End 2024 strong 💪 75% o ff for 3 months. Buy Now & Save

75% off for 3 months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

12 Legal Requirements for Starting a Small Business

When starting a new business venture, small business owners and entrepreneurs should comply with all the legal requirements for starting a small business. New businesses and startups have various legal obligations, including financial regulations, tax obligations, and employment laws. Ensure your new company complies with all its legal responsibilities so you can focus on growing your business.

Key Takeaways

- Registration is essential for legally running your business operations.

- Choose a clear and memorable business name and register it through the IRS before you begin operating, so you can separate your business from your personal name.

- Keeping detailed accounts of your registrations and transactions helps you comply with tax laws, keep track of what stage you’re at in registering your business, and enables you to manage any renewals for names and trademarks.

- Research what type of business setup is right for your company, and learn your local business and labor laws to protect yourself from liabilities and keep your employees safe.

Here’s what we’ll cover:

What Are the Legal Requirements for Starting a Business?

Can i start a business without registering it.

Frequently Asked Questions

You may have a terrific business idea, but to get your startup off the ground, you first have to make sure you comply with all the legal requirements involved as a business owner. Here’s an easy-to-follow guide for starting your business legally:

1. Create an LLC or Corporation

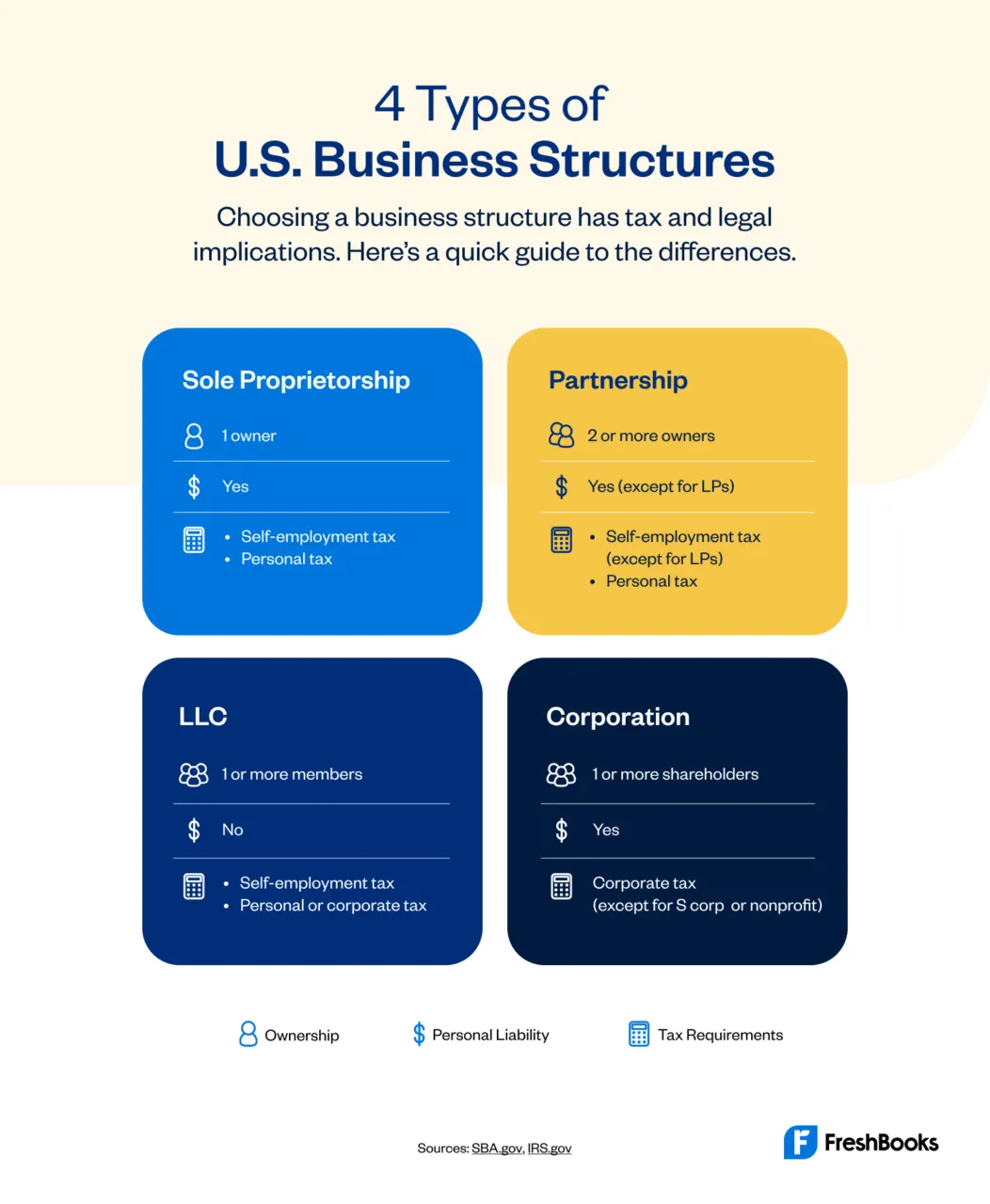

The first legal requirement you’ll need to meet as a new business owner is to choose your company’s business structure. The following four business structures are the most common and will offer different advantages depending on the size and aims of your company:

- Sole Proprietorship : Sole proprietorship is the simplest structure owned by only one person responsible for taxes and liability. This is often the most affordable structure to set up; however, it means that you and your business are one business entity from a legal and taxation perspective. This places greater liability risk on your personal assets.

- Partnership: A partnership structure shares ownership between you and one or more business partners, meaning that liability, workload, and profits are typically shared. Substructures like Limited Liability Partnerships provide additional security against liability for the actions of your business partner.

- LLC: A LLC , or Limited Liability Company, protects you from personal liability under most circumstances. This means that if your business is sued or if it declares bankruptcy, your personal assets, including your home and vehicle, won’t be at risk. With an LLC, you can file your business income as part of your personal income taxes, but you will likely need to pay self-employment tax.

- Corporation: A corporation , or C corp, is legally a separate entity from its owner or owners. Corporations offer the most significant personal protection from liability out of all business structures. However, they’re more expensive and complicated to form. Corporations file separate income taxes on profits.

2. Register Your Business Name

Once you’ve decided on a business structure, you’ll need to register your business name. Choose a name that reflects your brand and make sure it hasn’t already been claimed. You can then choose to register your business. There are four ways to register it, each serving its own purpose:

- An Entity Name: Legally protects your business at a state level

- A Trademark: Legally protects your business at a federal level

- A DBA (Doing Business As): Doesn’t offer legal protection but may be required, depending on your location and business structure

- A Domain Name: Claims your business’s web address

3. Trademark your Slogans and Logos

Create a clear and identifiable brand for your business by trademarking your slogans and logos. This helps to protect your intellectual property against other companies with similar phrases and visual branding. Choose simple, memorable slogans and logos that are easy to understand and effectively represent your business.

4. Apply for a Federal Tax ID Number

Your federal tax identification number is an Employer Identification Number (EIN). It allows hiring employees legally, paying federal taxes, applying for business licenses, and opening a business bank account . You can apply for an EIN through the IRS website . Your business will need an EIN if you plan on doing any of the following:

- Hiring and paying employees

- Filing employer tax returns

- Operating as a corporation

- Using a tax-deferred pension plan

5. Determine If You Need a State Tax ID Number

Do research to determine whether your startup needs a state tax ID number. You’ll only need one if your state collects taxes from businesses. Since tax obligations vary from state to state, it’s best to visit your own state’s website and check the local laws related to your income and employment tax obligations.

6. Obtain Business Permits and Licenses

You will need to apply for business licenses and permits at the federal and state government level, but the specific licenses you need depend on the industry you work in and your business location. The Small Business Administration lists common federal business licenses required based on industry, which is a good starting point for your research. At the state level, the licenses and permits needed and the fees owed will depend on your location and your primary business activities. Research requirements at the state and local levels based on where you do business.

Below are the three licenses and permits you need to look for depending on your industry:

- Federal Licenses And Permits

- State Licenses And Permits

- Local Licenses And Permits

7. Protect Your Business with Insurance

Professional liability insurance can protect you in cases where the personal liability protections offered by your specific business structure aren’t enough. Business insurance can protect not just your personal assets but your business assets as well. Some types of insurance are required by law, such as unemployment and disability insurance. Purchasing business insurance to protect your startup from other potential risks is also a good idea. Some common business insurance options include:

- General Liability Insurance: Protects your business from various forms of financial loss, including property damage, injury, medical issues, lawsuit settlements, or judgments.

- Product Liability Insurance: If your business sells products, this insurance protects you in the case that one of your products is defective and injures a customer.

- Commercial Property Insurance: Protects your business from loss or damage to company property as a result of natural disasters, accidents, or vandalism.

8. Hire and Classify your Employees Properly

Correctly classifying your employees is key to providing fair compensation and filing your taxes correctly. The employees you hire will typically be classified into four categories:

- Employees: This is the most protected category and includes both part-time and full-time employees. Depending upon your location and industry, the people you hire in this category will need benefits and overtime as well as their salaried or hourly compensation.

- Contractors: Contractors deliver a service for your business but are not classified as employees. They typically manage their own hours, and you are usually not responsible for their insurance or benefits.

- Interns: Interns may be paid, or unpaid depending upon your arrangement but are regulated by special rules regarding their hours and what you can ask of them. Internships allow interns to develop real-world career skills and provide short-term labor for your company.

- Volunteers: Volunteers are often involved with charitable work and are also governed by specific rules. Your business may have to meet certain requirements to qualify for volunteers from volunteer agencies.

Also Read: Business With Less Manpower

9. Comply With Labor Laws

Labor laws are essential to protect the rights and safety of employees in your workplace. These can cover everything from fair wages and hours to healthcare and worksite safety. Some labor laws may be federal, while others are specific to your region and industry. Research your local labor laws to understand how they apply to your small business so that you can operate safely and legally.

10. Open a Business Bank Account

From a legal perspective, separating your personal and business finances is important before you start collecting clients’ payments. Choose a convenient bank that serves your needs by offering lower banking fees for small business clients. When you’ve chosen a banking institution, you’ll need to provide some information about your business to open an account, including:

- Your Employer Identification Number (or Social Security Number, in the case of a sole proprietorship)

- The formation documents for your business

- Your business license

- Ownership agreement documents

11. Keep Good Records

Documenting your small business transactions is essential for taxation and measuring your growth and progress. Maintaining clear and accurate business records is also important for legality, as good records enable you to demonstrate your business’s compliance. If your business is ever subject to a tax audit, keeping your records organized makes it quick and easy to comply.

Discover a clear and simple way to keep your records with FreshBooks’ bookkeeping services . It helps you organize your sales, invoicing, and payments with free downloadable templates to manage your accounts. Click here to sign up for your free trial and learn more about how FreshBooks can support your small business.

12. Consult the Professionals

To ensure you’ve covered all your legal responsibilities as a business, it’s a good idea to consult professionals for advice. Consider sitting down separately with a lawyer and an accountant to ensure your company is covered legally and financially before opening for business.

You need to register your business name in order to use that name for your business. If you don’t have a business name registered with the Secretary of State, you can only conduct business under your personal name. Before filing for your business name, ensure it’s not currently used by someone else. Then, register the name online through the IRS.

Starting a small business requires several administrative steps to ensure that you’re legal to operate. Most businesses begin by registering important information like names, logos, and slogans. This helps protect your company’s brand identity and meet IRS requirements.

As you go through the steps to start a small business, remember to keep detailed records of all your information so you’re prepared when the time comes to renew any licensing. Thorough research of your industry is essential for complying with local business laws. Being prepared is the easiest way to protect yourself and your employees when operating a small business.

FAQs on Starting a Small Business Legal Requirements

What documents should a small business have.

When you start your own business, remember to keep document records of your:

- Tax numbers

- Business name registration

- Incorporation number

- Employer identification number

- A partnership agreement, depending upon your business structure

- Unanimous shareholder agreement

Can I run a small business without registering?

While you can run your small business under your personal name, to legally operate it under any other name, you’ll need to register that business name officially.

Does a small business need a permit?

Most small businesses will need at least one type of permit to operate legally. The permits you need will depend on your region and business type.

How do you structure a small business?

Small businesses can be structured in several ways. You can choose to operate as a sole proprietorship, partnership, limited liability company, or corporation.

What are the tax obligations for a small business?

Your small business tax obligations will depend upon where you live, but you’ll typically have to make a minimum level of profits before you’re required to register for GST.

What is a legal compliance checklist?

A legal compliance checklist is a list of items designed to ensure a business meets all regulatory requirements. The items on a compliance checklist will depend on your industry but will typically include required documentation that needs to be submitted, as well as non-compliance items to be avoided.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Stripe logo

Global payments.

Online payments

- Payment Links No-code payments

- Checkout Prebuilt payment form

- Elements Flexible UI components

In-person payments

Fraud prevention

Acceptance optimizations

Embedded payments and Finance

Payments for platforms

Financial accounts

Customer financing

Physical and virtual cards

Revenue and Finance Automation

Subscriptions and usage-based

Accounting automation

Sales tax & VAT automation

Online invoices

Custom reports

Access to 100+ globally

Accelerated checkout

Linked financial account data

Online identity verification

Startup incorporation

- Enterprises

- Startups

By business model

- Ecommerce

- Platforms

- Marketplaces

By use case

- Finance automation

- Embedded finance

- Global businesses

- Crypto

- Creator economy

- Stripe App Marketplace

- Partners

- Professional services

- Documentation

Get started

- Prebuilt checkout

- Libraries and SDKs

- App integrations

- Accept online payments

- Manage subscriptions

- Send payments

- Full API reference

- API status

- API changelog

- Build on Stripe Apps

- Support center

- Support plans

- Guides

- Customer stories

- Sessions

- Contact sales

- Newsroom

- Stripe Press

- Become a partner

Start integrating Stripe’s products and tools

- Code samples

- Set up in-person payments

- Chat With Us

10 legal requirements for starting a small business

Start your company in a few clicks and get ready to charge customers, hire your team, and fundraise.

- Introduction

1. Identify your business structure

2. register your business name, 3. apply for a federal tax id number or ein, 4. register with the state revenue office, 5. obtain business licenses and permits, 6. register for state employer taxes, 7. obtain insurance, 8. file organizational documents with the state, 9. create an operating agreement, 10. register any applicable trademarks or patents.

- Get started with Stripe

Starting a small business involves more than just a solid business plan, strong market demand, and financial readiness. It also entails a comprehensive understanding of the complex legal requirements that come with business ownership. Each form you fill out, registration you complete, and contract you prepare shield your organization from potential legal liabilities and missteps. Ignoring these requirements, tedious as they may be, is not an option.

But legal compliance isn’t an insurmountable challenge. With a thorough grasp of the regulations and procedures, you can establish your business on solid legal footing. In this article, we’ll outline the key legal requirements for starting a small business, providing a comprehensive guide to help you lay a strong foundation for your venture.

What’s in this article?

- Identify your business structure

- Register your business name

- Apply for a federal tax ID number or EIN

- Register with the state revenue office

- Obtain business licenses and permits

- Register for state employer taxes

- Obtain insurance

- File organizational documents with the state

- Create an operating agreement

- Register any applicable trademarks or patents

When you’re establishing your startup, one of the important early decisions is determining the legal structure of your business . This isn’t merely a bureaucratic step—it has profound implications for your startup’s future growth, scalability , potential for attracting investment , liability, and tax implications. Here are some of the common entity structures you can choose from:

Sole proprietorship If you’re a solopreneur launching a low-risk business, a sole proprietorship can be a cost-effective and straightforward option. However, you’ll be personally liable for business debts and legal issues. This could be risky if your startup operates in a litigious industry or one where debt is common.

Partnership If you’re cofounding the startup, a partnership may seem like a natural choice. It allows shared responsibility, profit, and loss. However, conflicts can arise in partnerships, so it’s vital to draft a partnership agreement outlining roles, responsibilities, and processes for dispute resolution. An often overlooked drawback is that you may be personally liable for your partner’s actions.

Corporation Corporations—most commonly S corps and C corps —are more complex to set up and manage due to regulatory requirements. However, they offer a major advantage for startups seeking venture capital: they allow for an easy division of ownership through the issuance of shares. This makes it much more straightforward to bring in investors. But they can be more expensive to establish and maintain, and they lead to double taxation—first on corporate income, and then on dividends to shareholders.

Limited liability company (LLC) LLCs are often a good choice for startups. They combine the liability protection of corporations with the tax advantages and operational flexibility of partnerships. Unlike corporations, profits and losses can be passed through to owners without taxation at the corporate level. However, investors may prefer corporations, particularly C corps, because they allow for preferred stock.

Choosing a business entity requires a deep understanding of each of these structures—and how each might impact your startup’s long-term strategy. Before committing to one structure, consider your plans for scaling, funding, and your personal risk tolerance. While the advice of professionals such as attorneys or CPAs can be invaluable, founders should also have a solid grasp of these implications, as they’ll impact many aspects of your startup’s journey.

Establishing an original, recognizable name for your startup is important, for branding, marketing, and legal purposes. The process involves several steps and depends on the business structure you’ve chosen.

Doing business as (DBA) If you’re a sole proprietor or a partnership, and you want to do business under a name that’s different from your personal name or your partners’ names, you’ll need to register a DBA, also known as a “fictitious name” or “trade name.” This process varies by state, but typically involves searching to make sure the name isn’t already in use , and then registering it with a specific state agency.

Corporate or LLC name If you’ve formed a corporation or an LLC, the name you chose when you filed your articles of incorporation or organization is already registered and protected in your state. However, if you want to conduct business under a different name, you’ll also need to file a DBA.

Trademarks If you want to prevent other businesses from using your business name in ways that could confuse your customers, you should consider registering it as a trademark. This is a more complex process, often requiring the assistance of a trademark attorney. You can register a trademark at the state level, but for the broadest protection—especially if you plan to do business or have an online presence outside your own state—you should register it with the United States Patent and Trademark Office (USPTO).

Choosing and registering your business name requires careful thought. Your business name is a key part of your brand and marketing strategy. It should reflect what your startup does and stand out in the markets you’re targeting. You also need to ensure that your chosen name doesn’t infringe on existing trademarks or business names, as this could lead to costly legal disputes down the road. Each state has its own laws and regulations regarding business name registration and trademark, so make sure you research the rules applicable in your specific state.

An employer identification number (EIN) is essentially a Social Security number for your business. It’s a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax filing and reporting purposes. Even if you don’t plan to have employees, most businesses are still required to obtain an EIN.

Who needs an EIN If your business is a corporation or a partnership, or has employees, you’ll need an EIN. Most banks also require an EIN to open a business bank account . An EIN is also necessary if you’re self-employed and want to create a tax-deferred retirement plan, or if you’re involved with trusts, estates, real estate mortgage investment conduits, nonprofit organizations, or farmers’ cooperatives.

How to apply The process to apply for an EIN is straightforward and free of charge. You can apply online through the IRS website . You’ll need to complete the application in one session as you cannot save and return to it later, so make sure you’ve gathered all necessary information beforehand.

Information needed To apply for an EIN, you’ll need to provide information about your business, such as its legal name, the county and state where it operates, and the nature of your business activities. You’ll also need to provide information about the “responsible party”—the individual or entity who controls, manages, or directs your business and its assets.

Securing an EIN early in the process of setting up your startup is beneficial because it allows you to keep your Social Security number private, reducing the risk of identity theft. Additionally, it enables you to complete other business setup activities that may require an EIN, such as opening a business bank account or applying for business licenses and permits.

Once you’ve established your business name and have your EIN, you’ll need to register with your state’s Department of Revenue or equivalent body. This registration allows your startup to pay state taxes, which can include sales tax, unemployment insurance tax, and income tax. The requirements can vary significantly from state to state, so it’s important to understand your specific obligations. Here are some of the taxes you might have obligations to pay:

Sales tax If you’re selling a physical product, you’ll likely need to register for a sales tax permit. Some states also require sales tax for certain services. After registration, you’ll collect sales tax from customers and remit it back to the state. The frequency of these payments varies by state and can also depend on the volume of your sales.

Employer taxes If you’re planning to hire employees, you will also need to pay unemployment insurance tax and employee withholding tax. The unemployment insurance tax goes into a state fund that pays benefits to workers laid off due to no fault of their own. The withholding tax is the income tax that employers withhold from employees’ wages and pay directly to the government.

Income tax Depending on your business structure, you may also need to pay state income tax. For example, while an LLC itself isn’t subject to income tax (with the tax “passing through” to individual members), some states levy a franchise or privilege tax on LLCs for the privilege of doing business in that state.

Notably, not all states have the same tax structure. Some states do not charge sales tax, others don’t have an individual income tax, and a handful don’t have either. Furthermore, some cities and counties also impose additional taxes, so you’ll need to consider local regulations as well.

Addressing these state and local tax obligations can be complex, and the stakes are high. If you fail to properly register and pay your business taxes, you could face penalties, fines, and interest on any amount overdue. You may want to consider using the services of a tax professional, who can ensure that you’re meeting all your obligations and taking advantage of any potential tax benefits.

To operate legally, your startup may need specific licenses and permits. These requirements vary widely depending on your business’s location and industry. Failing to obtain the necessary licenses and permits can result in penalties and, in extreme cases, force you to cease operations. Here are some examples of licenses and permits you might be required to get:

State licenses and permits Many states require specific businesses to hold licenses. For instance, if your startup is in the food service industry, you’ll likely need health permits and a food handler’s permit. Professional services, such as legal services, real estate, and medical care, often require professional licenses.

Local licenses and permits In addition to state licenses, your city or county might require you to have certain permits. Common examples include signage permits, home-based business permits, and a general business license. The process to obtain these can often be found on your local city or county government website.

Federal licenses and permits Federal licenses are typically only required for specific industries. For instance, if your business involves broadcasting, aviation, or selling alcohol, tobacco, or firearms, you’ll need a federal license or permit.

Specialty permits Depending on your operations, you may need additional permits. For example, if your business affects the environment, such as certain manufacturing operations, you may need an environmental permit.

Securing the appropriate licenses and permits is an important step in your startup’s journey. The process can be time-consuming and complex, so it’s wise to start early. Ensure that your business is fully compliant with all regulations to avoid any future penalties or interruptions to your operations. Keep in mind that requirements can vary depending on your specific industry, location, and business activities, so thorough research or consulting with a business expert is highly recommended.

When you start hiring employees for your startup, you’ll need to fulfill specific tax responsibilities related to employment, including:

Unemployment insurance tax In the US, businesses are required to pay state unemployment insurance taxes, also known as SUTA or SUI taxes, to fund unemployment benefits. The process of registration and payment varies by state. Usually, you’re required to register with the state’s labor department or unemployment insurance agency. The tax rate you’ll pay often depends on factors such as your industry and your company’s history of layoffs.

Employee withholding tax As an employer, you’re also required to withhold certain taxes from your employees’ wages and pay them to the government. This typically includes federal income tax and FICA taxes, which fund Social Security and Medicare. In most states, you’ll also need to withhold state income tax. The specifics of this process depend on your state’s rules and the details of your payroll.

Managing these tax obligations can be complex, especially as your startup grows and your workforce expands. Stay organized, keep accurate records, and make timely tax payments. Many businesses find it beneficial to use payroll services or employ an accountant to handle these tasks and stay up to date with federal, state, and local tax laws, as they can change from year to year.

The right insurance can protect your business from financial losses caused by a variety of risks, including property damage, theft, legal claims, and even business interruption. Here’s an overview of some types of insurance you might need to deal with:

General liability insurance This coverage protects your business if it’s sued for causing bodily injury or property damage. For example, if a customer slips and falls in your office or if you accidentally damage client property during a service call, general liability insurance can help cover legal costs and damages.

Property insurance If you own or lease a physical space for your business, property insurance can protect your buildings and contents in case of fires, theft, or other disasters. Even home-based businesses should consider this coverage, as homeowners’ insurance may not adequately cover business property.

Workers’ compensation insurance If you have employees, most states require you to carry workers’ compensation insurance. This coverage can help pay for medical expenses and lost wages if an employee is injured on the job.

Professional liability insurance If your business provides professional services, such as consulting or financial advice, consider professional liability insurance (also known as errors and omissions insurance). It can protect you if you’re sued for negligence, misrepresentation, or inaccurate advice.

Cyber liability insurance If your startup stores sensitive customer data (such as credit card information or personal details), cyber liability insurance can protect you in case of data breaches or cyber-attacks.

Choosing the right types and levels of insurance can be complex, and it depends on several factors including the nature of your business, its location, and its size. It’s a good idea to consult with an experienced insurance broker who understands your industry and can guide you to the appropriate coverages. Keep in mind that as your business changes over time, your insurance needs might change, too, so review your coverage periodically.

To formally establish your startup’s legal structure, you must file certain organizational documents with your state’s secretary of state or similar government agency. The exact documents and the filing process can vary by state and by your chosen legal structure. Here’s a brief overview of the requirements for different business structures:

Corporation If you’re forming a corporation, you’ll need to file articles of incorporation. This document includes key details about your business, such as its name, principal office address, purpose, the number of shares the corporation is authorized to issue, and information about the registered agent.

Limited liability company If you’re starting an LLC, you’ll file articles of organization. Much like the articles of incorporation, this document will include the name of your LLC, the principal office address, the purpose of the LLC, and information about the registered agent.

Partnership If you’re forming a partnership, the requirements can vary. Some states require partnerships to file a similar document called a “Statement of Partnership Authority.”

After filing these documents, your business is officially registered with the state. But the paperwork doesn’t stop there. If you’re operating as a corporation or an LLC, you’ll also need to create bylaws or an operating agreement. While these documents don’t need to be filed with the state, they are important, as they outline the governance and operating procedures for your business.

Your business will also likely need to file an annual report and pay an annual fee to keep your business in good standing with the state. The due date, filing fees, and processes for these reports can vary greatly by state and business structure, so be sure to note these requirements.

An operating agreement is a foundational legal document that outlines the operational procedures and ownership structure of your startup, particularly if you’re forming an LLC. Here’s what you need to know about this document:

What it includes Your operating agreement should cover key aspects of your business, such as the percentage of ownership for each member, distribution of profits and losses, member roles and responsibilities, procedures for adding or removing members, dissolution of the company, and how to handle disputes among members. It can also specify details such as meeting frequency and voting rights.

Why it’s important An operating agreement provides clarity and structure, prevents misunderstandings, and safeguards your limited liability status by separating your personal assets from those of the company. It provides a roadmap for decision-making processes and the resolution of potential disagreements among members.

Legal requirements While not all states require an LLC to have an operating agreement, it’s highly recommended to have one—even for single-member LLCs. Some states may have default rules that govern LLCs without operating agreements, but these rules may not be suitable for your business needs.

Creating an operating agreement requires thoughtfully considering how you want to run your business and how decisions will be made. It’s a good idea to consult with an attorney or a professional advisor during this process to ensure your operating agreement covers all necessary details and is in line with state laws and regulations. The operating agreement isn’t a one-and-done document. As your business grows and evolves, the agreement should be revisited and updated to reflect changes in your business structure or strategy.

Intellectual property (IP) refers to creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce, that are legally protected by patents, copyrights, trademarks, or trade secrets. IP protection is an important step for many startups. Your IP—including your business name, logo, products, or services—can be some of your most valuable assets, and protecting them can be necessary for your success.

Trademarks A trademark can protect a word, phrase, symbol, design, or a combination of these, that identifies and distinguishes your goods or services. It’s what makes your brand recognizable. Registering a trademark with the United States Patent and Trademark Office (USPTO) gives you exclusive rights to use the mark nationwide in connection with your goods or services. The process involves a comprehensive search to ensure your mark doesn’t infringe on existing trademarks, followed by an application that includes details about your mark and the goods or services it represents.

Patents If your startup has invented a new and useful process, machine, manufacture, or composition of matter, you may want to consider applying for a patent. A patent grants the inventor exclusive rights to the invention, preventing others from making, using, selling, or importing it without permission. Patents are granted by the USPTO and can take several years and substantial resources to obtain. There are different types of patents (utility, design, and plant patents) each protecting a different aspect of an invention.

Securing intellectual property rights can be a complex process requiring detailed technical and legal knowledge—and mistakes during the application process can result in lost rights or unnecessary expenses. For this reason, it’s often beneficial to engage an IP attorney or a professional service to handle these applications. Protecting your IP not only secures your rights but can also add value to your startup, attract investors, and provide a competitive advantage in the marketplace.

This is not an exhaustive list of legal requirements, and the journey to starting a business may require additional steps or involve different considerations based on a variety of factors. The nature of your startup, the industry you’re operating in, and the specific regulations of the state or states where you plan to operate can all influence which steps you’ll need to take to start your business.

For example, a tech startup with a unique software solution might need to focus heavily on patent applications, while a restaurant would have different concerns, such as health permits and food-handling certifications. A company operating in multiple states will have to comply with different state regulations, requiring a comprehensive understanding of the varying legal landscapes.

The preceding steps serve as a general roadmap, but every business’s journey is different. Conduct in-depth research, consult with professionals such as lawyers and accountants, and seek advice from business advisors familiar with your specific industry and region to ensure you’re meeting all legal requirements. This will create a foundation for launching and growth that is best suited for your specific business.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.

More articles

- How to pick a name for your startup: A step-by-step guide

- How to scale a startup: A guide for strategic planning

- Six best practices for increasing conversion and revenue for startups

Ready to get started?

- Enterprise Solutions

- Talent Solutions

- Case Studies

- State of Independence

- Guides & Research

- Meet Our Team

Press enter to see results

10 Legal Requirements for Starting a Small Business

- Following legal requirements is important to ensure your business remains compliant and profitable.

- Obtaining required permits and insurance are key steps to landing your first contracts.

- Learning about your tax obligations will help keep your business legally compliant.

Starting a small business involves several legal steps, and following legal requirements is important to ensure your business remains compliant and profitable. As a small business owner, it’s up to you to research applicable laws and follow them. This process can be daunting at first, so we’ve put together a checklist of basic legal requirements you’ll want to review before starting your small business.

1. Choose a Business Structure

A business structure is a legal structure that determines important components of your business such as how you pay taxes, if and how you are allowed to raise capital, who owns the company, and how profits are distributed. When considering which business structure to choose, start by asking yourself a few questions:

- What are my short- and long-term business goals?

- What type of services am I providing?

- Do I plan to hire employees in the future, or will this be a solo business venture?

- What capital do I have available and what future financial requirements do I have?

Gathering this information will help inform your choice. Every individual has different needs for their business, and legal entities are not a one-size-fits-all solution. While some individuals may feel their work carries little risk of legal action, others may choose to position their company for bigger growth that could carry more risk.

Four business structure options to consider when starting a small business:

1. Sole Proprietor

Many independents begin their journey as sole proprietors. For tax purposes, sole proprietors generally operate under their personal Social Security number, but you can apply for a Taxpayer Identification Number (TIN) for your business instead. This business structure requires minimal paperwork and offers flexibility if you decide to freelance part-time.

2. Limited Liability Company (LLC)

A LLC (Limited Liability Company) is a business structure that provides a middle ground between operating a corporation and a sole proprietorship: it allows for the pass-through taxation of a sole proprietorship while also providing the limited liability of a corporation. LLCs are popular due to their simplicity, while providing strong legal protections of a corporation that shield personal assets. Think of it as the next step above a sole proprietorship.

3. S Corporation

With an S Corporation, or S-Corp, profits and losses pass through to the shareholder’s personal tax return, so the business itself is not taxed. The shareholder must be paid a fair market value, but any additional profit is not subject to self-employment tax.

4. C Corporation

With a C Corporation, or C-Corp, you are the majority shareholder of your company. This business structure provides limited liability, separating your personal and professional assets. While this structure is one of the most complex business arrangements available, it is also the most sophisticated, making it an attractive option for independents.

2. Register Your Business Name

If you choose to run your business as a Sole Proprietor, the name of the business will default to the name of the owner’s legal name. For example, if your name is Rachel Smith and you form a consulting company, the legal name of the business will be “Rachel Smith.” However, if you decide to name your company “Rachel Smith Consulting,” you’ll need to register this as a DBA name.

This process lets your state or local government know the name you are operating your business under. This allows you to create and use the name you want for branding purposes without having to incorporate. Specific DBA registration rules vary from state to state .

For those who are filing a legal entity, an application must be filed with your state for either Articles of Incorporation or Articles of Organization. Whether you choose an LLC, S Corp, or C-Corp in step one above, you will need to file a name for the company with your state.

3. Trademark Names, Logos, or Slogans

If you are planning on operating nationally or providing online services, you may want to consider getting your business name trademarked. A DBA name or incorporated business name will not offer brand protection in the 49 states where your business is not registered. While trademarking is not a requirement, it will provide stronger protection for your brand. This process involves applying for a trademark with the U.S. Patent and Trademark Office. If you do want to pursue a trademark, start by conducting a comprehensive search to make sure the name you want to use is available.

Check out: 9 Ways to Build a Personal Brand for Small Business

4. Get an Employer Identification Number (EIN) from the IRS

Any business that operates as a corporation or partnership or has employees will be required to have an Employer Identification Number (EIN) from the IRS. An EIN identifies your business for tax purposes—think of it as a Social Security number for your business—and you can use to open a business bank account, file tax returns, and apply for business licenses.

The easiest way to apply for an EIN is online via the IRS EIN Assistant . If you operate as a sole proprietorship or single member LLC, you are not required to obtain an EIN, although obtaining one is a way to create additional separation between business and personal liability and it will shield your social security number on business documents and help protect against identity theft.

5. Learn About State and Local Taxes

Income tax is likely not the only tax you are responsible for paying into, so it’s important to understand other tax requirements you may have. The majority of independent contractors are considered to be self-employed and are therefore subject to paying Self-Employment (SE) Tax in addition to income tax. SE Tax is both the employer and employee halves of Social Security and Medicare (FICA).

However, there are circumstances in which your tax situation may differ. For example, how your business is structured may affect which taxes you are required to pay into. In addition, whether or not your business made a significant profit during the past year could also be a factor. More information about tax requirements can be found on the IRS website .

Learn more: Filing Independent Contractor Taxes: 4 Best Practices

6. Obtain Required Business Permits and Licenses

Just like any other business, independent contractors must obtain proper permits and licenses. Depending on your industry and where your business is located, you may need to be licensed on the federal level as well as on the state or local level. Federal licenses are required for businesses involved in any sort of activity that is supervised and regulated by a federal agency. State licensing and permits will vary depending on location.

7. Create a Compliance Plan

Even as a small business owner, you’re subject to some of the laws and regulations that apply to large corporations. These include advertising, marketing, finance, intellectual property, and privacy laws. For companies that have employees, there are additional state and federal regulations that may need to be followed situationally. The SBA has helpful advice for keeping your small business compliant .

Additionally, small businesses must ensure that they are free and clear of contractor misclassification concerns. Not only is this a threat to your business itself, but also your future clients.

Don’t miss: 5 Tips for Staying Legally Compliant as a Small Business

8. Open a Business Bank Account

Legally, having a separate bank account for business transactions will enable you to better track and report on your income and expenses. It is advisable to set up a business bank account before you start receiving payments from clients but it’s even better if you do so once you start setting up your business. Do your research and find a bank that best fits your needs. You will often need several pieces of information when opening a business bank account, such as:

- Your EIN (Employer Identification Number) or your social security number if your business is a sole proprietorship

- Formation documents for your business

- Your ownership agreement documents

- Your Business License

9. Obtain Business Insurance

The decision to start a small business means that you are responsible for ensuring the legal and financial well-being of your company. Remember that you are your business—if any legal or financial problems arise that affect your company, they will also affect you directly. It’s important to protect your business against the risk of liability losses not just because many clients will require you to have these insurances, but it also to protect yourself and your future security.

Of course, the types of insurance that are right for your business will vary greatly and depend on your industry, the size of your business, and the type of clients you work with, among other factors. Here are a few common types of business insurance that many independent contractors carry:

1. General Liability Insurance

General liability insurance is often necessary for independents. This insurance covers a wide range of incidents, including accidental damage to a client’s property, claims of libel or slander, and the cost of defending lawsuits.

2. Errors and Omissions Insurance

Errors and omissions insurance, also known as professional liability insurance, provides protection in the instance that a client incurs financial harm due to an error or omission—that is, a failure on your behalf to perform an integral part of your responsibility on a project.

3. Home-based Business Insurance

While an insurance policy for a home-based business doesn’t apply to everyone, it’s relevant for independents who choose to work out of a home office. Most homeowners’ insurance policies do not cover losses sustained out of a home office, but an insurance policy for a home-based business can provide the protection you and your clients need.

Check out: Business Insurance Requirements for Independent Consultants

10. Consider How You Will Handle Your Back Office

Back-office management consists of all of the administrative and support tasks that need to be done to run your business. This includes filing paperwork, tracking expenses, filing taxes, and billing clients. While managing your back office is not technically a legal requirement , how you choose to manage these tasks can have legal implications down the road.

Some independents choose to hire administrative support help while others go the do-it-yourself route using online tools and tech to generate invoices, track expenses, and bill clients. Planning for how you will manage these responsibilities is a smart move as a new small business owner and will allow you to focus your time and attention on clients rather than routine business maintenance.

The information provided in the MBO Blog does not constitute legal, tax or financial advice. It does not take into account your particular circumstances, objectives, legal and financial situation or needs. Before acting on any information in the MBO Blog you should consider the appropriateness of the information for your situation in consultation with a professional advisor of your choosing.

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies, related posts.

Learn more about MBO

Are you independent talent.

Learn how to start, run and grow your business with expert insights from MBO Partners

Are you an enterprise?

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

Data driven reports

MBO Partners publishes influential reports, cited by government and other major media outlets.

Informed insights

Research and tools designed to uncover insights and develop groundbreaking solutions.

Search MBO Partners by typing keyword...

IMAGES

VIDEO

COMMENTS

To stay legally compliant, you’ll need to meet external and internal business compliance requirements. Most external requirements involve filing paperwork or paying taxes with state or federal governments. Internal business requirements are for your own record keeping.

Here’s an easy-to-follow guide for starting your business legally: 1. Create an LLC or Corporation. The first legal requirement you’ll need to meet as a new business owner is to choose your company’s business structure.

While there’s no substitute for advice from experienced legal counsel, this guide outlines some of the most important legal requirements to start a small business in 2024. Be sure you...

In this article, we’ll outline the key legal requirements for starting a small business, providing a comprehensive guide to help you lay a strong foundation for your venture. What’s in this article? 1. Identify your business structure.

To ensure compliance, it’s essential that you research federal, state, and local guidelines and regulations, including zoning, licensing, employment, permits, and tax laws. To help you navigate the complexities of how to legally start a business, here are 12 common small business legal requirements to be aware of. 1. Choosing a legal business name.

Starting a small business involves several legal steps, and following legal requirements is important to ensure your business remains compliant and profitable. As a small business owner, it’s up to you to research applicable laws and follow them.