How the market works

Business at lloyd’s is still conducted face-to-face, and the bustling underwriting room is central to the smooth running of the market.

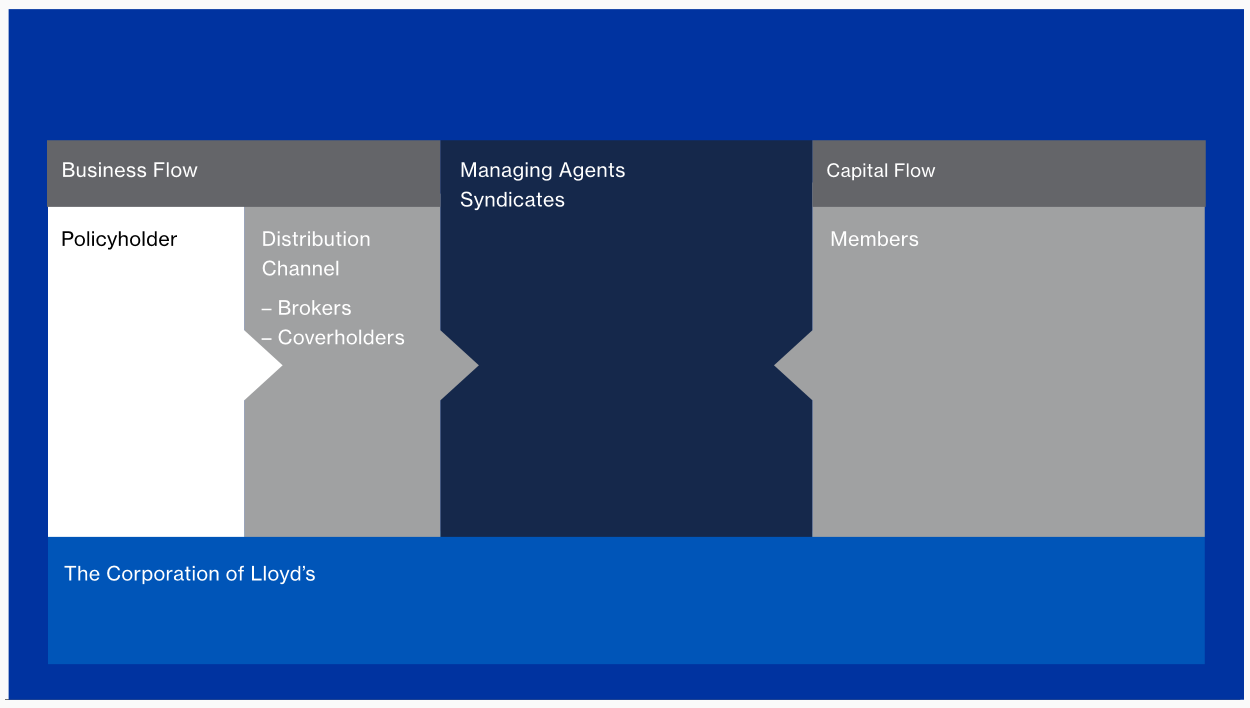

The majority of business written at Lloyd’s is placed through brokers who facilitate the risk-transfer process between clients (policyholders) and underwriters.

Clients can discuss their risk needs with a broker, a coverholder or a service company. Specialist underwriters for each syndicate price, underwrite and handle any subsequent claims in relation to the risk.

The market structure encourages innovation, speed and better value, making it attractive to policyholders and participants alike. Immediate access to decision-makers means that answers on whether a risk can be placed are made quickly, enabling the broker to provide fast, good-value solutions.

The Lloyd’s market houses syndicates which offer an unrivalled concentration of specialist underwriting expertise and talent.

How the Lloyd's market works

Policyholders - transferring risk

Policyholders include businesses, organisations, other insurers and individuals from around the world who seek to mitigate the impact of potential risks. Policyholders may access the Lloyd’s market via a broker, coverholder or service company.

Brokers - distributing the business

Lloyd’s is a broker market in which strong relationships, backed by deep expertise, play a crucial part. Brokers facilitate the risk transfer process between policyholders and underwriters. Much of this business involves face to face negotiations between brokers and underwriters.

At 31 December 2022, there were 384 registered brokers at Lloyd’s.

Coverholders and service companies - offering local access to Lloyd's

A managing agent may also authorise third parties to accept insurance risks directly on behalf of its syndicates. These businesses, known as coverholders, form a vital distribution channel, offering a local route to Lloyd’s in many territories around the world.

At 31 December 2022, there were 3,464 approved coverholders.

A service company is wholly owned by a managing agent or related group company and is authorised to enter into contracts of insurance for the associated syndicate. It is also able to sub-delegate underwriting authority to coverholders.

At 31 December 2022, there were 402 service companies.

Managing agents - managing the syndicates

A managing agent is a company set up to manage one or more syndicates on behalf of the members. Managing agents have responsibility for employing underwriters, overseeing their underwriting and managing the infrastructure and day-to-day operations.

At 31 December 2022, there were 52 managing agents at Lloyd’s.

Syndicates - writing the insurance

A Lloyd’s syndicate is formed by one or more members joining together to provide capital and accept insurance risks. Most syndicates write a range of classes of business but many will have areas of specific expertise. Syndicates are, technically, set up on an annual basis. In practice, they usually operate from year to year with members having the right, but not the obligation, to participate in syndicates the following year. This continuity of capital backing the syndicates means they function like permanent insurance operations. Each syndicate sets its own appetite for risk, develops a business plan, arranges its reinsurance protection and manages its exposures and claims.

At 31 December 2022, there were 77 syndicates, 8 special purpose arrangements and 7 syndicates in a box at Lloyd’s.

Members - providing the capital

The capital to underwrite policies is provided by members of Lloyd’s . This capital is backed by many of the world’s major insurance groups, listed companies, individuals and limited partnerships, with corporate groups providing the majority of the capital for the Lloyd’s market.

Members' agents - supporting the members

Members’ agents provide advice and administrative services to members, including assisting with syndicate selection.

Corporation of Lloyd's - supporting the market

The Corporation oversees the Lloyd’s market. It provides the market’s infrastructure, including services to support its efficient running, and protects and maintains its reputation.

In 2022, the Corporation had an average of 1,320 employees.

If you're new to the Lloyd's market, we know it can be confusing. To help, we have created a guide of who is who at every step of your journey with Lloyd's.

Reinsurance News

Lloyd’s aims to identify underwriting & exposure challenges earlier in the syndicate business planning process.

16th May 2023 - Author: Luke Gallin

Lloyd’s, the world’s oldest insurance and reinsurance marketplace, has released a market bulletin detailing the 2024 business plan and capital approval process and timeline for syndicates, stating that it intends to identify underwriting and exposure challenges earlier in the syndicate business planning process.

It underlines that performance remains Lloyd’s number one priority, highlighting the importance of syndicates providing evidence that they have considered and factored in the risks linked to macro thematic challenges in their plans.

“This will provide us with the confidence to contextualise any immediate underwriting and exposure challenges,” reads the bulletin. “This year we will endeavour to define those areas of focus and levels of materiality for challenge, earlier and with more specificity by setting clear direction during the Syndicate Business Discussions (SBDs) and maintaining consistency throughout the planning process.”

Lloyd’s adopts a principle based oversight model that it says enables it to ensure “a fair but differentiated” approach to both the capital and planning process for the 2024 year of account.

However, the level of flexibility that Lloyd’s is able to afford syndicates depends entirely on a syndicate’s categorisation.

Nevertheless, the market “will seek to enhance the attractiveness of the Lloyd’s platform by capitalising on the opportunities that a principles-based framework allows for differentiation.”

Lloyd’s syndicates come under three main categories: Outperforming syndicates; Good and moderate syndicates; and Underperforming and Unacceptable syndicates.

For the first group, which are the strongest performers at Lloyd’s, the approach will be “to understand what they intend to do, check that all material strategic or thematic issues have been resolved and evidenced through SDB engagement, and trust them to have planned appropriately.”

For the syndicates who are not outperforming, Lloyd’s notes that its “principle-based approach means we will focus our review on the area(s)that is driving the overall categorisation rating and the potential impact of such on underwriting and capital.”

Syndicates who fall under the good category, will see their review of plans focus on “only material issues as part of a portfolio based approach,” while moderate syndicates’ plans will be reviewed in more detail.

Regarding those that fall under the underperforming and unacceptable category, Lloyd’s explains that they will have already had Board Level discussions and therefore “must operate strictly within pre-agreed remediation plans.”

Regardless of the category, however, Lloyd’s aims to engage earlier this year as it looks to address any immediate underwriting and exposure challenges.

The SBDs will start in June, with every managing agent meeting with Lloyd’s representatives. Discussions will focus on performance and cover syndicates’ goals and ambitions for the 2024 year of account, including exploring managing agents’ ambitions for syndicate classes of business.

While Lloyd’s intends to engage earlier than in previous year, it will still adopt a phased approach for business plan and capital submissions for the 2024 capital and planning process.

Share this:

Recent reinsurance news, talanx aims to grow net income 30% by 2027, duck creek bolsters global team with three senior executive appointments, gabriel ewing to lead amwins global risks’ transactional risk practice in london, getting your daily reinsurance news from reinsurance news is a simple way to receive only the reinsurance industry news that matters, delivered directly to your email inbox..

Advertise on Reinsurance News

We have 225,000+ readers every month & 27,000+ email subscribers. Reach the largest reinsurance audience .

- Only email is mandatory, but the more you tell us about yourself the better we can serve you in future!

- Do you work in reinsurance?

- Sector eg: broker, laywer

- Email This field is for validation purposes and should be left unchanged.

COMMENTS

Business Plan to be agreed by Lloyd's. — A syndicate, through its managing agent, arranges its own reinsurance protection and manages its exposures and claims. — for sustainability; Syndicates can lead, and provide follow capacity, on subscription risks covering a wide range of classes of business although many will

Business Plan to be agreed by Lloyd's. — A syndicate, through its managing agent, arranges its own reinsurance protection and manages its exposures and claims. — Syndicates can lead, and provide follow capacity, on subscription risks covering a wide range of classes of business although many will be specialists in particular classes.

More broadly, Lloyd's will consider the extent to which the applicant's proposed business adds value to the Lloyd's market, having regard to criteria including: the nature and robustness of the business plan of the syndicate; whether the applicant is a competent, proficient and capable organisation;

A three-tiered, risk-based approach to 2021 business plans. Lloyd's will take a three-tiered, risk-based approach for approving 2021 business plans. ... These discussions will give managing agents the opportunity to present their prospective syndicate business plan, evolution of capital in light of risk profile and three-year plan activities ...

Additionally, to reflect internal workloads and priorities post business plans and capital approval, no SBF submissions between 1st December 2022 and 6 January 2023 will be reviewed by Lloyd's. In July we will publish the 2023 guidance on the Syndicate Business Forecast (SBF), Lloyd's Capital Return (LCR) and Catastrophe Returns.

Business at Lloyd's is still conducted face-to-face, and the bustling underwriting room is central to the smooth running of the market ... develops a business plan, arranges its reinsurance protection and manages its exposures and claims. At 31 December 2022, there were 77 syndicates, 8 special purpose arrangements and 7 syndicates in a box ...

the syndicate business plan or the syndicate business forecast (as the context requires) for the Syndicate for a particular Year of Account (in such format and containing such information as may ... carried on by it as a member of Lloyd's syndicate 1322 (the Syndicate) in accordance with the Standard Managing Agent's Agreement (General) in the ...

SYNDICATE BUSINESS PLAN CLINIC Thursday 07 March, 09.00 - 13.00 LMA Presentation Room, Gallery 4, Lloyd's SYNDICATE TEAM PRESENTATION PRACTICE Friday 05 April, 09.00 - 14.00 Old Library, Lloyd's POST REVIEW OF SYNDICATE BUSINESS PLANS Tuesday 16 April, 09.00 - 13.00 LMA Presentation Room, Gallery 4, Lloyd's

Lloyd's, the world's oldest insurance and reinsurance marketplace, has released a market bulletin detailing the 2024 business plan and capital approval process and timeline for syndicates, stating that it intends to identify underwriting and exposure challenges earlier in the syndicate business planning process.

Lloyd's intends to identify underwriting and exposure challenges earlier in the syndicate business planning process. The pressure is on, and Ebix Europe is ready to respond with ExposureHub. On 16th May Lloyd's issued a market bulletin detailing its 2024 business plan and capital approval timeline for syndicates. A critical detail within ...