also focuses hugely on the customer needs rather than the console needs. The company strives to give customers the best user experience with a highly interactive console, and it is evident as the Nintendo Wii outsold both the PS3 and Xbox 360. The Nintendo Wii was hugely profitable as the company uses fewer resources in the manufacturing process. Financial Performance The latest Nintendo financial report from January shows that Nintendo is still a world- beater. It arrives as the company launches new games the Pokémon Sword & Shield and Luigi’s Mansion 3. Nintendo reports its financials in Yen and American Dollars. The operating income stands at one and a half billion dollars up by ninety-two and a half million dollars. The net income, therefore, stands at $1 up by $272m. Nintendo’s revenue stands at $5 down by $272b. The companies digital sales rack up $488m up by $75m. The mobile revenue stands at $156m up by $22m. The console hardware shipments rank at 10 million units a new high for the company and only need about nine more million shipments to set a new record in the company. The company estimates that all hardware shipments will reach around nineteen million units at the end of the year. Risk Management Nintendo focuses on pointing out risks, analysing them, and creating measures to mitigate them and applying other ways when the risk hits. At Nintendo, every department manages its own risk, and the Auditing division is responsible for giving a go-ahead of the plans of the other divisions. They also give advice and suggestions on how they can improve their risk management plans. The company acts with advice from lawyers and other legal

Recommendations Nintendo could use the following recommendations to improve its enterprise risk management. The board of directors should get more oversight power over the risk management plan to ensure proper implementation and mitigation of risks. Nintendo should improve the intelligence on risk by ensuring that all levels of the company maintain control over risk mitigation measures and pushing for new opportunities. Nintendo should determine its risk appetite, meaning the extent to which they are willing to risk by going for new opportunities in the market. Nintendo should ensure that all strategies fall under the risk management principles to ensure the company does not go into investments blindly (Florio & Leoni, 2017). Nintendo should analyze its maturity in risk management, meaning their experience on how they handle risks. Nintendo can also inform stakeholders of risks they are taking before going for them. Results Nintendo has an effective enterprise risk management and is reflective of the COSO framework. It gears the company towards achieving its objectives in different categories as follows. The enterprise risk management plan is strategic as it supports the company’s mission to achieve its goals. It covers all the operations and is influential in utilizing its resources. The enterprise risk management plan is efficient in reporting and complies with all the legal, safety, and environmental regulations. Discussion Enterprise risk management has vital components that are important for the success of an organization, and they are the following. An internal environment is important to show how a company views the risk that it takes and the outcomes or consequences. It covers the risk appetite, operating environment, and the philosophy of managing risk. A company should

set objectives, and enterprise risk management is useful to align it with the mission and the degree of risk appetite. A company should identify the events that can affect its objectives, strategies, and mission. A company should assess its risk to check whether they are likely to occur and ways to manage it. After the assessment, it should be ready to respond to these risks effectively. It means having control measures that are useful to control the risk depending on the company’s risk appetite. The company should ensure that there is effective communication across all levels of the organization and that everyone has the right information on their responsibilities to carry out the plans in place. An organization should monitor the enterprise risk management and make necessary updates whenever possible. Conclusion Companies have more responsibility to manage risk and oversee activities like transitions to move them forward without entering a financial crisis. It means that the companies have to delegate responsibilities effectively and ensure that communication reaches all levels. Companies come up with strategies, and they analyze them to discard assumptions and to isolate risks that arise. It means that the company should have a set risk appetite and should employ risk intelligence. Stakeholders and investors are crucial in overseeing risks as they are crucial in the development of the company. Nintendo is an example of a company that utilizes enterprise risk management to ensure they achieve their objectives and to mitigate the risks that come with the outcomes. References Berry-Stölzle, T. R., & Xu, J. (2016). Enterprise risk management and the cost of capital. Journal of Risk and Insurance, 85 (1), 159- 201. doi/10.1111/jori.

- Multiple Choice

Course : Business and Leadership (BUS102)

University : mississippi gulf coast community college.

- Discover more from: Business and Leadership BUS102 Mississippi Gulf Coast Community College 182 Documents Go to course

- More from: Business and Leadership BUS102 Mississippi Gulf Coast Community College 182 Documents Go to course

- Search Search Please fill out this field.

What Is ERM?

- Understanding ERM

- A Holistic Approach to Risk

- Components of ERM

- How to Implement ERM Practices

- Pros and Cons of ERM

- Types of Risk That ERM Addresses

Ideal Entities for ERM Systems

Erm vs. erp, erm vs. crm, example of erm, the bottom line.

- Business Essentials

Enterprise Risk Management (ERM): What It Is and How It Works

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Michela Buttignol / Investopedia

What Is Enterprise Risk Management (ERM)?

Enterprise risk management (ERM) is a methodology that looks at risk management strategically from the perspective of the entire firm or organization. It is a top-down strategy that aims to identify, assess, and prepare for potential losses, dangers, hazards, and other potentials for harm that may interfere with an organization’s operations and objectives and/or lead to losses.

Key Takeaways

- Enterprise risk management (ERM) is a firm-wide strategy to identify and prepare for hazards with a company’s finances, operations, and objectives.

- ERM allows managers to shape the firm’s overall risk position by mandating that certain business segments engage with or disengage from particular activities.

- Traditional risk management, which leaves decision making in the hands of division heads, can lead to siloed evaluations that do not account for other divisions.

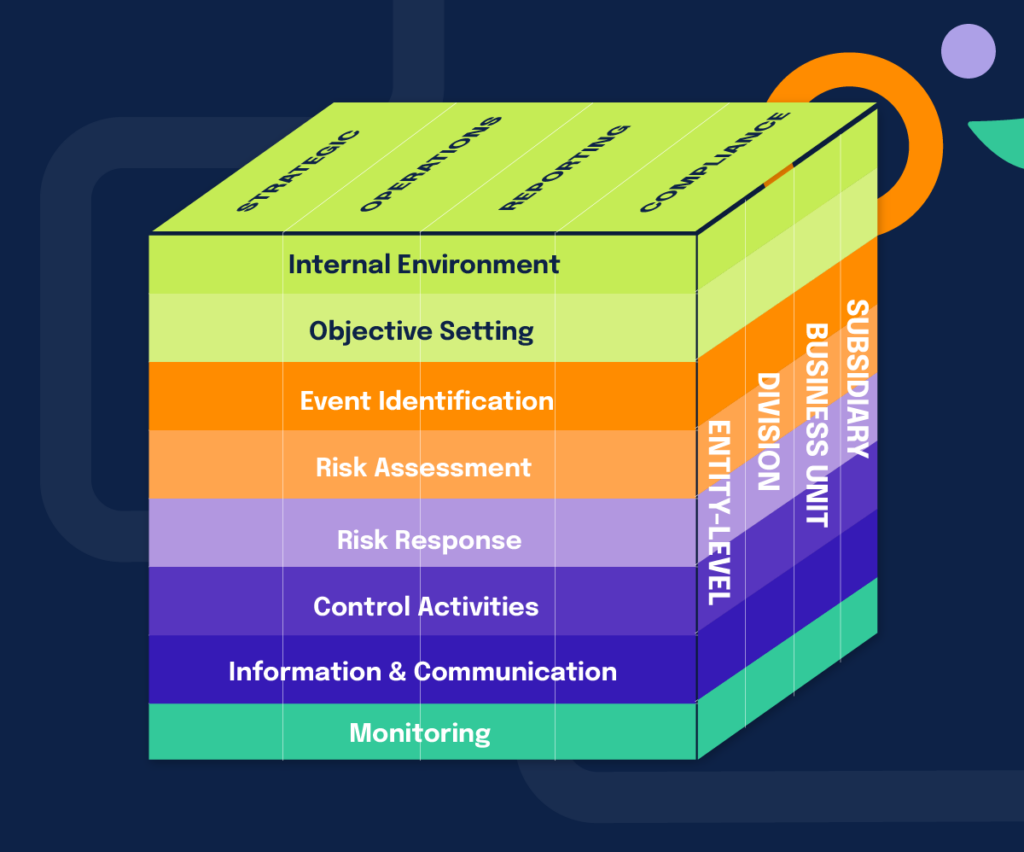

- The COSO framework for enterprise risk management identifies eight core components of developing ERM practices.

- Successful ERM strategies can mitigate operational, financial, security, compliance, legal, and many other types of risks.

Understanding Enterprise Risk Management (ERM)

Enterprise risk management takes a holistic approach and calls for management-level decision making that may not necessarily make sense for an individual business unit or segment. Thus, instead of each business unit being responsible for its own risk management, firm-wide surveillance is given precedence.

It also often involves making the risk plan of action available to all stakeholders as part of an annual report. Industries as varied as aviation, construction, public health, international development, energy, finance, and insurance all have shifted to utilize ERM.

ERM, therefore, can work to minimize firm-wide risk as well as identify unique firm-wide opportunities. Communicating and coordinating between different business units are key for ERM to succeed, since the risk decision coming from top management may seem at odds with local assessments on the ground. Firms that utilize ERM will typically have a dedicated enterprise risk management team that oversees the workings of the firm.

While ERM best practices and standards are still evolving, they have been formalized through COSO, an industry group that maintains and updates such guidance for companies and ERM professionals.

ERM-friendly firms may be attractive to investors because they signal more stable investments.

A Holistic Approach to Risk Management

Modern businesses face a diverse set of risks and potential dangers. In the past, companies traditionally handled their risk exposures via each division managing its own business. Enterprise risk management calls for corporations to identify all the risks they face. It also makes management decide which risks to manage actively. As opposed to risks being siloed across a company, a company sees the bigger picture when using ERM.

ERM looks at each business unit as a “portfolio” within the firm and tries to understand how risks to individual business units interact and overlap. It is also able to identify potential risk factors that are unseen by any individual unit.

Companies have been managing risk for years. Traditional risk management has relied on each business unit evaluating and handling its own risk and then reporting back to the CEO at a later date. More recently, companies have started to recognize the need for a more holistic approach.

A chief risk officer (CRO) , for instance, is a corporate executive position that is required from an ERM standpoint. The CRO is responsible for identifying, analyzing, and mitigating internal and external risks that impact the entire corporation.

The CRO also works to ensure that the company complies with government regulations, such as Sarbanes-Oxley (SOX) , and reviews factors that could hurt investments or a company’s business units. The CRO’s mandate will be specified in conjunction with other top management along with the board of directors and other stakeholders.

A good indication that a company is working at effective ERM is the presence of a chief risk officer (CRO) or a dedicator manager who coordinates ERM efforts.

Components of Enterprise Risk Management

The COSO enterprise risk management framework identifies eight core components that define how a company should approach creating its ERM practices.

Internal Environment

A company’s internal environment is the atmosphere and corporate culture within the company set by its employees. This sets the precedence of what the company’s risk appetite is and what management’s philosophy is regarding incurring risk. The internal environment may be set by upper management or the board and communicated throughout an organization, though it is often reflected through the actions of all employees.

Objective Setting

As a company determines its purpose, it must set objectives that support the mission and goals of a company. These objectives must then be aligned with a company’s risk appetite. For example, an ambitious company that has set far-reaching strategic plans must be aware that there may be internal risks or external risks associated with these lofty goals. In response, a company can align the measures to be taken with what it wants to accomplish, such as hiring additional regulatory staff for expansion areas it is currently unfamiliar with.

Event Identification

Positive events may have a great impact on a company. On the other hand, negative events may have detrimental outcomes on a company’s ability to continue to operate. ERM guidance recommends that companies identify important areas of the business and associated events that may have dire outcomes. These high-risk events may pose risks to operations (e.g., natural disasters that force offices to temporarily close) or strategic (e.g., government regulation outlaws the company’s primary product line).

Risk Assessment

In addition to being aware of what may happen, the ERM framework details the step of assessing risk by understanding the likelihood and financial impact of risks. This includes not only the direct risk (e.g., a natural disaster yields an office unusable) but also residual risks (e.g., employees may not feel safe returning to the office). Though difficult, the ERM framework encourages companies to consider quantifying risks by assessing the percent change of occurrence as well as the dollar impact.

Risk Response

A company can respond to risk in the following four ways:

- The company can avoid risk. This results in the company leaving the activity that causes the risk, as the company would rather forgo the benefits of the activity than incur the risk. An example of risk avoidance is a company shutting down a product line and discontinuing selling a specific good.

- The company can reduce risk. This results in the company staying engaged in the activity but putting forth effort in minimizing the likelihood or magnitude of the risk. An example of risk reduction is a company keeping the product line above open but investing more in quality control or consumer education on how to properly use the product.

- The company can share risk. This results in the company moving forward as-is with the current risk profile of the activity. However, the company leverages an independent third party to share in the potential loss in exchange for a fee. An example of risk sharing is purchasing an insurance policy.

- The company can accept risk. This results in the company analyzing the potential outcomes and determining whether it is financially worth pursuing mitigating practices. An example of risk acceptance is the company keeping open the product line with no changes to operations and risk sharing.

Control Activities

Control activities are the actions taken by a company to create policies and procedures to ensure management carries out operations while mitigating risk. Control activities, often referred to as internal controls , are broken into two different types of processes:

- Preventative control activities are in place to stop an activity from happening. These controls aim to mitigate risk by disallowing certain events from happening. An example of preventative control is a keypad or physical lock preventing all employees from entering a sensitive area.

- Detective control activities are in place to recognize when a risky action has taken place. Although the event is allowed to happen (or was not supposed to happen but still did), detective controls may alert management to ensure appropriate follow-up steps occur. An example of a detective control is an alarm for a room.

Information and Communication

Information systems should be able to capture data useful to management to better understand a company’s risk profile and risk management. This means not granting exceptions for departments outperforming others; all aspects of a company should be continually monitored. By extension, some of this data should be analyzed and communicated to employees if it is relevant to mitigating risk. By communicating with employees, there is more likely to be greater buy-in for processes and protection over company assets.

A company can turn to an internal committee or an external auditor to review its policies and practices. This may include reviewing what is actually performed compared with what policy documents suggest. This may also entail getting feedback, analyzing company data, and informing management of unprotected risks. In an ever-changing environment, companies must also be ready to assess their ERM environment and pivot as needed.

The Committee of Sponsoring Organizations (COSO) board originally published the ERM framework in 2004, then an updated version was published in 2017. The publication has been widely used since.

How to Implement Enterprise Risk Management Practices

ERM practices will vary based on a company’s size, risk preferences, and business objectives. Below are best practices that most companies can use to implement ERM strategies.

- Define risk philosophy . Before implementing any practices, a company must identify how it feels about risk and what its strategy around risk will be. This should involve strategic discussions between management and an analysis of a company’s entire risk profile.

- Create action plans . With a company’s risk philosophy in hand, it is time to create an action plan. This defines the steps a company must take to protect its assets and plans to protect the future of the organization after a risk assessment has been performed.

- Be creative . When considering risks, ERM entails thinking broadly about the problems a company may face. Though far-fetched, it is in a company’s best interest to think of as many challenges it may face and how it will respond (or decide to not respond) should the event happen.

- Communicate priorities . A company may determine that several high-importance risks are critical to mitigate for the continuation of the company. These priorities should be communicated and broadly understood as the risks that should not be incurred under any circumstance. Alternatively, a company may wish to communicate the plans if the event were to occur.

- Assign responsibilities . When an action plan has been devised, specific employees should be identified to carry out specific parts of the plan. This may include delegating tasks to specific positions should employees leave the company. This not only allows for all action items to be worked on but also will hold members responsible for their area(s) of risk.

- Maintain flexibility . As companies and risks evolve, a company must design ERM practices to be adaptable. The risks a company faces one day may be different the next; the company must be able to carry its current plan while still making plans for new, future risks.

- Leverage technology . ERM digital platforms may host, summarize, and track many of the risks of a company. Technology can also be used to implement internal controls or gather data on how performance is tracking to ERM practices.

- Continually monitor . Once ERM practices are in place, a company must ensure the practices are adhered to. This means tracking progress toward goals, ensuring certain risks are being mitigated, and employees are performing tasks as expected.

- Use metrics . As part of monitoring ERM practices, a company should develop a series of metrics to quantifiably gauge whether it is meeting targets. Often referred to as SMART goals, these metrics keep a company accountable on whether it met objectives or not.

As a company implements ERM practices, it is widely advised to continually gather feedback from all employees. Everyone will have a different perspective of what might not be working or what could be done better.

Advantages and Disadvantages of Enterprise Risk Management

ERM sets the organization-wide expectations around a company’s culture. This includes communicating more openly about the risks a company faces and how to mitigate them. This leads to less unexpected risks and more guided direction on how to respond to certain events.

In addition, this may lead to greater employee satisfaction knowing plans are in place to protect company resources, as well as greater customer service knowing how to respond to customers should certain risks actually occur.

ERM practices are often synthesized by a standardized risk report delivered to upper management. This report succinctly summarizes the risks a company faces, the actions being taken, and the information needed for decision making. As a result, a company may be more efficient with its time, especially considering what is delivered to upper management.

ERM may also have a company-wide positive impact on the resourcefulness of the business. ERM may eliminate redundant processes, ensure efficient use of staff, reduce theft, or increase profitability by better understanding what markets to enter into.

Disadvantages

As a company builds out its ERM practices, it will likely consider familiar risks it has been exposed to in the past. Therefore, ERM is limited in identifying future risks that the organization is unaware of that may have more detrimental impacts. In this manner, some may consider ERM as reactive, as companies can only forecast risk based on what they have prior experience with.

ERM also relies very heavily on management estimates and inputs. This may be nearly impossible to accurately predict. For example, in the very low chance that a company forecasts the occurrence of the COVID-19 pandemic, would a company be able to accurately calculate the fiscal impact of business closures or changes in consumer spending? ERM mitigation costs may also be difficult to assess.

ERM practices are time-intensive and therefore require the resources of the company to be successful. Though the company will benefit from protecting its assets, a company must detract time of its staff and may make capital investments to implement ERM strategies. In addition, a company may find it difficult to quantify the success of ERM, as financial risks that do not occur must simply be projected.

ERM Practices

May make a company more prepared for risks and uncertainties

May leave employees more satisfied with the future state of the company

May result in greater customer service, as companies are prepared for certain situations

May result in efficient reporting to upper management that enhances decision making

May lead to more efficient company-wide operations

May not accurately identify the risks a company is likely to experience

May not accurately assess the financial impact or likelihood of an outcome

Often requires time investment from a company to be successful

Often requires capital investment from a company to be successful

What Types of Risk Does Enterprise Risk Management Address?

ERM can help devise plans for almost any type of business risk. Business risk threatens a company’s ability to survive, and these risks may be further classified into different risks discussed below. In general, ERM most commonly addresses the following types of risk:

- Compliance risk threatens a company due to a violation of external law or requirement. An example of compliance risk is a company’s inability to produce timely financial statements in accordance with applicable accounting rules, such as generally accepted accounting principles (GAAP).

- Legal risk threatens a company should the company face a lawsuit or penalty for contractual, dispute, or regulatory issues. An example of legal risk is a billing dispute with a major customer.

- Strategic risk threatens a company’s long-term plan. For example, new market participants in the future may supplant the company as the lowest-cost provider of a good.

- Operational risk threatens the day-to-day activities required for the company to operate. An example of operational risk is a natural disaster that damages a company’s warehouse where inventory is stored.

- Security risk threatens the company’s assets if physical or digital assets are misappropriated. An example of security risk is insufficient controls overseeing sensitive client information stored on network servers.

- Financial risk threatens the debt or financial standing of a company. An example of financial risk is translation losses by holding foreign currency.

ERM is particularly well-suited for large corporations operating in complex and diverse environments. These companies often face a bunch of risks across different business units, regions, and functions. ERM helps large corporations systematically identify, assess, and manage risks at both the operational and strategic levels.

ERM can also be specifically useful in certain industries. For example, ERM is great for financial institutions such as banks, insurance companies, and investment firms. These companies operate within highly regulated and volatile markets. These institutions face so many of the risks discussed above. By integrating ERM into their operations, financial institutions can strengthen risk management practices, optimize capital allocation, and enhance their resilience to economic downturns.

Last, it's worth calling out multinational corporations and global enterprises as ideal entities. These companies benefit from ERM because of their expansive operations across multiple countries and jurisdictions. These companies encounter diverse risks related to geopolitical instability, currency fluctuations, supply chain disruptions , and regulatory compliance in varying regions. By implementing ERM frameworks, global enterprises can better track and maintain these risks, especially if their entity has higher risks in certain areas, departments, or business units.

ERM is primarily concerned with identifying, assessing, managing, and mitigating risks across an organization. On the other hand, enterprise resource planning (ERP) tools focus on integrating and optimizing core business processes. The primary purpose of ERP systems is to streamline operations across finance, manufacturing, sales, and marketing (amongst others). ERM addresses risks across various functions and departments within an organization. ERP systems are generally more specific in their scope. They tend to focus on more granular operational efficiencies instead of bigger-picture, comprehensive risks.

Implementing ERM tools requires collaboration among key stakeholders like risk managers, compliance officers, executives, and board members. These stakeholders work together to establish risk management frameworks. ERP implementations may be more geared towards collaboration among IT teams, department heads, and end-users . In addition to having a heavy part to play in operations, a primary component of ERP systems is the potentially live, interconnected play between data. For this reason, as opposed to an ERM tool, ERP systems may have a more technical demand to them.

Last, risk management strategies in ERM are designed to support long-term sustainability, protect organizational assets, and minimize potential disruptions. ERP systems align with an organization's strategic goals by improving productivity, reducing costs, and providing real-time insights into business operation opportunities. In a sense, ERM and ERP systems may counteract each other. For instance, an ERP system may signal growth and efficiency opportunities to expand in a specific new market; an ERM may signal that a new market is too great of a risk to consider.

Customer relationship management (CRM) systems are centered around managing interactions with customers and prospects. It leverages technology and processes to organize, automate, and synchronize sales, marketing, customer service, and support activities. The primary aim of CRM is to improve relationships with customers , streamline business processes, and increase profitability by understanding and meeting customer needs effectively.

Like an ERM, a CRM system consolidates data. However, the nature of the data is entirely different. While ERMs track and monitor risks, CRMs care most about customer data, interactions, and insights that enable the company to enhance customer engagement and satisfaction. CRM implementation is crucial for sales teams, marketing departments , customer service representatives, and executives who rely on customer data to drive sales growth and improve overall business performance. Alternatively, ERMs are more useful for operational teams like risk, insurance, operations, or finance.

An ERM focuses on comprehensive risk management across all facets of an organization. This tends to be inward-looking, though it can also incorporate external market forces. A CRM, alternatively, is much more outward-facing. While it will consider current processes and resources within a company, a CRM exists to monitor what is going on outside of the company with a company's arguably most important resource (i.e. its customers).

ExxonMobil is a robust example of how ERM is implemented in a large multinational corporation operating in the oil and gas industry. ERM at ExxonMobil is a structured approach that spans all levels of the organization, aiming to identify, assess, manage, and mitigate risks that could impact its business operations and overall performance. Information on ExxonMobil's ERM strategy is on the company's website.

ExxonMobil's framework integrates five core elements: organizing and aggregating risks, rigorous risk identification practices, a prioritization method, systems and processes for risk management, and comprehensive risk governance. This multi-layered approach includes defined roles and responsibilities for risk owners, functional experts, and independent verifiers. The goal is that each type of risk is actively managed and aligned with corporate requirements and processes.

Prior to initiating new developments, the company employs advanced data and computer modeling to assess potential environmental, socioeconomic, and health risks associated with construction and operations. Engaging with communities through public meetings and collaborating with regulators ensures transparent communication and compliance with regulatory standards, both of which can minimize risks in the future.

This rigorous process guided by an integrated ERM also enables ExxonMobil to implement tailored measures to prevent, minimize, or mitigate environmental impacts. These different types of risks could range from changing weather patterns to sea level rise, seismic activity, or geological conditions. ExxonMobil's environmental assessments with its ERM are conducted for both offshore and onshore facilities to deploy protective measures effectively and uphold operational safety.

ERM is a company’s approach to managing risk. It is the practices, policies, and framework for how a company handles a variety of risks that its business faces.

Why Is ERM Important?

ERM is important because it helps prevent losses or unexpected negative outcomes. ERM is also important because it helps a company set the plans in place to strategically approach risk and garner employee buy-in.

What Are the 3 Types of Enterprise Risk?

ERM often summarizes the risks a company faces into operational, financial, and strategic risks. Operational risks impact day-to-day operations, while strategic risks impact long-term plans. Financial risks impact the general financial standing and health of a company.

What Are the 8 Components of ERM?

The COSO framework for ERM identifies eight components: internal environment, objective setting, event identification, risk assessment, risk response, control activities, information & communication, and monitoring. These eight core components drive a company’s ERM practices.

What Is the Difference Between Risk Management and Enterprise Risk Management?

Risk management has traditionally been used to describe the practices and policies surrounding a specific risk that a company faces. More modern risk management has introduced ERM, a comprehensive, company-wide approach to view risk holistically for the entire company.

As a company makes, sells, and delivers goods to customers, it faces countless risks from numerous sources. To better plan for these risks, companies are turning to enterprise risk management, a company-wide, top-down approach to assessing risk and devising plans. The ultimate goal of ERM is to protect a company’s assets and operations while having strategies in place should certain unfortunate events occur.

North Carolina State University, Poole College of Management, Enterprise Risk Management Initiative. “ What Is Enterprise Risk Management (ERM)? ”

COSO. “ Guidance: Enterprise Risk Management .”

ExxonMobil. " Risk Management ."

:max_bytes(150000):strip_icc():format(webp)/relationship-management.asp-final-328dedfe770649a197cbab3b6a2aa18d.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Global directory Global directory

- Product logins Product logins

- Contact us Contact us

Our Privacy Statement & Cookie Policy

All Thomson Reuters websites use cookies to improve your online experience. They were placed on your computer when you launched this website. You can change your cookie settings through your browser.

- Privacy Statement

- Cookie Policy

Not long ago, retailer Bed Bath & Beyond was a Fortune 500 company. In 2023, it filed for Chapter 11 bankruptcy, closing its last store at the end of July. The reasons for its closure are numerous and complex. But it’s clear that it didn’t or couldn’t plan for all the dangers that brought down its once-booming business model.

As events such as the pandemic, the decline of many economies, and rapidly rising interest rates have demonstrated, even solid businesses can be disrupted. Companies of all kinds face numerous risks that could damage their operations, their reputation, their profitability, and even their viability. This makes the implementation of an enterprise risk management (ERM) initiative absolutely crucial. The goal of ERM is to help businesses make informed decisions about risk in order to operate more efficiently and profitably. But to be effective, an ERM initiative needs careful planning and enterprise-wide participation.

What is enterprise risk management?

Enterprise risk management (ERM) is a systematic approach to identifying risks associated with running a business, assessing their likelihood and potential impact, and developing strategies to manage and mitigate them. Most businesses have some kind of risk management program in place. But in “traditional” risk management, the management is typically left in the hands of separate divisions or departments. By contrast, ERM is a holistic approach, requiring communication and coordination between business units to identify and manage risks across the entire organization. Many companies have established an ERM team that includes stakeholders from several key departments.

This is because of the risks that enterprise risk management (ERM) addresses across departmental boundaries. These include strategic risks, which involve activities related to achieving business objectives. They also include financial risks that need to be managed such as debt levels, cash flow shortfalls, or investments that could harm the business’s bottom line. New technologies, notably generative AI technologies such as ChatGPT, could disrupt many companies’ business models and open them up to possible compliance challenges. Insufficient cybersecurity can cause crucial company or customer data to fall into the hands of cybercriminals. There are legal risks that would need to be managed such as lawsuits involving contracts or other business agreements. Then there are the risks associated with compliance–not meeting regulatory requirements such as Sarbanes-Oxley regarding financial reporting, for instance.

Enterprise risk management (ERM) also includes operational risk management (ORM) , which focuses specifically on identifying, assessing, and managing risks related to the organization’s day-to-day operations. These can include risks associated with technology, regulatory compliance, and onboarding vendors . Like ERM, ORM seeks to reduce risks. However, the risks ORM addresses are unintentional risks, such as employees who accidentally open up company data systems to cybercriminals. Besides managing all types of risk, ERM can also help an organization to optimize certain intentional strategic risks —those that could bring in new customers, new product lines, and new ways to reduce expenses and improve performance.

In addition, enterprise risk management (ERM) incorporates the use of key performance indicators , or KRIs, with metrics that track risk assessment performance. It also typically includes the development of a “risk register” that outlines potential risks associated with certain activities or operations.

There are numerous reasons why enterprise risk management (ERM) is essential. Most notably, it allows organizations to be proactive in identifying and monitoring potential internal and external risks rather than simply reacting to them after they occur. It also establishes protocols for mitigating those risks that an enterprise simply can’t avoid.

Another key reason a business should establish an ERM program is to enhance its ability to operate more efficiently and profitably. By raising the profile of the potential dangers a company faces, ERM protocols can help inform strategic decision-making and implementation while also minimizing losses from potentially damaging risks.

By openly and transparently sharing information about risk and mitigation, a company-wide risk management initiative can keep all employees and other stakeholders aware of risks and risk management protocols. This can be beneficial when employees interact with customers about potential risks. That in turn can reassure all stakeholders about a company’s resilience and durability.

Steps to the enterprise risk management process

Crafting a successful enterprise risk management (ERM) initiative requires careful thought and rigorous execution. That thinking informs the following ERM components, which were developed by the Committee of Sponsoring Organizations (COSO), a private-sector group that helps organizations provide guidance on internal control, risk management , and fraud deterrence:

Setting goals

This involves defining the organization’s goals and objectives and aligning them with its tolerance for risk. A business should recognize that long-range strategic plans are fraught with risks that could translate into opportunities–or dangers.

Internal workflows

Internal factors that influence the organization’s risk management include its management structure, governance, and company culture. These factors determine the enterprise’s risk appetite and what kinds of risks it needs to manage. While it is senior management (and, in many organizations, the company’s board of directors) that typically identifies what risks require managing, many organizations also engage employee input.

Identifying risks

This involves identifying risks, defined as events or situations, that could affect the organization’s ability to achieve its objectives. These impacts can be either beneficial or harmful to the company’s future operations. An ERM program should identify high-risk events that could be particularly damaging. An example of such an event might be the current backup at the Panama Canal, which is snarling numerous companies’ supply chains.

Assessing risk

In this step, a company determines how likely the risks it has identified risks are likely to occur. It also prioritizes them based on how significant an impact they might have. The COSA ERM framework suggests that companies assess both the percent change of occurrence and the dollar impact of a potential risk. In addition, COSA advises that an organization assess not only the direct risk (COVID-19 social distancing) but also residual risks (employees resisting returning to the office). There are many types of risk assessments depending on the industry, but overall, risk assessment tools have their benefits .

Responding to risk

The organization then develops and implements strategies for managing the risks it has identified. One strategy is avoidance. An example would be shedding a business line where the potential dangers outweigh any benefits. A second strategy is maintaining that business line while establishing protocols to reduce any potential damage. A third option is acceptance. A company may choose this route if it determines the possibility of a risk event occurring is low and the costs of reducing potential negative impacts are too high.

Controlling activities

Also known as internal controls, these activities involve implementing policies and procedures to mitigate the identified risks and monitoring their effectiveness. Control activities can be classified as preventative (preventing or mitigating a risk event) or detective (recognizing the risk event and responding appropriately).

Monitoring risk activity

This involves continuously monitoring the organization’s risk management processes and controls, and making adjustments as needed. A company may wish to contract with an external consultant to evaluate its risk management practices. Whether the monitoring is conducted externally or internally, it should determine how well the ERM process is working, and whether the company is leaving itself vulnerable to any risk despite the processes and policies in place.

Communicating information

This step ensures that the organization’s risk management processes and results are communicated to stakeholders. Those within the business overseeing its ERM initiative should gather data and design metrics regarding the company’s risks and how they’re being managed. Sharing this information with senior management and affected employees can ensure their involvement in any needed mitigation.

Benefits and challenges to enterprise risk management

What are the benefits of enterprise risk management.

A rigorous, thoughtfully developed enterprise risk management (ERM) program can help avoid financial losses, reputational damage, compliance failures, and legal liability. It also improves business decision-making because it provides more complete information on the risks a company faces. As a result, an ERM program can strengthen corporate governance and oversight and reduce instances of fraud.

Enterprise risk management (ERM) also boosts internal communication and interdepartmental cooperation. The regular risk reports that a firm’s ERM team delivers to upper management include a list or “matrix” of the risks, how these risks are being prepared for or mitigated, and how the risks are being prioritized. This information is crucial for management decision-making and guidance regarding risk response and preparation.

An enterprise risk management (ERM) program can help a company’s operations and profitability in numerous ways. It can uncover areas where a company is vulnerable to theft or embezzlement. It can be useful in discovering markets and product areas to enter or to avoid. ERM also can strengthen a business’s supply chain by identifying areas where that chain might be weak. An example would be the recent semiconductor shortage, which slowed production for many companies. All this can result in better management of strategic risks that could lead to new opportunities (such as acquisitions and new products) or dangers (such as new competitors and disruptive technologies).

What are the challenges of enterprise risk management?

Despite all the advantages of enterprise risk management (ERM), getting a program established is by no means a slam dunk. For most companies, ERM requires culture, process, or system changes that can be costly, time-consuming, and disruptive. ERM can be particularly costly to businesses that have limited resources. As a result, it may be difficult for supporters of an effective ERM program to get buy-in from upper management.

Company leaders may believe that the investments of time, talent, technology, and capital needed to implement an enterprise risk management (ERM) initiative don’t pencil out, and that those costs exceed the potential benefits. They may argue that it’s difficult to project a program’s effectiveness, including a legal project management tool , because it involves assessing the probability and impact of risk events that may or may not occur. Establishing metrics is often one of the most significant challenges an ERM initiative wrestles with. In addition, ERM also could result in organizations becoming reliant on particular digital technology tools, which could be a risk in itself.

If a company does go forward with establishing an enterprise risk management (ERM) program, there are other risks it will need to anticipate. It makes perfect sense that the risks an enterprise will seek to manage will be those that the company has already faced or is currently facing. But the most potentially dangerous risks are those that it hasn’t encountered. The recent pandemic is a particularly notable example. How many companies not only anticipated the pandemic but also had metrics in place to measure its effect on the business’s customers, employees, and other stakeholders? And how could the potential costs of mitigating the risks associated with the coronavirus have been determined?

Best practices for enterprise risk management

Companies need to consider both the benefits and challenges of enterprise risk management as they craft their own enterprise risk management (ERM) program. This can help them determine the best practices they should follow.

The components of enterprise risk management (ERM) discussed earlier reflect many of the best practices of an effective ERM initiative. Clearly, such a program needs to identify, assess, and prioritize all risks an enterprise might face. It needs to develop consistent action plans that eliminate or reduce the most significant risks, as well as processes to continuously monitor risk and risk-related metrics–and then enforce risk management policies.

For this to succeed, a company should also develop a culture that includes open communication about risk and risk management throughout the organization. It should also assign risk management responsibilities to appropriate employees. And it should determine whether there are ways to automate risk management processes.

Final words

In an unpredictable, fast-changing business environment, an enterprise risk management (ERM) initiative is essential. An ERM program includes assessment, prioritizing, and mitigation of any potential risk to a company’s future health and success. And wherever necessary, it solicits the participation and input of all stakeholders—senior management, board of directors, employees, and customers.

The benefits of a well-crafted risk management strategy include thorough regulatory compliance, a clearer sense of how strategic risks can help or hurt a business, and improved decision-making about operations, opportunities, and future planning. It’s not stated too strongly to say that an enterprise risk management program could mean the difference between maintaining a successful business—or going out of business entirely.

- Fraud Waste & Abuse

- Preventing Fraud

- Risk and Fraud

Navigate the current landscape of AI

Our latest Future of Professionals Report examines how AI technology is transforming professional work, highlighting key findings and recommendations.

Read the fifth annual report to understand the current state and the future of the government sector.

The growing importance of adverse media searches

False positives and false negatives: How best to leverage adverse media searches in the battle against financial crime.

Identity Verification 101: Navigating the complexities of online security for governments and corporations

Join us for a comprehensive overview of what identity verification really means in today’s interconnected world.

Mitigate risk, detect fraudulent activity, and streamline investigations

In today’s digital world, risk and fraud detection is even more important than ever before

Related posts

Beyond the main product: How ancillary products impact insurance and retail industries

Types of cybersecurity threats

How Alert Center on CLEAR reduces your risk exposure [infographic]

More answers.

6 ways law firms can set themselves up for innovation success

Sources of legal research: Primary, secondary and the role of AI

State of the Courts Report 2024: Worries over caseloads and backlogs recede as GenAI enters the chat

The Ultimate Guide to Enterprise Risk Management Strategy

Last Updated on: Nov 22, 2024 | 10 Minute Read

Enterprise risk management is a nebulous, hard-to-define topic area and requires a strong enterprise risk management strategy. It encompasses a large variety of risks and procedures for the enterprise and it differs greatly from traditional risk management.

So, what exactly is it? In this article, we’ll establish what it is, present two common enterprise risk management strategies, and emphasize the value of having enterprise-ready software to help simplify the process.

What is enterprise risk management?

According to the Committee of Sponsoring Organizations of the Treadway Commission (COSO), enterprise risk management is defined as “ the culture, capabilities, and practices, integrated with strategy-setting and its performance, that organizations rely on to manage risk in creating, preserving, and realizing value. ”

Put simply, it is the monitoring and remediation of the all-encompassing risks a business enterprise faces. These include all areas of risk management and are not limited to just cyber and info security. The key difference is that enterprise risk management is not siloed into different risk areas; it concerns all of them from one holistic view.

The 8 Types of enterprise risk

There are eight common types of enterprise risks to consider when learning about enterprise risk management, each of which are outlined below:

1. Financial risk

One of the most common — financial risk — can affect the company’s overall financial standing, with one such example being debt. If a company takes on too much debt, it could affect operations and potentially halt business procedures. For this reason, it is one of many types of financial risk an enterprise may face.

2. Operational risk

Operational risk is any risk that can affect the day-to-day operations of the company. Some examples include a wifi outage in the office, a telecommunications failure during meetings, or even supply chain disruptions. All of these risks — and more — can affect the operations of an enterprise, resulting in a loss of capital.

3. Strategic risk

Strategic risks can impact the future plans of the company. Examples include the loss of a strategy to a competitor, being undercut in pricing, or market disruption by competitors. Anything affecting the strategy and future of the enterprise can be considered a strategic risk.

4. Compliance risk

One of the most essential components to enterprise risk management, compliance risk is any compliance and rules and regulations the company must follow. This could be anything from accounting procedures to following certain standards in the industry, such as risk management frameworks. By monitoring controls in these compliance areas, enterprise companies can prevent compliance risk from affecting business operations.

5. Economic risk

Economic risk concerns the global economy and financial markets. If an enterprise is public, shareholders hold it to certain standards. Any major disruptions in the global economy may impact the financial markets, resulting in an unstable stock market. This can affect the enterprise by causing investors to sell and result in a company losing capital.

6. Legal risk

Legal risk encompasses the fact that an enterprise may be sued by a customer or third-party at any time. Lawsuits are time- and resource-consuming, and the public details of a legal matter can also cause disruptions to business operations. Customers may boycott the company or there may be large fines involved with the lawsuit, which will affect the enterprise.

7. Natural disasters

Earthquakes, tornadoes, hurricanes, tsunamis, and more are all considered enterprise risk. Natural disasters can disrupt manufacturing if a plant is damaged or workers are affected by the disaster. It can also impact the workforce if they live in an area prone to natural disasters.

8. Security risk

Lastly, enterprise risk management must take security risk into account. Security risk typically consists of a malicious threat actor taking action against the company in some way. This might be through a cyber attack , such as phishing, an issue with the physical security of a site, a data breach of sensitive client information, or even theft of physical items in a retail store. Related: Cybersecurity Best Practices

The 8 components of enterprise risk management

Enterprise risk management differs from traditional risk management in that it has more components. You might be familiar with the four pillars of risk management , but if not, they include risk identification, risk evaluation, risk handling, and risk controlling. They are just part of what constitutes enterprise risk management.

Using the COSO framework, we can actually identify eight components : internal environment, objective setting, event identification, risk assessment, risk response, control activities, information and communication, and monitoring. Let’s discuss each in detail and how they work together.

1. Internal environment

The internal environment of an enterprise is essential to enterprise risk management. How risk is perceived and remediated must be established by leadership, as well as the risks they face and the organization’s overall risk appetite.

2. Objective setting

Enterprises must set objectives before they can measure risk. These objectives must also align with the organization’s risk appetite, as well as their mission.

3. Event identification

Any events — both internal and external — that may impact the enterprise have to be identified. They can be categorized in two ways: as risks to the organization or as opportunities for the organization.

4. Risk assessment

Once risks have been identified, they can be assessed and tied back to the business’ objectives. This allows the organization to track them. Likelihood and impact should be assessed on a regular basis. Assessment should occur regularly and at all levels of the enterprise.

5. Risk response

Responding to risks can take many forms in enterprise risk management. Typically it will occur in four ways: avoiding the risk, accepting the risk, reducing the risk, or sharing the risk. Decisions are made based on the risk tolerance and risk appetite of the enterprise.

6. Control activities

Once risk response has been determined, it is time to execute and monitor the risks and their related activities. These are set up as controls so the enterprise can track and make progress toward its ideal risk posture.

7. Information and communication

To remediate risk, employees need to understand what is being asked of them. Determining what is relevant to which stakeholders across the enterprise is a difficult task, but it must be done in order to identify, assess, and respond to risks.

8. Monitoring

For enterprise risk management to be successful, it must be monitored at all levels. This allows for the organization to be able to respond dynamically at any time to changes in its environment and risks.

Two effective approaches to enterprise risk management strategy

Three Lines Model

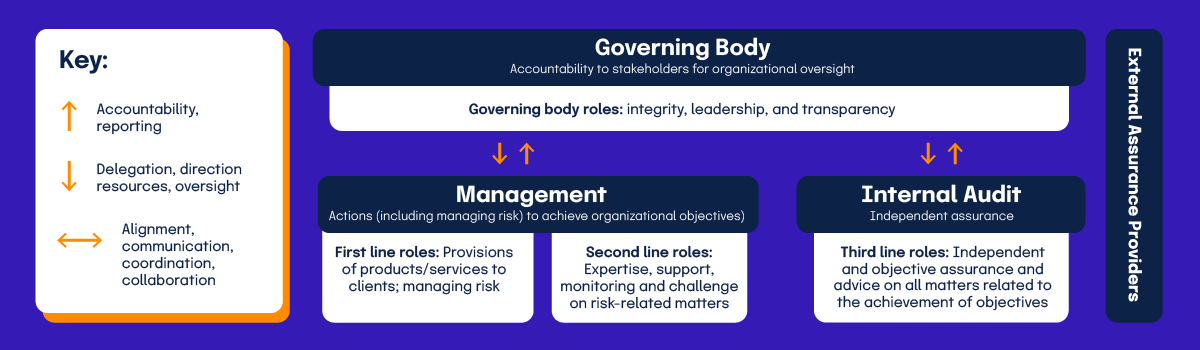

Developed by the Institute of Internal Auditors (IIA), the Three Lines Model “helps organizations identify structures and processes that best assist the achievement of objectives and facilitate strong governance and risk management.”

It is a strategy for managing risk, often implemented at the enterprise level, but it applies to all risk management . In the Three Lines Model, there are four entities: the governing body, management, internal auditors, and external assurance providers. Within the management and internal audit entities are the three lines for which the model is named.

First and second line

Per the IIA , first line roles “are most directly aligned with the delivery of products and/or services to clients of the organization, and include the roles of support functions.” Meanwhile, second line roles “provide assistance with managing risk.” These lines are the first two layers of defense for the company against risk. Their roles both impact a company’s risk as they go about achieving organizational objectives. As risk managers and stakeholders with more expertise, these lines are essential to the overall enterprise risk management. Both report to the governing body but also receive oversight from it.

The third line is internal audit, which “provides independent and objective assurance and advice on the adequacy and effectiveness of governance and risk management.” Independence from management is essential to ensure that the entity remains objective and free from bias. They do, however, have accountability to the overall governing body and oversight from it.

External assurance providers

The external assurance providers “complement internal sources of assurance,” so that there is an added layer of objectivity. They do not have shared objectives like the other entities, and therefore can provide a truly neutral perspective to the risk management activities.

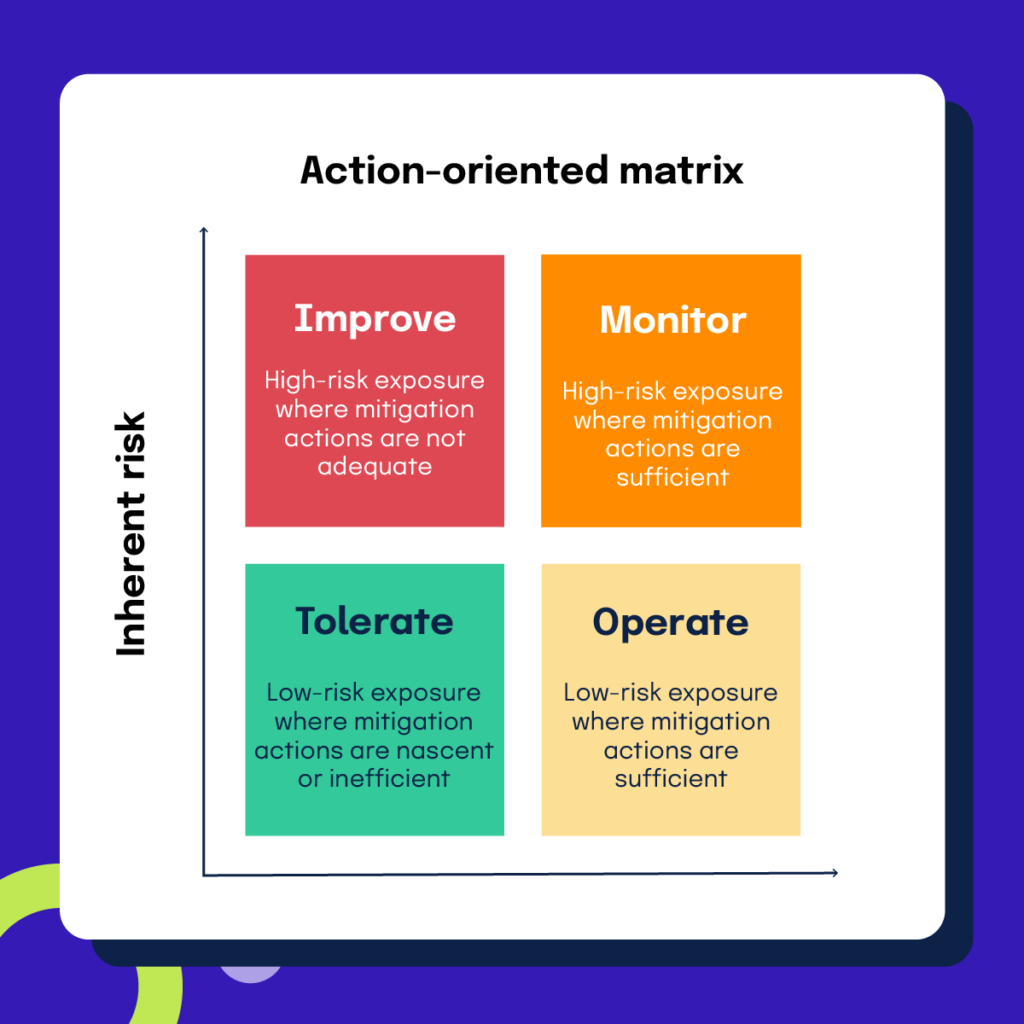

Action-oriented matrix

DLA Piper has developed an action-oriented matrix that divides risk into four categories: improve, monitor, tolerate, and operate. This matrix helps organizations allocate resources, budget, and staff to the risks that need the most attention. Risks falling in the “Tolerate” and “Operate” categories require less attention than those in the “Improve” and “Monitor” categories.

Risks in the “Improve” category should be the primary focus of the organization, but stakeholders should continue to track and monitor risks in the “Monitor” category to ensure that they do not become more severe.

Functional groups and individuals should remain aware of all four of the categories, whereas management groups should only be concerned with the “Improve” and “Monitor” categories. Lastly, board members and the audit committee should receive information about the “Improve” category because they have the least time and attention to give to the risks, and instead need updates on the most critical risks.

DLA Piper also provides an equation for pairing with your risk data so you can calculate where risks fall within the matrix: [Probability * (Severity + Velocity) = Risk]. There’s some subjectivity required in order to assign points to the risks, but overall the model helps to develop a way to manage enterprise risks holistically.

To maintain your enterprise risk management strategy, we recommend the following, as suggested by DLA Piper:

- Conducting quarterly interviews of relevant stakeholders, such as HR, IT, legal, internal audit, etc., to determine what they are seeing as the top risks

- Researching externally for risks other organizations are noting, such as at conferences or in white papers

- Evaluating whether new risks affecting part of the enterprise warrants testing across the broader enterprise

- Automating as many workflows as possible to reduce the amount of manual work your team spends managing risks

The value of enterprise risk management software

The right risk management software can help alleviate some of the stressors of enterprise risk management by giving your company a platform to simplify tasks, including evidence collection, controls monitoring, reporting and dashboarding, managing risks, and collaborating with relevant stakeholders. It can also help remove human error in the form of automation.

Automate evidence collection

Enterprises may find benefits in automating their evidence collection . From connecting the many systems they need to monitor to eliminating human error, automation allows for smoother management of evidence. Rather than repeatedly asking a colleague for a screenshot or proof of a process, an ideal enterprise risk management platform will have built-in reminders that help manage evidence collection . It will also integrate into all of the relevant tools you use daily for evidence management and allow you to reuse evidence across multiple controls.

Continuous controls monitoring

Continuous controls monitoring is defined as applying technology to allow continuous, automated monitoring of controls to validate the effectiveness of controls designed to mitigate risk, including maintaining an active cyber defense posture and ensuring business continuity and regulatory compliance.

This means that your controls will be monitored at all times, alerting you when there’s a problem or a requirement has expired. An ideal enterprise risk management software helps you monitor hundreds of controls, with the ability to drill down into specifics when needed. No more spreadsheets are needed (unless you want them); store evidence for your controls all in one place.

Reports and dashboards

Modern enterprise risk management software will have rich reporting capabilities, allowing you to immediately see your risk posture and know where your organization stands. It will have custom analytics, so you can break down reports to show what you care about — and support building the right reports and dashboards.

With dashboards, CISOs and board members can quickly understand your risk posture by looking at a single pane of glass without deep-diving into reports to find what they’re looking for. Better dashboarding means easier communication with leadership and the board using the data that actually matters to them, thus making your work easier.

Risk register

The ideal enterprise risk management software should also have a risk register , where you can track and monitor all of your risks in one place. It should also provide a matrix for you to understand what and where your most critical risks are located.

Collaboration tools

Enterprise risk management platforms should have rich collaboration tools that allow you to collaborate both with internal and external stakeholders. These tools should also provide the ability to delegate tasks to help monitor and remediate risks.

Building your enterprise risk management strategy doesn’t have to be scary

Risk can make even the most seasoned professionals uncomfortable. It’s a tough topic to dig into because it relies on so many uncertainties and different aspects of a business and its operations. But, it doesn’t have to be scary. Handling it with transparency, clear communication, and software can help unlock easier, more tolerable enterprise risk management methods. With a solution like Hyperproof , you can automate evidence collection, monitor your risk register , store and reuse evidence , continuously monitor your controls , collaborate with internal and external stakeholders, and generate beautiful, rich reporting and dashboards . Enterprise risk management has never been easier.

Learn more about how Hyperproof can support your enterprise risk management strategy .

Monthly Newsletter

Get the Latest on Compliance Operations.

Related Posts

Kayne McGladrey

Kayne McGladrey, CISSP is the field CISO for Hyperproof and a senior member of the IEEE. He has over two decades of experience in cybersecurity and has served as a CISO and advisory board member, and focuses on the policy, social, and economic effects of cybersecurity lapses to individuals, companies, and the nation.

600 1st Ave Ste 330 PMB 78059, Seattle, WA, 98104-2246

833 497 7663 // [email protected]

Product Integrations Frameworks

Blog Resource Library Glossary

About Careers Press Security and Trust Main Subscription Agreement Partner Program Benefits Contact

Current Customers

Log Into Hyperproof Support Help Center Developer Portal Status Page

© 2024 Copyright All Rights Reserved Hyperproof

Privacy | Cookies | Terms of Use | Approved Subprocessors

IMAGES

VIDEO

COMMENTS

This assignment will firstly be looking at outcomes as a form of risk, along with and explanation on risk control and analysis on Eskom's risk steps, procedures or actions. Secondly, this assignment will be addressing enterprise risk management in relation to the King reports and will look at the key drivers of change.

Studying ENRM7322 Enterprise Risk Management at Varsity College? On Studocu you will find 34 summaries, mandatory assignments, lecture notes, practice materials, ... Enterprise Risk Management Assignment. 28 pages. 2018/2019. 73% (11) 2018/2019 73% (11) Save. ENRM7322 w A1 W - Assignment 1. 4 pages. 2022/2023. 100% (1) 2022/2023 100% (1)

Assignment 3: Enterprise Risk Management Framework and Process Assignment Objectives: Provides examiners with the purpose and component parts of an ERM framework and process. Also details designing and implementing ERM and a discussion on ISO 3100 and the COSO ERM

The enterprise risk management plan is strategic as it supports the company's mission to achieve its goals. It covers all the operations and is influential in utilizing its resources. The enterprise risk management plan is efficient in reporting and complies with all the legal, safety, and environmental regulations.

1.2 Risk Management vs. Enterprise Risk Management As a consequence of economic crisis many executives now recognize that single risks can be valued realistically only in their interaction with other risks. Risks should no longer be regarded isolated, but be identified, analyzed and controlled within the framework of all interacting risks.

Risk management strategy is poorly articulated : Risk management strategy is articulated with limited detail : Risk management strategy is articulated with good detail : 5: Risk type and ...

Enterprise risk management (ERM) is a methodology that looks at risk management strategically from the perspective of the entire firm or organization. It is a top-down strategy that aims to ...

Enterprise risk management (ERM) is a systematic approach to identifying risks associated with running a business, assessing their likelihood and potential impact, and developing strategies to manage and mitigate them. Most businesses have some kind of risk management program in place. But in "traditional" risk management, the management is ...

Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives. ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization's objectives (threats and opportunities), assessing them in ...

ERM concerns all types of risk management and is much more in-depth than how one would typically manage risks. According to the Committee of Sponsoring Organizations of the Treadway Commission (COSO), enterprise risk management is defined as "the culture, capabilities, and practices, integrated with strategy-setting and its performance, that organizations rely on to manage risk in creating ...