Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Key Metrics in a Business Plan

Key Metrics in a Business Plan

… we measure our success like this …

What are Key Metrics?

Additionally a key metric is sometimes referred to as key performance indicator or a KPI for short. Furthermore they vary from business to business and are chosen by management to be good indicators of success in the chosen industry.

Key Metrics Examples

- Monthly visitors and growth rates

- New paying customers

- Paying customer churn

- Paying customers at year end

or in contrast for a coffee shop business key performance indicators might be:

- Passing footfall

- Total customers

- Seat turnover rate

- Average Cover price

Key Metrics in Business Plan Sample

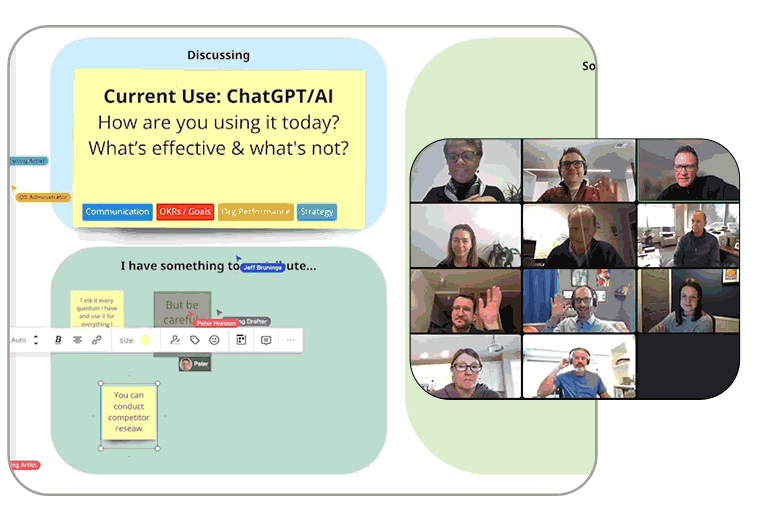

There is no set style to the KPI’s section, but the number of key metrics used should be kept to a minimum to avoid confusion, and is best shown in graph format. The example below shows the three most important KPI’s and provides a graph for each over an appropriate period of time, in this case five periods.

The purpose of the key metric section is to show what management consider the most important data to be tracked. By tracking the key metrics the business is able to monitor the progression of the business against its original projections. In doing so management is able to take early action to correct any issues which may occur as the business grows.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

Top 50 Business Metrics to Track in 2024 (+ Formulas, Examples)

By Hady ElHady

February 9, 2024

Get Started With a Prebuilt Model

Start with a free template and upgrade when needed.

Ever wondered what sets successful businesses apart from the rest? It often boils down to their ability to effectively track, analyze, and leverage key business metrics. In today’s competitive landscape, data-driven decision-making is paramount for driving growth and staying ahead of the curve.

In this guide, we’ll delve into the top business metrics every company should know and track. From measuring financial performance to evaluating customer satisfaction and optimizing employee productivity, we’ll explore how these metrics can empower organizations to make informed decisions, identify opportunities, and drive sustainable success.

What are Business Metrics?

Business metrics are quantifiable measures used to track, analyze, and assess various aspects of a business’s performance. These metrics provide valuable insights into different areas of operations, helping organizations make data-driven decisions, identify opportunities for improvement, and measure progress towards strategic objectives. Business metrics can encompass a wide range of key performance indicators (KPIs) across departments and functions, including sales, marketing, finance, operations, and customer service. They serve as vital tools for evaluating performance, optimizing processes, and driving organizational success.

Importance of Business Metrics

Business metrics play a crucial role in enabling organizations to:

- Measure Performance: Business metrics allow organizations to measure the performance and effectiveness of their operations, strategies, and initiatives. By tracking key metrics, businesses can assess their progress towards goals and objectives, identify areas of success, and pinpoint areas needing improvement.

- Make Informed Decisions: Data-driven decision-making is essential for business success. Business metrics provide actionable insights and empirical evidence that guide decision-makers in identifying opportunities, mitigating risks, and allocating resources effectively. By leveraging data-driven insights, organizations can make informed decisions that drive growth and profitability .

- Identify Trends and Patterns: Analyzing business metrics over time enables organizations to identify trends, patterns, and correlations in their data. This helps in understanding market dynamics, customer behavior, and competitive landscapes, allowing businesses to adapt strategies and stay ahead of the curve.

- Optimize Processes: Business metrics help organizations identify inefficiencies, bottlenecks, and areas of underperformance within their processes. By pinpointing areas for improvement, businesses can implement targeted interventions, streamline operations, and optimize workflows to enhance productivity and efficiency.

- Evaluate Success and ROI : Business metrics provide a framework for evaluating the success and return on investment ( ROI ) of various initiatives, projects, and campaigns. By quantifying outcomes and results, organizations can assess the effectiveness of their investments , justify expenditures, and allocate resources strategically.

- Drive Accountability and Alignment: Establishing clear, measurable metrics fosters accountability among employees and teams. By setting targets and tracking progress against predefined metrics, organizations can ensure alignment with strategic objectives, foster a culture of performance excellence, and incentivize achievement.

In summary, business metrics are essential tools for measuring, analyzing, and optimizing performance across all facets of an organization. By leveraging business metrics effectively, organizations can drive continuous improvement, enhance decision-making, and achieve sustainable growth in today’s dynamic business environment.

Key Performance Indicators (KPIs)

Understanding key performance indicators (KPIs) is crucial for assessing the health and progress of your business. KPIs are measurable values that demonstrate how effectively a company is achieving its key business objectives. Let’s delve deeper into the significance of KPIs and explore the various types you should consider tracking.

What are KPIs?

KPIs serve as quantifiable metrics that businesses use to evaluate their success in reaching strategic goals. These indicators provide insight into performance across different aspects of the business, enabling informed decision-making and strategic planning . By defining and monitoring KPIs, organizations can gauge their progress, identify areas for improvement, and drive sustainable growth.

Types of KPIs

Financial kpis.

Financial KPIs focus on assessing the monetary aspects of a company’s performance. These metrics provide insights into revenue generation, profitability , and financial stability. Common financial KPIs include:

- Formula: ((Current Period Revenue – Previous Period Revenue) / Previous Period Revenue) * 100%

- Example: If your revenue for the current period is $100, 000 and for the previous period was $80, 000 , then the revenue growth rate would be (($100,000 – $80,000) / $80,000) * 100% = 25%

- Formula: (Gross Profit / Total Revenue ) * 100%

- Example: If your gross profit is $50, 000 and total revenue is $150,000, then the gross profit margin would be ($50,000 / $150,000) * 100% = 33.33%

- Formula: (Net Profit / Investment Cost) * 100%

- Example: If your net profit from an investment is $20, 000 and the initial investment cost was $100,000, then the ROI would be ($20,000 / $100,000) * 100% = 20%

Operational KPIs

Operational KPIs assess the efficiency and effectiveness of internal processes and workflows within an organization. These metrics help optimize operations, enhance productivity, and streamline resource utilization. Examples of operational KPIs include:

- Formula: Total time to complete a process or task

- Example: If it takes 5 hours to complete a manufacturing process, then the cycle time would be 5 hours.

- Formula: Cost of Goods Sold / Average Inventory

- Example: If the cost of goods sold is $500,000 and the average inventory value is $100,000, then the inventory turnover ratio would be $500,000 / $100,000 = 5

- Formula: Total time taken to respond to customer inquiries or support requests

- Example: If it takes 1 hour to respond to a customer inquiry, then the response time would be 1 hour.

Customer KPIs

Customer KPIs focus on measuring customer satisfaction, loyalty, and engagement levels. These metrics provide insights into the customer experience, preferences, and overall satisfaction with products or services. Key customer KPIs include:

- Formula: % Promoters – % Detractors

- Example: If 30% of customers are promoters and 10% are detractors, then the NPS would be 30 – 10 = 20

- Formula: (Average Purchase Value x Purchase Frequency) x Customer Lifespan

- Example: If the average purchase value is $100, purchase frequency is 2 times per month, and the customer lifespan is 2 years, then the CLV would be ($100 x 2) x (2 x 12) = $4,800

- Formula: (Number of Customers at Start of Period – Number of Customers at End of Period) / Number of Customers at Start of Period

- Example: If you have 500 customers at the start of the month and 450 customers at the end, then the churn rate would be (500 – 450) / 500 = 0.1 or 10%

Employee KPIs

Employee KPIs assess the performance, engagement, and satisfaction of employees within an organization. These metrics help optimize workforce management, foster a positive work culture, and drive employee productivity. Examples of employee KPIs include:

- Formula: (Number of Employees Who Left / Total Number of Employees) * 100%

- Example: If 20 employees leave out of a total of 200, then the turnover rate would be (20 / 200) * 100% = 10%

- Formula: (Number of Satisfied Employees / Total Number of Employees) * 100%

- Example: If 150 out of 200 employees report being satisfied, then the satisfaction score would be (150 / 200) * 100% = 75%

- Formula: (Gain from Investment – Cost of Investment) / Cost of Investment

- Example: If the gain from training is $50,000, the cost of investment is $20,000, then the ROI would be ($50,000 – $20,000) / $20,000 = 1.5 or 150%

Selection Criteria for KPIs

Choosing the right KPIs is essential for accurately assessing performance and driving organizational success. When selecting KPIs, consider the following criteria:

- Alignment with Strategic Goals: Ensure that KPIs are directly linked to your company’s overarching objectives and key priorities.

- Measurability: Select KPIs that can be quantified and tracked using reliable data sources and measurement techniques.

- Relevance: Choose KPIs that are relevant to your industry, business model , and specific areas of focus.

- Actionability: Focus on KPIs that provide actionable insights and drive meaningful improvements in performance and outcomes.

- Timeliness: Select KPIs that can be measured and monitored in a timely manner, allowing for proactive decision-making and course corrections.

By adhering to these selection criteria, you can ensure that your chosen KPIs effectively measure progress, drive performance improvements, and support your overall business objectives.

Financial Metrics

Understanding and effectively managing financial metrics is essential for ensuring the long-term success and sustainability of your business. From tracking revenue generation to evaluating profitability and liquidity, these metrics provide valuable insights into your company’s financial health and performance. Let’s delve deeper into these key financial metrics and their calculation formulas.

Revenue Metrics

Revenue metrics are vital indicators of your business’s sales performance and income generation. By analyzing these metrics, you can assess the effectiveness of your sales strategies and identify opportunities for growth.

- Total Revenue: Total revenue represents the overall income generated by a business from its primary operations, including sales of goods or services.

- Example: If your revenue for the current period is $100,000 and for the previous period was $80,000, then the revenue growth rate would be (($100,000 – $80,000) / $80,000) * 100% = 25%

- Formula: Total Revenue / Number of Customers

- Example: If your total revenue for a month is $10,000 and you have 100 customers, then the ARPU would be $10,000 / 100 = $100 per customer.

- Formula: Total Revenue from Product or Service / Total Revenue

- Example: If your total revenue is $500,000 and revenue from Product A is $100,000, then the revenue contribution from Product A would be $100,000 / $500,000 = 20%.

Profitability Metrics

Profitability metrics assess your company’s ability to generate profit from its operations and investments. These metrics are crucial for evaluating financial performance and sustainability. Here are some key profitability metrics along with their calculation formulas:

- Formula: ( Gross Profit / Total Revenue) * 100%

- Example: If your gross profit is $50,000 and total revenue is $150,000, then the gross profit margin would be ($50,000 / $150,000) * 100% = 33.33%

- Formula: (Net Profit / Total Revenue) * 100%

- Example: If your net profit is $20,000 and total revenue is $100,000, then the net profit margin would be ($20,000 / $100,000) * 100% = 20%

- Formula: ((Net Profit – Initial Investment) / Initial Investment) * 100%

- Example: If your net profit from an investment is $30,000 and the initial investment was $100,000, then the ROI would be (($30,000 – $100,000) / $100,000) * 100% = -70%

Liquidity Metrics

Liquidity metrics measure your company’s ability to meet its short-term financial obligations and manage cash flow effectively. Maintaining sufficient liquidity is crucial for financial stability.

- Formula: Current Assets / Current Liabilities

- Example: If your current assets are $200,000 and current liabilities are $100,000, then the current ratio would be $200,000 / $100,000 = 2

- Formula: (Current Assets – Inventory) / Current Liabilities

- Example: If your current assets are $200,000, inventory is $50,000, and current liabilities are $100,000, then the quick ratio would be ($200,000 – $50,000) / $100,000 = 1.5

- Formula: Operating Cash Flow / Current Liabilities

- Example: If your operating cash flow is $50,000 and current liabilities are $100,000, then the operating cash flow ratio would be $50,000 / $100,000 = 0.5

Efficiency Metrics

Efficiency metrics help assess the effectiveness and productivity of your business operations. These metrics are essential for identifying areas for improvement and optimizing resource utilization.

- Formula: ( Accounts Receivable / Total Credit Sales) * Number of Days

- Example: If your accounts receivable is $50,000, total credit sales are $100,000, and the number of days in the period is 30, then the DSO would be ($50,000 / $100,000) * 30 = 15 days

- Formula: Revenue / Total Assets

- Example: If your total revenue is $1,000,000 and total assets are $500,000, then the asset turnover ratio would be $1,000,000 / $500,000 = 2

By calculating and analyzing these financial metrics regularly, you can gain valuable insights into your company’s financial performance, identify areas for improvement, and make informed decisions to drive sustainable growth and profitability.

Operational Metrics

Efficiently managing your business’s day-to-day operations requires a keen understanding of various operational metrics. These metrics provide valuable insights into the efficiency, productivity, and quality of your operational processes, allowing you to make informed decisions and drive continuous improvement. Let’s explore the different categories of operational metrics and their calculation formulas in more detail.

Production Metrics

Production metrics are essential for assessing the efficiency and effectiveness of your manufacturing or production processes. By monitoring these metrics, you can optimize resource allocation, minimize production costs, and enhance overall output.

- Formula: End Time – Start Time

- Example: If a production process starts at 8:00 AM and ends at 10:00 AM, then the cycle time would be 10:00 AM – 8:00 AM = 2 hours.

- Formula: (Availability) x (Performance) x (Quality)

- Example: If availability is 80%, performance is 90%, and quality is 95%, then OEE would be (0.80) x (0.90) x (0.95) = 0.684 or 68.4%.

- Formula: Total Units Produced / Time Period

- Example: If 100 units are produced in a day, then the throughput would be 100 units / 1 day = 100 units/day.

Inventory Metrics

Inventory metrics play a crucial role in managing inventory levels effectively to meet customer demand while minimizing costs and stockouts. By tracking these metrics, you can optimize inventory management practices and improve supply chain efficiency.

- Example: If the cost of goods sold is $500,000 and the average inventory value is $100,000, then the inventory turnover ratio would be $500,000 / $100,000 = 5.

- Formula: (Average Inventory / Cost of Goods Sold) x Number of Days

- Example: If average inventory is $50,000, cost of goods sold is $200,000, and the number of days in the period is 365, then DIO would be ($50,000 / $200,000) x 365 = 91.25 days.

- Formula: (Number of Stockouts / Total Orders) x 100%

- Example: If there were 10 stockouts out of 200 orders, then the stockout rate would be (10 / 200) x 100% = 5%.

Quality Metrics

Quality metrics are crucial for ensuring consistent product quality and customer satisfaction. By monitoring these metrics, you can identify and address quality issues proactively, improving overall product performance and brand reputation.

- Formula: (Total Units Produced – Defective Units) / Total Units Produced

- Example: If 900 units are produced with 50 defective units, then FPY would be (900 – 50) / 900 = 0.944 or 94.4%.

- Formula: (Number of Defective Units / Total Units Produced) x 100%

- Example: If 100 defective units are found in a batch of 1,000 units produced, then the defect rate would be (100 / 1,000) x 100% = 10%.

- Formula: (Number of Customer Complaints / Total Number of Customers) x 100%

- Example: If there were 20 customer complaints out of 1,000 customers, then the complaint rate would be (20 / 1,000) x 100% = 2%.

Supply Chain Metrics

Supply chain metrics help evaluate the performance and efficiency of your supply chain processes, from sourcing raw materials to delivering finished products to customers. By tracking these metrics, you can optimize supply chain operations, reduce costs, and improve overall performance. Here are some important supply chain metrics along with their calculation formulas:

- Formula: Order Delivery Time – Order Placement Time

- Example: If an order is placed at 9:00 AM and delivered at 3:00 PM on the same day, then the order fulfillment cycle time would be 3:00 PM – 9:00 AM = 6 hours.

- Formula: Date of Goods Receipt – Date of Order Placement

- Example: If goods are received on May 15th and the order was placed on May 10th, then the supplier lead time would be May 15th – May 10th = 5 days.

- Formula: (Number of Perfect Orders / Total Number of Orders) x 100%

- Example: If there were 80 perfect orders out of 100 total orders, then the perfect order rate would be (80 / 100) x 100% = 80%.

By calculating and analyzing these operational metrics regularly, you can gain valuable insights into your business’s operational performance, identify areas for improvement, and drive continuous enhancement of your operations.

Customer Metrics

Understanding and effectively managing customer relationships is paramount for the success of any business. Customer metrics provide valuable insights into various aspects of the customer journey, enabling businesses to make informed decisions and deliver exceptional experiences. Let’s explore the different categories of customer metrics and their calculation formulas to gain a deeper understanding of customer behavior and satisfaction.

Customer Acquisition Metrics

Customer acquisition metrics help businesses evaluate the effectiveness of their marketing and sales efforts in attracting new customers. By tracking these metrics, you can assess the performance of your acquisition strategies and optimize resource allocation. Here are some key customer acquisition metrics along with their calculation formulas:

- Formula: Total Cost of Acquisition / Number of New Customers

- Example: If you spent $10,000 on marketing campaigns and acquired 100 new customers, then the CPA would be $10,000 / 100 = $100 per customer.

- Formula: (Number of Conversions / Number of Leads) x 100%

- Example: If you received 500 leads from a marketing campaign and 50 of them converted into customers, then the conversion rate would be (50 / 500) x 100% = 10%.

- Formula: Average Purchase Value x Purchase Frequency x Customer Lifespan

- Example: If the average purchase value is $50, customers purchase twice a month, and the average customer lifespan is 2 years, then CLV would be ($50 x 2) x (2 x 12) = $2,400.

Customer Satisfaction Metrics

Customer satisfaction metrics gauge the level of satisfaction and happiness customers experience with your products or services. By monitoring these metrics, you can identify areas for improvement and enhance overall customer experience. Here are some important customer satisfaction metrics along with their calculation formulas:

- Formula: (Number of Satisfied Customers / Total Number of Survey Respondents) x 100%

- Example: If 80 out of 100 survey respondents report being satisfied, then the CSAT score would be (80 / 100) x 100% = 80%.

- Formula: (% Promoters – % Detractors)

- Example: If 30% of customers are promoters and 10% are detractors, then the NPS would be 30 – 10 = 20.

- Formula: (Total CES Scores / Number of Responses)

- Example: If the total CES scores from customer surveys sum up to 400 and there were 100 responses, then the CES would be 400 / 100 = 4.

Customer Retention Metrics

Customer retention metrics focus on retaining existing customers and reducing churn rates. By analyzing these metrics, you can implement strategies to increase customer loyalty and lifetime value. Here are some key customer retention metrics along with their calculation formulas:

- Formula: (Number of Customers Lost / Total Number of Customers at the Beginning of the Period) x 100%

- Example: If you lost 50 customers out of 500 at the beginning of the month, then the churn rate would be (50 / 500) x 100% = 10%.

- Formula: (Number of Repeat Customers / Total Number of Customers) x 100%

- Example: If you have 200 repeat customers out of 1,000 total customers, then the repeat purchase rate would be (200 / 1,000) x 100% = 20%.

- Formula: Total Cost of Retention Activities / Number of Retained Customers

- Example: If you spent $5,000 on retention activities and retained 100 customers, then the retention cost would be $5,000 / 100 = $50 per customer.

Net Promoter Score (NPS)

Net Promoter Score (NPS) is a widely used metric for assessing customer loyalty and satisfaction. It is based on a single question: “How likely are you to recommend our product/service to a friend or colleague?” Customers are categorized into promoters (score 9-10), passives (score 7-8), and detractors (score 0-6). The NPS is calculated by subtracting the percentage of detractors from the percentage of promoters:

NPS = % Promoters – % Detractors

A high NPS indicates strong customer advocacy and loyalty, while a low NPS may signal areas for improvement in customer experience and satisfaction.

By analyzing these customer metrics comprehensively and acting on insights gained, you can optimize your customer relationships, enhance satisfaction levels, and drive sustainable business growth.

Employee Metrics

Understanding and optimizing employee performance and satisfaction is crucial for fostering a positive work environment and achieving organizational success. Employee metrics provide valuable insights into various aspects of employee performance, engagement, and retention. Let’s explore the different categories of employee metrics and their significance in maximizing workforce productivity and satisfaction.

Employee Productivity Metrics

Employee productivity metrics measure the efficiency and effectiveness of employees in completing tasks and achieving goals. By tracking these metrics, organizations can identify top performers, optimize resource allocation, and improve overall productivity. Here are some key employee productivity metrics along with their descriptions, formulas, and examples:

- Formula: Total Revenue / Number of Employees

- Example: If a company generates $5 million in revenue with 100 employees, then the revenue per employee would be $5,000,000 / 100 = $50,000.

- Formula: (Total Sales / Number of Sales Representatives) x 100%

- Example: If a sales team achieves $1 million in sales with 10 sales representatives, then the sales performance would be ($1,000,000 / 10) x 100% = $100,000 per sales representative.

- Formula: Total Number of Tasks Completed / Number of Employees

- Example: If a team completes 500 tasks in a month with 50 employees, then the tasks completed per employee would be 500 / 50 = 10 tasks per employee.

Employee Engagement Metrics

Employee engagement metrics assess the level of commitment, satisfaction, and motivation among employees. Engaged employees are more productive, creative, and loyal, leading to higher organizational performance. Here are some important employee engagement metrics along with their descriptions, formulas, and examples:

- Formula: (Number of Satisfied Employees / Total Number of Employees) x 100%

- Example: If 80 out of 100 employees report being satisfied with their job, then the employee satisfaction score would be (80 / 100) x 100% = 80%.

- Example: If 40% of employees are promoters and 10% are detractors, then the eNPS would be 40 – 10 = 30.

- Formula: (Number of Employees Participating in Survey / Total Number of Employees) x 100%

- Example: If 200 out of 300 employees participate in an engagement survey, then the participation rate would be (200 / 300) x 100% = 66.67%.

Employee Turnover Metrics

Employee turnover metrics evaluate the rate at which employees leave the organization. High turnover rates can be costly and disruptive to business operations, while low turnover rates indicate a stable workforce. Here are some key employee turnover metrics along with their descriptions, formulas, and examples:

- Formula: (Number of Voluntary Terminations / Total Number of Employees) x 100%

- Example: If 20 employees voluntarily leave a company with 200 employees, then the voluntary turnover rate would be (20 / 200) x 100% = 10%.

- Formula: (Number of Involuntary Terminations / Total Number of Employees) x 100%

- Example: If 10 employees are terminated by a company with 200 employees, then the involuntary turnover rate would be (10 / 200) x 100% = 5%.

- Formula: (Number of Employees Who Left / Average Number of Employees) x 100%

- Example: If 30 employees leave a company with an average of 300 employees, then the overall turnover rate would be (30 / 300) x 100% = 10%.

Training and Development Metrics

Training and development metrics assess the effectiveness of employee training programs and professional development initiatives. Investing in employee development can enhance skills, knowledge, and performance, contributing to organizational growth and success. Here are some important training and development metrics along with their descriptions, formulas, and examples:

- Formula: (Net Training Benefits – Training Costs) / Training Costs x 100%

- Example: If training costs amount to $50,000 and the net benefits derived from training are $100,000, then the training ROI would be (($100,000 – $50,000) / $50,000) x 100% = 100%.

- Formula: (Number of Employees Who Completed Training / Total Number of Employees Enrolled in Training) x 100%

- Example: If 80 employees complete a training program out of 100 enrolled employees, then the completion rate would be (80 / 100) x 100% = 80%.

- Formula: (Post-Training Skill Level – Pre-Training Skill Level) / Pre-Training Skill Level x 100%

- Example: If an employee’s skill level increases from 70% to 90% after training, then the skill improvement rate would be ((90% – 70%) / 70%) x 100% = 28.57%.

By tracking and analyzing these employee metrics, organizations can gain valuable insights into employee performance, engagement, and satisfaction levels. This information can inform strategic decision-making, drive continuous improvement initiatives, and create a positive work culture conducive to employee success and organizational growth.

Data Collection and Analysis

Analyzing data is crucial for making informed decisions and driving organizational success. In this section, we’ll explore the process of collecting and analyzing data, covering various data sources, tools, and techniques used for effective data analysis.

Data Sources

Data can be sourced from a variety of sources, both internal and external, to provide valuable insights into different aspects of business operations. Here are some common data sources used by organizations:

- Internal Data: This includes data generated from internal systems and processes such as customer relationship management (CRM) systems, enterprise resource planning ( ERP ) systems, sales databases, and employee performance records .

- External Data: External data sources encompass data obtained from outside the organization, such as market research reports, industry benchmarks, social media platforms , government databases, and third-party data providers.

- Customer Feedback: Customer feedback collected through surveys, feedback forms, online reviews, and social media platforms can offer valuable insights into customer preferences, satisfaction levels, and areas for improvement.

- Website and App Analytics: Website and app analytics tools like Google Analytics provide valuable data on website traffic, user behavior, conversion rates, and engagement metrics, helping organizations optimize their online presence and user experience.

- Sensor Data: For organizations in manufacturing, healthcare, or IoT (Internet of Things) industries, sensor data from equipment, devices, or machinery can provide insights into performance, efficiency, and maintenance needs.

Tools and Technologies

Numerous tools and technologies are available to collect, store, process, and analyze data efficiently. Here are some commonly used tools and technologies for data collection and analysis:

- Data Management Platforms (DMPs): DMPs allow organizations to collect, organize, and manage large volumes of data from various sources. They provide capabilities for data integration, cleansing, and storage, facilitating seamless data analysis.

- Business Intelligence (BI) Tools: BI tools like Tableau, Power BI, and QlikView enable organizations to visualize and analyze data to uncover insights, trends, and patterns. These tools offer interactive dashboards, reports, and data visualization capabilities for data-driven decision-making.

- Statistical Software: Statistical software such as R, Python (with libraries like pandas and numpy), and SAS are used for advanced data analysis, hypothesis testing, predictive modeling, and machine learning algorithms.

- Database Management Systems (DBMS): DBMS like MySQL, PostgreSQL, and MongoDB are essential for storing, organizing, and retrieving structured and unstructured data efficiently. They provide robust data management capabilities for large-scale data processing.

- Text Analytics Tools: Text analytics tools like IBM Watson and Lexalytics enable organizations to analyze unstructured textual data from sources such as social media, customer reviews, and surveys. These tools extract insights, sentiments, and trends from text data.

Data Analysis Techniques

Data analysis involves applying various techniques and methodologies to extract actionable insights from data. Here are some common data analysis techniques used by organizations:

- Descriptive Analysis: Descriptive analysis involves summarizing and describing the main features of a dataset, such as mean, median, mode, standard deviation, and percentiles. It provides a snapshot of historical data trends and patterns.

- Diagnostic Analysis: Diagnostic analysis aims to identify the root causes of observed trends or anomalies in data. It involves analyzing relationships between variables, conducting regression analysis, and identifying correlations to understand underlying factors influencing outcomes.

- Predictive Analysis: Predictive analysis utilizes statistical modeling and machine learning algorithms to forecast future trends, outcomes, or behaviors based on historical data patterns. It helps organizations make proactive decisions and anticipate future events.

- Prescriptive Analysis: Prescriptive analysis goes beyond predicting outcomes by recommending actions or strategies to achieve desired goals or optimize performance. It involves simulating different scenarios, conducting optimization techniques, and recommending the best course of action.

- Sentiment Analysis: Sentiment analysis examines text data to determine the sentiment or opinion expressed by users. It categorizes text as positive, negative, or neutral, allowing organizations to understand customer opinions, sentiments, and feedback.

- Cluster Analysis: Cluster analysis groups similar data points or observations into clusters or segments based on their characteristics or attributes. It helps identify patterns, segments, or customer groups within a dataset, enabling targeted marketing or personalized recommendations.

By leveraging a combination of data sources, tools, and analysis techniques, organizations can gain valuable insights into their operations, customers, and market dynamics. This enables data-driven decision-making, enhances business performance, and drives competitive advantage in today’s data-driven landscape.

How to Implement Business Metrics?

Implementing business metrics is essential for monitoring performance, identifying areas for improvement, and driving organizational success. In this section, we’ll explore the steps involved in effectively implementing business metrics, from setting objectives to continuous monitoring and adjustment.

Setting Objectives

Setting clear and measurable objectives is the foundation of effective metric implementation. Objectives should align with the organization’s overall goals and strategic priorities. Here’s how to set objectives for business metrics:

- Define Key Goals: Identify the key goals and priorities of your organization, such as increasing revenue, improving customer satisfaction, or enhancing operational efficiency.

- Identify Key Performance Areas: Determine the key areas or processes that directly contribute to achieving your goals. These could include sales, marketing, customer service, operations, and finance.

- Define Specific Metrics: Choose specific metrics that align with each key performance area and measure progress towards your objectives. Ensure that metrics are relevant, actionable, and measurable.

- Set SMART Goals: Ensure that objectives are SMART (Specific, Measurable, Achievable, Relevant, Time-bound) to provide clarity and accountability. Establish clear targets or benchmarks for each metric.

Establishing Baselines

Establishing baselines involves determining the current performance levels of selected metrics as a reference point for future comparisons. Baselines provide context and allow organizations to track progress over time. Here’s how to establish baselines for business metrics:

- Collect Historical Data: Gather historical data for each selected metric from relevant sources, such as internal systems, databases, or third-party sources. Ensure data accuracy and consistency.

- Calculate Current Metrics: Calculate the current values of selected metrics based on historical data. This provides a baseline or starting point for performance measurement.

- Analyze Trends and Patterns: Analyze historical data to identify trends, patterns, and fluctuations in performance metrics over time. Understand the factors influencing variations in performance.

- Document Baseline Metrics: Document baseline metrics and performance trends for future reference. This serves as a benchmark for evaluating progress and identifying areas for improvement.

Creating Dashboards and Reports

Creating dashboards and reports facilitates the visualization and communication of key metrics to stakeholders across the organization. Dashboards provide real-time insights into performance, while reports offer in-depth analysis and recommendations. Here’s how to create dashboards and reports for business metrics:

- Select Visualization Tools: Choose suitable data visualization tools or dashboard platforms that meet the needs of your organization. Common tools include Tableau, Power BI, Google Data Studio, and Excel.

- Design Dashboard Layout: Design intuitive and user-friendly dashboard layouts that display key metrics, trends, and performance indicators at a glance. Organize information logically and prioritize critical metrics.

- Customize Metrics Views: Customize dashboard views for different stakeholders, such as executives, managers, and frontline employees. Tailor metrics and visualizations to align with the needs and interests of each audience.

- Schedule Regular Reporting: Establish a cadence for regular reporting and updates, such as weekly, monthly, or quarterly. Ensure timely dissemination of reports to relevant stakeholders to keep them informed and engaged.

Continuous Monitoring and Adjustment

Continuous monitoring and adjustment involve regularly tracking performance metrics, identifying deviations from targets, and making necessary adjustments to strategies and operations. This ensures alignment with organizational goals and drives continuous improvement. Here’s how to implement continuous monitoring and adjustment:

- Set Monitoring Intervals: Define the frequency of metric monitoring based on the criticality and volatility of each metric. High-priority metrics may require real-time or daily monitoring, while others may be monitored weekly or monthly.

- Implement Alert Mechanisms: Implement alert mechanisms or notifications to flag significant deviations or anomalies in performance metrics. Set thresholds or triggers to automatically notify stakeholders of potential issues.

- Conduct Performance Reviews: Conduct regular performance reviews and meetings to analyze metric trends, discuss insights, and identify areas for improvement. Engage cross-functional teams to collaborate on problem-solving and decision-making.

- Iterate and Improve: Use insights gained from monitoring and analysis to iterate and improve strategies, processes, and initiatives. Implement corrective actions, optimizations, or enhancements to address performance gaps and drive continuous improvement.

By following these steps and best practices , organizations can effectively implement business metrics, aligning performance measurement with strategic objectives, and driving sustainable growth and success.

Mastering the art of tracking and analyzing top business metrics is the cornerstone of success for any organization. By understanding and leveraging these metrics effectively, businesses can gain valuable insights into their performance, identify areas for improvement, and make informed decisions that drive growth and profitability. Whether it’s monitoring financial health , optimizing customer satisfaction, or maximizing employee productivity, the power of data-driven decision-making cannot be overstated.

Ultimately, embracing a culture of continuous improvement and innovation, fueled by insights from key business metrics, is key to staying competitive in today’s fast-paced business landscape. By prioritizing the tracking and analysis of these metrics, organizations can navigate challenges, capitalize on opportunities, and chart a course towards long-term success. Remember, the journey to business excellence begins with a deep understanding of your key metrics and a commitment to using them to drive positive change.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health .

Marketplace Financial Model Template

E-Commerce Financial Model Template

SaaS Financial Model Template

Standard Financial Model Template

E-Commerce Profit and Loss Statement

SaaS Profit and Loss Statement

Marketplace Profit and Loss Statement

Startup Profit and Loss Statement

Startup Financial Model Template

Expert Templates For You

Don’t settle for mediocre templates. Get started with premium spreadsheets and financial models customizable to your unique business needs to help you save time and streamline your processes.

Receive Exclusive Updates

Get notified of new templates and business resources to help grow your business. Join our community of forward-thinking entrepreneurs and stay ahead of the game!

[email protected]

© Copyright 2024 | 10XSheets | All Rights Reserved

Your email *

Your message

Send a copy to your email

Looking for AI in local government? See our newest product, Madison AI.

More Like this

Kpis meaning + 27 examples of key performance indicators.

As your organization builds the foundation of your strategic plan, it’s likely to come to your attention you’ll need to gain consensus around what your key performance indicators (KPIs) will be and how they will impact your plan. If you don’t know the basics of KPIs or need guidance on KPI development, we are here to help!

We’ve compiled a complete guide that includes an overview of what makes a good KPI, the benefits of good key performance indicators (KPIs), and a list of KPI examples organized by department and industry to reference build your organization’s strategic plan and goals.

What is a Key Performance Indicator KPI — KPI Definition

Key performance indicators, or KPIs, are the elements of your organization’s plan that express the quantitative outcomes you seek and how you will measure success. In other words, they tell you what you want to achieve and by when.

They are the qualitative, quantifiable, outcome-based statements you’ll use to measure progress and determine if you’re on track to meet your goals or objectives. Good plans use 5-7 KPIs to manage and track their progress against goals. A good key performance indicator measures strategic goals.

DOWNLOAD THE FREE KPI GUIDE

What is KPI Meaning, and Why Do You Need Them?

Key performance indicators are intended to create a holistic picture of how your organization is performing against its intended targets, organizational goals, business goals, or objectives. A great key performance indicator should accomplish all the following:

- Outline and measure your organization’s most important set of outputs.

- Work as the heartbeat of your performance management process and confirm whether progress is being made against your strategy.

- Represent the key elements of your strategic plan that express what you want to achieve by when.

- Measure the quantifiable components of your strategic goals and objectives.

- Measure the most important leading indicators and lagging measures in your organization.

The Five Elements of a KPI

These are the heartbeat of your performance management process and must work well! Your plan’s strategic KPIs tell you whether you’re making progress or how far you are from reaching your goals. Ultimately, you want to make progress against your strategy. You’ll live with these KPIs for at least the quarter (preferably the year), so make sure they’re valuable!

Great strategies track the progress of core elements of the plan. Each key performance indicator needs to include the following elements:

- A Measure: Every KPI must have a measure. The best ones have more specific or expressive measures.

- A Target: Every KPI needs to have a target that matches your measure and the period of your goal. These are generally a numeric values you’re seeking to achieve.

- A Data Source: Each of these needs to have a clearly defined data source so there is no gray area in measuring and tracking each.

- Reporting Frequency: Different measures may have different reporting needs, but a good rule to follow is to report on them at least monthly.

- Owner: While this isn’t a mandatory aspect of your KPI statement, setting expectations of who will take care of tracking, reporting, and refining specific KPIs is helpful to your overall organizational plan.

Indicators vs. Key Performance Indicators

An indicator is a general term that describes a business’s performance metrics.

There can be several types of indicators a company may track, but not all indicators are KPIs, especially if they don’t tie into an organization’s overall strategic plan or objectives, which is a MUST!

Key Performance Indicators

On the other hand, a key performance indicator is a very specific indicator that measures an organization’s progress toward a specific company-wide goal or objective. We typically recommend you narrow down the KPIs your organization tracks to no more than 7. When you track too many goals, it can get daunting and confusing.

Pro Tip : You should only track the best and most valuable indicators that tie to your organization’s long-term strategic goals and direction.

Benefits of Good Key Performance Indicators

What benefits do key performance indicators have on your strategic plan, and on your organization as a whole? A lot of benefits, actually! They are extremely important to the success of your strategic plan as they help you track progress of your goals. Implementing them correctly is critical to success.

- Benefit #1: They provide clarity and focus to your strategic plan by measuring progress and aligning your team’s efforts to the organization’s objectives. They also show your measurable progress over time and create ways to track your organization’s continued improvement.

- Benefit #2: Key performance indicators create a way to communicate a shared understanding of success. They give your team a shared understanding of what’s important to achieve your long-term vision and create a shared language to express your progress.

- Benefit #3: They provide signposts and triggers to help you identify when to act. A good balance of leading and lagging key performance indicators allow you to see the early warning signs when things are going well, or when it’s time to act.

How to Develop KPIs

We’ve covered this extensively in our How to Identify Key Performance Indicators post. But, here’s a really quick recap:

Step 1: Identify Measures that Contribute Directly to Your Annual Organization-wide Objectives

Ensure you select measures that can be directly used to quantify your most important annual objectives.

PRO TIP: It doesn’t matter what plan structure you’re using – balanced scorecard, OKRs, or any other framework – the right KPIs for every objective will help you measure if you’re moving in the right direction.

Step 2: Evaluate the Quality of Your KPI

Select a balance of leading and lagging indicators (which we define later in the article) that are quantifiable and move your organization forward. Always ensure you have relevant KPIs. Having the right key performance indicators makes a world of difference!

Step 3: Assign Ownership

Every key performance indicator needs ownership! It’s just that simple.

Step 4: Monitor and Report with Consistency

Whatever you do, don’t just set and forget your goals. We see it occasionally that people will select measures and not track them, but what’s the point of that? Be consistent. We recommend selecting measures that can be reported upon at least monthly.

The 3 Types of KPIs to Reference as You Build Your Metrics

Key performance indicators answer the quantifiable piece of your goals and objectives . here are three types of KPIs. Now that you know the components of great key performance indicators, here are some different ones that you might think about as you’re putting your plan together:

Broad Number Measures

The first type of KPI is what we like to call broad number measures. These are the ones that essentially count something. An example is counting the number of products sold or the number of visits to a webpage.

PRO TIP: There is nothing wrong with these, but they don’t tell a story. Great measures help you create a clear picture of what is going on in your organization. So, using only broad ones won’t help create a narrative.

KPI Type #2: Progress Measures

Progress key performance indicators are used to help measure the progress of outcomes . This is most commonly known as the “percent complete” KPI, which is helpful in measuring the progress of completing a goal or project. These are best when quantifiable outcomes are difficult to track, or you can’t get specific data.

PRO TIP: Progress KPIs are great, but your KPI stack needs to include some easily quantifiable measures. We recommend using a mixture of progress KPIs and other types that have clear targets and data sources.

KPI Type #3: Change Measures

The final type of KPI is a change indicator. These are used to measure the quantifiable change in a metric or measure. An example would be, “X% increase in sales.” It adds a change measure to a quantifiable target and is usually measured as a percentage increase in a given period of time.

The more specific change measures are, the easier they are to understand. A better iteration of the example above would be “22% increase in sales over last year, which represents an xyz lift in net-new business.” More expressive measures are better.

PRO TIP: Change measures are good for helping create a clear narrative . It helps explain where you’re going instead of just a simple target.

Leading KPIs vs Lagging KPIs

Part of creating a holistic picture of your organization’s progress is looking at different types of measures, like a combination of leading and lagging indicators. Using a mixture of both allows you to monitor progress and early warning signs closely when your plan is under or over-performing (leading indicator) and you have a good hold on how that performance will impact your business down the road (lagging indicator). Here’s a deep dive and best practices on using leading versus lagging indicators:

Leading Indicator

We often refer to these metrics as the measures that tell you how your business might/will perform in the future. They are the warning buoys you put out in the water to let you know when something is going well and when something isn’t.

For example, a leading KPI for an organization might be the cost to deliver a good/service. If the cost of labor increases, it will give you a leading indicator that you will see an impact on net profit or inventory cost.

Another example of a leading indicator might be how well your website is ranking or how well your advertising is performing. If your website is performing well, it might be a leading indicator that your sales team will have an increase in qualified leads and contracts signed.

Lagging Indicator

A lagging indicator refers to past developments and effects. This reflects the past outcomes of your measure. So, it lags behind the performance of your leading indicators.

An example of a lagging indicator is EBITA. It reflects your earnings for a past date. That lagging indicator may have been influenced by leading indicators like the cost of labor/materials.

Balancing Leading and Lagging Indicators

If you want to ensure that you’re on track, you might have a KPI in place telling you whether you will hit that increase, such as your lead pipeline. We don’t want to over-rotate on this, but as part of a holistic, agile plan, we recommend outlining 5-7 key performance metrics or indicators in your plan that show a mix of leading and lagging indicators. .

Having a mixture of both gives you both a look-back and a look-forward as you measure the success of your plan and business health. A balanced set of KPIs also gives you the data and business intelligence you need for making decision making and strategic focus.

We also recommend identifying and committing to tracking and managing the same KPIs for about a year, with regular monthly or quarterly reporting cadence, to create consistency in data and reporting.

Any shorter tracking time frame won’t give you a complete picture of your performance. Always moving your KPI targets is also a sure way to miss how you’re actually performing.

27 KPI Examples

Sales key performance indicators.

Sales KPIs are essential metrics for evaluating a company’s revenue generation process and leading indicators for achieving financial goals. Using sales performance KPIs can provide leading insights beyond traditional financial metrics, which are often considered lagging indicators

- Number of contracts signed per quarter

- Dollar value for new contracts signed per period

- Number of qualified leads per month

- Number of engaged qualified leads in the sales funnel

- Hours of resources spent on sales follow up

- Average time for conversion

- Net sales – dollar or percentage growth

- New sales revenue

- Growth rate

- Customer acquisition count

- Lead conversion rate

- Average sales cycle

Increase the number of contracts signed by 10% each quarter.

- Measure: Number of contracts signed per quarter

- Target: Increase number of new contracts signed by 10% each quarter

- Data Source: CRM system

- Reporting Frequency: Weekly

- *Owner: Sales Team

- Due Date: Q1, Q2, Q3, Q4

Increase the value of new contracts by $300,000 per quarter this year.

- Measure: Dollar value for new contracts signed per period

- Data Source: Hubspot Sales Funnel

- Reporting Frequency: Monthly

- *Owner: VP of Sales

Increase the close rate to 30% from 20% by the end of the year.

- Measure: Close rate – number of closed contracts/sales qualified leads

- Target: Increase close rate from 20% to 30%

- *Owner: Director of Sales

- Due Date: December 31, 2024

Increase the number of weekly engaged qualified leads in the sales from 50 to 75 by the end of FY23.

- Measure: Number of engaged qualified leads in sales funnel

- Target: 50 to 75 by end of FY2024

- Data Source: Marketing and Sales CRM

- *Owner: Head of Sales

Decrease time to conversion from 60 to 45 days by Q3 2024.

- Measure: Average time for conversion

- Target: 60 days to 45 days

- Due Date: Q3 2024

Increase number of closed contracts by 2 contracts/week in 2024.

- Measure: Number of closed contracts

- Target: Increase closed contracts a week from 4 to 6

- Data Source: Sales Pipeline

- *Owner: Sales and Marketing Team

Examples of KPIs for Financial

- Growth in revenue

- Net profit margin

- Gross profit margin

- Operational cash flow

- Current accounts receivables

- Operating expenses

- Average cost of goods or services

- Average account lifetime total value

Financial KPIs as SMART Annual Goals

Grow top-line revenue by 10% by the end of 2024.

- Measure: Revenue growth

- Target: 10% growt

- Data Source: Quickbooks

- *Owner: Finance and Operations Team

- Due Date: By the end 2024

Increase gross profit margin by 12% by the end of 2024.

- Measure: Percentage growth of net profit margin

- Target: 12% net profit margin increase

- Data Source: Financial statements

- *Owner: Accounting Department

Increase net profit margin from 32% to 40% by the end of 2024.

- Measure: Gross profit margin in percentage

- Target: Increase gross profit margin from 32% to 40% by the end of 2024

- Data Source: CRM and Quickbooks

- *Owner: CFO

Maintain $5M operating cash flow for FY2024.

- Measure: Dollar amount of operational cash flow

- Target: $5M average

- Data Source: P&L

- Due Date: By the end FY2024

Collect 95% of account receivables within 60 days in 2024.

- Measure: Accounts collected within 60 days

- Target: 95% in 2024

- Data Source: Finance

- Due Date: End of 2024

Examples of Customer Service KPIs

- Number of customers retained/customer retention

- Customer service response time

- Percentage of market share

- Net promotor score

- Customer satisfaction score

- Average response time

Customer KPIs in a SMART Framework for Annual Goals

90% of current customer monthly subscriptions during FY2024.

- Measure: Number of customers retained

- Target: Retain 90% percent of monthly subscription customers in FY2024

- Data Source: CRM software

- *Owner: Director of Client Operations

Increase market share by 5% by the end of 2024.

- Measure: Percentage of market share

- Target: Increase market share from 25%-30% by the end of 2024

- Data Source: Market research reports

- Reporting Frequency: Quarterly

- *Owner: Head of Marketing

Increase NPS score by 9 points in 2024.

- Measure: Net Promoter Score

- Target: Achieve a 9-point NPS increase over FY2024

- Data Source: Customer surveys

- *Owner: COO

Achieve a weekly ticket close rate of 85% by the end of FY2024.

- Measure: Average ticket/support resolution time

- Target: Achieve a weekly ticket close rate of 85%

- Data Source: Customer support data

- *Owner: Customer Support Team

Examples of KPIs for Operations

- Order fulfillment time

- Time to market

- Employee satisfaction rating

- Employee churn rate

- Inventory turnover

- Total number of units produced or on-hand

- Resource utilization

Operational KPIs as SMART Annual Goals

Average 3 days maximum order fill time by the end of Q3 2024.

- Measure: Order fulfilment time

- Target: Average maximum of 3 days

- Data Source: Order management software

- *Owner: Shipping Manager

Achieve an average SaaS project time-to-market of 4 weeks per feature in 2024.

- Measure: Average time to market

- Target: 4 weeks per feature

- Data Source: Product development and launch data

- *Owner: Product Development Team

Earn a minimum score of 80% employee satisfaction survey over the next year.

- Measure: Employee satisfaction rating

- Target: Earn a minimum score of 80% employee

- Data Source: Employee satisfaction survey and feedback

Maintain a maximum of 10% employee churn rate over the next year.

- Measure: Employee churn rate

- Target: Maintain a maximum of 10% employee churn rate over the next year

- Data Source: Human resources and payroll data

- *Owner: Human Resources

Achieve a minimum ratio of 5-6 inventory turnover in 2024.

- Measure: Inventory turnover ratio

- Target: Minimum ratio of 5-6

- Data Source: Inventory management software

- *Owner: Operations Department

Marketing KPIs

- Monthly website traffic

- Number of marketing qualified leads

- Conversion rate for call-to-action content

- Keywords in top 10 search engine results/organic search

- Blog articles published this month

- E-Books published this month

- Marketing campaign performance

- Customer acquisition cost

- Landing page conversion rate

Marketing KPIs as SMART Annual Goals

Achieve a minimum of 10% increase in monthly website traffic over the next year.

- Measure: Monthly website traffic

- Target: 10% increase in monthly website

- Data Source: Google analytics

- *Owner: Marketing Manager

Generate a minimum of 200 qualified leads per month in 2024.

- Measure: Number of marketing qualified leads

- Target: 200 qualified leads per month

- Data Source: Hubspot

Achieve a minimum of 10% conversion rate for on-page CTAs by end of Q3 2024.

- Measure: Conversion rate on service pages

- Target: 10%

- Due Date: End of Q3, 2024

Achieve a minimum of 20 high-intent keywords in the top 10 search engine results over the next year.

- Measure: Keywords in top 10 search engine results

- Target: 20 keywords

- Data Source: SEM Rush data

- *Owner: SEO Manager

Publish a minimum of 4 blog articles per month to earn new leads in 2024.

- Measure: Blog articles

- Target: 4 per month

- Data Source: CMS

- *Owner: Content Marketing Manager

- Due Date: December 2024

Publish at least 2 e-books per quarter in 2024 to create new marketing-qualified leads.

- Measure: E-Books published

- Target: 2 per quarter

- Data Source: Content management system

Bonus: +40 Extra KPI Examples

Supply chain example key performance indicators.

- Number of on-time deliveries

- Inventory carry rate

- Months of supply on hand

- Inventory-to-sales Ratio (ISR)

- Carrying cost of inventory

- Inventory turnover rate

- Perfect order rate

- Inventory accuracy

Healthcare Example Key Performance Indicators

- Bed or room turnover

- Average patient wait time

- Average treatment charge

- Average insurance claim cost

- Medical error rate

- Patient-to-staff ratio

- Medication errors

- Average emergency room wait times

- Average insurance processing time

- Billing code error rates

- Average hospital stay

- Patient satisfaction rate

Human Resource Example Key Performance Indicators

- Organization headcount

- Average number of job vacancies

- Applications received per job vacancy

- Job offer acceptance rate

- Cost per new hire

- Average salary

- Average employee satisfaction

- Employee turnover rate

- New hire training Effectiveness

- Employee engagement score

Social Media Example Key Performance Indicators

- Average engagement

- % Growth in following

- Traffic conversions

- Social interactions

- Website traffic from social media

- Number of post shares

- Social visitor conversion rates

- Issues resolved using social channel

- Social media engagement

Conclusion: Keeping a Pulse on Your Plan

With the foundational knowledge of the KPI anatomy and a few example starting points, it’s important you build out these metrics with detailed and specific data sources so you can truly evaluate if you’re achieving your goals. Remember, these will be the 5-7 core metrics you’ll live by for the next 12 months, so it’s crucial to develop effective KPIs that follow the SMART formula. They should support your business strategy, measure the performance of your strategic objectives, and help you make better decisions.

A combination of leading and lagging KPIs will paint a clear picture of your organization’s strategic performance and empower you to make agile decisions to impact your team’s success.

Need a Dedicated App to Track Your Strategic Plan with KPI Dashboards? We’ve got you covered.

The StrategyHub by OnStrategy is a purpose built tool to help you build and manage a strategic plan with KPIs. Run your strategy reviews with zero prep – get access to our full suite of KPI reports, dynamic dashboards for data visualization, access to your historical data, and reporting tools to stay connected to the performance of your plan. Get 14-day free access today!

Our Other KPI Resources

We have several other great resources to consider as you build your organization’s Key Performance Indicators! Check out these other helpful posts and guides:

- OKRs vs. KPIs: A Downloadable Guide to Explain the Difference

- How to Identify KPIs in 4 Steps

- KPIs vs Metrics: Tips and Tricks to Performance Measures

- Guide to Establishing Weekly Health Metrics

FAQs on Key Performance Indicators

KPI stands for Key Performance Indicators. KPIs are the elements of your organization’s business or strategic plan that express what outcomes you are seeking and how you will measure their success. They express what you need to achieve by when. KPIs are always quantifiable, outcome-based statements to measure if you’re on track to meet your goals and objectives.

The 4 elements of key performance indicators are:

- A Measure – The best KPIs have more expressive measures.

- A Target – Every KPI needs to have a target that matches your measure and the time period of your goal.

- A Data Source – Every KPI needs to have a clearly defined data source.

- Reporting Frequency – A defined reporting frequency.

No, KPIs (Key Performance Indicators) are different from metrics. Metrics are quantitative measurements used to track and analyze various aspects of business performance, while KPIs are specific metrics chosen as indicators of success in achieving strategic goals.

16 Comments

HI Erica hope your are doing well, Sometime Strategy doesn’t cover all the activities through the company, like maintenance for example may be quality control …. sure they have a contribution in the overall goals achievement but there is no specific new requirement for them unless doing their job, do u think its better to develop a specific KPIs for these department? waiting your recommendation

Thanks for your strategic KPIs

Hello Erica, Could you please clarify how to set KPIs for the Strategic Planning team?

Hi Diana, check out the whitepaper above for more insight!

Hello Erica, Could you please clarify, how to set the KPIs for the Strategic PLanning team?

exampels of empowerment kpis

I found great information in this article. In any case, the characteristics that KPIs must have are: measurability, effectiveness, relevance, utility and feasibility

How to write methodology guidelines for strategy implementation / a company’s review and tracking (process and workflow) for all a company’s divisions

support on strategizing Learning & Development for Automobile dealership

Could you please to clarify how to write the KPIs for the Secretary.

Check out our guide to creating KPIs for more help here: https://onstrategyhq.com/kpi-guide-download/

That’s an amazing article.

Could you please to clarify how to write the KPIs for the office boy supervisor

Could you please clarify how to write KPIs for the editorial assistant in a start up publishing company.

Kindly advice how I would set a kpi for a mattress factory

Comments Cancel

Join 60,000 other leaders engaged in transforming their organizations., subscribe to get the latest agile strategy best practices, free guides, case studies, and videos in your inbox every week..

Leading strategy? Join our FREE community.

Become a member of the chief strategy officer collaborative..

Free monthly sessions and exclusive content.

Do you want to 2x your impact.

InvoiceBerry Blog

Small business | invoicing | marketing | entrepreneurship | freelancing, 15 key metrics essential to track for business growth.

All businesses must track some specific key business metrics to keep a check on the growth and performance of the business. For those who are new to the term, let’s define what key business metrics are. They are a quantifiable index of some component of your business. They help you track, keep a check on, and evaluate, the success or failure of these business components. A business metric is also known as a key performance indicator (KPI) or a business performance key metric.

Even today, many businesses are yet to realize the need to track different business metrics. We recommend it because they tell you if your strategy is succeeding or failing. They also indicate if you need to carry out any kind of modifications in order to boost your performance. They even aid you in measuring the total time it will take to reach your goals.

Try our online invoicing software for free

As it can be pretty challenging to stay on top of all critical business metrics, we are going to talk about which specific business metrics you should track for ensuring adequate business performance in this blog.

What Are the Examples of Key Metrics?

Here’s a list of 15 key business metrics that are important to track for business growth:

- Website Traffic

- Leads per Month

- Leads to Sales Conversion Rate

- Customer Acquisition Cost

- Customer Retention Rate

- Net Promoter Score

- Net Profit Margin

- Employee Satisfaction

- Customer Lifetime Value

- Progress Towards Deadlines and Goals

- Sales Revenue

- Overhead Costs

- Training Cost per Employee

- Employee Engagement

Note: The key business metrics you need to monitor differ from business to business. The metrics that you choose to track your business’s performance should be based on your business’s unique goals.

Let’s discuss the key metrics that are important to track for ensuring business growth!

1. Website Traffic

Website traffic is amongst the most important business performance metrics to monitor. While tracking this metric, don’t just check out plain traffic. You need to dig a little deeper and check out metrics like monthly traffic too.

As time progresses, your traffic numbers should increase. This will aid you in finding out if your best SEO practices and various other marketing efforts are effectively implemented or not.

Tip: Make it a point to check other traffic metrics also such as new vs returning visitors, session length, location, bounce rate, and sources to get a deeper understanding of your overall traffic.

Note: Traffic by itself means nothing. Do you know what matters more? If the traffic is rendering itself to increased conversion rates! We discuss this in detail in the following sections.

2. Leads Per Month

Leads per month are the number of individuals who sign up in a month. When we talk of sign-ups, it means sign-up to a demo, lead magnet, consultation call, or webinar.

Once you know how many leads you get in a month, you can determine the amount of traffic you need. For instance, for every 1000 visits, if you generate 50 leads in a month, then this means that your conversion rate is about 5%. Therefore, to get another 25 leads every month, you will need an additional 500 visits per month.

Tip: To quickly increase your conversion rate, you can think about directing traffic to a particular landing page as opposed to your website homepage. This could be a page for a recent upcoming event, a discount voucher for your services/products, or a page detailing your brand new schemes!

3. Leads to Sales Conversion Rate

Why do you need to track leads to sales conversion rate? Because not all leads will convert to sales. The leads to sales conversion rate is the number of sales divided by the number of leads multiplied by 100.

Let’s take an example to further understand this. If you generate 10 sales from 50 leads, your conversion rate will be 20%. Such data helps you improve your sales conversion rate, and even predict your traffic to sales conversion rate.

4. Customer Acquisition Cost

While wondering what are the key metrics to incorporate in your business plan , turn your attention to Customer Acquisition Cost (CAC). Also called the cost of customer acquisition , it is the total cost of marketing and sales over a particular period of time that goes towards acquiring a customer.

Now, how to calculate this cost? Simply take the complete amount spent on marketing and sales over a certain time period and divide it with the total count of customers acquired during that period.

The result of this calculation denotes how much it costs you to acquire one customer.

5. Customer Retention Rate

The customer retention rate is the percentage of customers retained by your company over a particular time period.

Now, you may wonder how to calculate it. You can do so by taking the number of customers at the end of a specific period and subtracting the count of new customers acquired in that period from it. Then, divide the result by the number of customers at the beginning of the period, and then multiply it by 100. There, you have your customer retention rate during that specific period!

Note: How you look at the user or customer retention rate is based on your business type. For example, for e-commerce stores, customer retention is the number of returning customers. For SaaS companies, on the other hand, it is the number of individuals who continue subscribing after their initial subscription runs out.

6. Net Promoter Score

A net promoter score is a metric that aids you in measuring the relationship of your customers with your company. The entire process of calculating the score is pretty simple. You ask your customers an important question, such as “how likely are you to recommend <your business name> to a friend or colleague?”, etc., to which they respond with a number on a scale of 1 to 10.

Once you get the answers, you subtract the percentage of detractors from the percentage of promoters to get the score, which ranges from -100 to +100.

The ones who rated 0-6 are the detractors.

The ones who rated 9 or 10 are the promoters.

The net promoter score depicts your customers’ satisfaction with your service and/or product. A score of +100 shows that all customers are promoters and a score of -100 shows that all customers are detractors.

The bottom line, you must try and get close to +100 to ensure long-term customer retention and satisfaction.

7. Net Profit Margin

When you use a metric called ‘net profit margin,’ you subtract the sales expenses of your business from the monthly revenue to know how much profit you earned.

Now, you may be thinking about the need to calculate the net profit margin. It is necessary to help you compare the company’s income with the cost of running the business. It also helps you forecast long-term growth.

Tip: To improve your company’s net profit margin, either lower the cost of sales and/or production or try increasing the revenue.

8. Employee Satisfaction

Employee satisfaction, sometimes called employee happiness, is a metric that helps you understand how satisfied or happy your employees are with their job. You can determine this metric with the help of different factors such as compensation, workload, satisfaction with management, work-life balance, etc.

Just as you used the NPS to measure your customer’s satisfaction rates, go for a similar survey using Google NPS to measure your employee’s happiness and satisfaction within your company.

9. Customer Lifetime Value

One of the key metrics you should incorporate in your business plan is Customer Lifetime Value (CLV). It denotes how much revenue you can expect to earn from a customer. Although CLV can vary from one sales model to another, a simple way to calculate it is by multiplying the average sale’s value by the typical customer’s retention time (in months) and the number of transactions they typically do in that time period.

The customer lifetime value is important because it helps you:

- Understand how to afford customer acquisition.

- Recognize customer segments that are too difficult to convert or turn profitable.

- Find out the issues that are decreasing customer retention rates.

10. Progress Towards Deadlines and Goals

Irrespective of the industry, a business has deadlines and goals which you can break down into milestones. Once you do so, you can track if the milestones are met or overdue. Why do this? So that you are better able to know your business’s capacity for production. You get to find out a couple of other problems as well, such as inadequate resources, unreasonable expectations, and low productivity.

11. Sales Revenue

Month-over-month sales results depict if your marketing efforts are paying off and whether

individuals are interested in purchasing your service/product. Sales revenue is one metric that can tell you a lot about the current state of your business. But how to calculate it?

Sales revenue is computed by summing up the income from client purchases, minus the cost linked with undeliverable or returned products.

To grow sales revenue, you need to boost the number of sales. You can do this by hiring new salespersons, offering discounts that people cannot resist, and expanding your marketing endeavors to new markets.